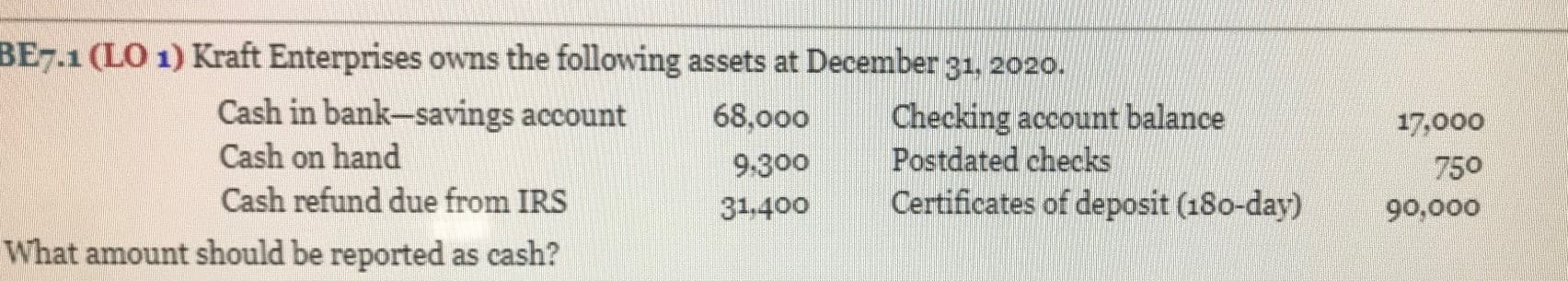

BE7.1 (LO 1) Kraft Enterprises owns the following assets at December 31, 2020. Cash in bank-savings account Checking account balance Postdated checks Certificates of deposit (180-day) 68,000 17,000 Cash on hand 9:300 750 Cash refund due from IRS 31,400 90,000 What amount should be reported as cash?

Q: SM Investments Corporation had the following account balances at December 31, 2019: Cash on hand…

A: Hello. Since your question has multiple parts, we will solve first question for you. If you want…

Q: BT21 Corp provided the following information on December 31, 2021: Cash in bank, net of bank…

A: Current liability are amount due to be paid with in twelve months

Q: TRUE Company had the following account balances at December 31, 2020: Cash in bank P5,000,000 Cash…

A: 1. Cash in Bank : it is included in cash along with amount of 1000,000 which is unrestricted and…

Q: Kraft Enterprises owns the following assets at December 31, 2017. Cash in bank - Savings Account…

A: Certificates of deposit will be classified as temporary investments, but not cash.

Q: On December 31, 2019 Ivan Company showed the following current assets: Cash 3,200,000 Accounts…

A: Adjusted balance of accounts receivable = Customer’s debit balances + customer deposit + customer…

Q: On December 31, 2020, ABC Company had the following cash balances: Cash in BDO per bank statement,…

A: The cash & cash equivalent show the item of cash and other deposit that have maturity value…

Q: ndie Company had the following account balances at December 31, 2021: Cash in Metrobank (includes…

A: Current assets are the assets that are to be reported in the balance sheet under the current assets'…

Q: SaKanya Company provided the following information on December 31, 2020: Cash in Bank (net of bank…

A: Current Assets are assets that are expected to be sold or consumed or converted into cash within a…

Q: The financial statements of Exo Corporation included the following: December 31, 2022 December 31,…

A: Note:Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: ndia Company reported the following accounts on December 31, 2020: Cash on hand P 1,000,000…

A: Step 1 Restricted items or items which are not available for immediate use are excluded ad cash and…

Q: A check of P43,000 was drawn on December 31,2020 payable to petty cash. The check book balance of…

A: Bank reconciliation statement: It is a statement of the deviation between the organization cash book…

Q: CPA Company’s “cash count” as of December 31, 2021, is composed of the following: · Cash on…

A: Adjusted demand deposit account=Demand deposit+Check undelivered+Post dated check-Collection=P…

Q: AAA Corporation's checkbook balance on December 31, 2020, was P800,000. In addition, AAA held the…

A: The bank reconciliation statement helps to match the balance as per cash book and bank book.

Q: · Check payable to Taemin Inc., dated January 4, 2020, included in the December 31 checkbook…

A: The answer has been mentioned below.

Q: cash balances:

A: In the December 31, 2019, statement of financial position, what total amount should be reported as…

Q: BBB Company’s check book balance on December 31,2020 was P5,000,000. Inaddition, BBB Company held…

A: Introduction: NSF Check: NSF stands for Non sufficient funds check, When there is no sufficient…

Q: Bataan Company's checkbook balance at December 31, 2020 was P50,000. in addition, Bataan held the…

A: Bank reconciliation: It is a statement drawn up by the business to verify the cash book balance with…

Q: Greenfield Company had the following cash balances at December 31, 2019: Cash in banks includes…

A: In terms of accountancy, cash is treated as the most liquid form of asset. It comes under the…

Q: One company had the following items in its “cash” account ad of december 31, 2022: Cash on…

A: Cash is one of the important current asset being reported by the business. It includes cash in hand,…

Q: DO IT ABC Co. is preparing its November 30, 2020 bank reconciliation. The following information was…

A: Following are the answers to the given questions

Q: AA Corporation shows a cash balance of P1,570,000 as of December 31, 2022. The following cash…

A: Cash balances between bank book and local ledger can vary due to many aberrations and deferrals…

Q: . MELON Company’s “cash count” as of December 31, 2021, is composed of the following: · Cash…

A: SOLUTION CASH & CASH EQUIVALENT = DEMAND DEPOSIT + TIME DEPOSIT + RESTORED CASH BALANCE FOR…

Q: Buffalo Enterprises owns the following assets at December 31, 2022. Cash in bank-savings account €…

A: Cash to be reported = Cash in bank savings account + Cash on hand + Checking account balance

Q: 46. How much is the correct cash balance at June 30? The cash account of the Siopao Corporation as…

A: Cash is one of the important liquid asset of the business, which is reported in balance sheet. It…

Q: Quart Company had the following account balances at December 31, 2021: Cash in banks - P2,250,000*…

A: Current assets are the assets that can be converted into cash in a short time span.

Q: 0. Grebe Inc. had the following as at December 31, 2020: Cash balances in the cash registers at its…

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve first three…

Q: The accountant of Jepjep Holdings presented the following account balances as of December 31, 2021:…

A: Cash and cash equivalents: Cash and cash equivalents are those term assets that are either in cash…

Q: Joana Company had the following account balances on December 31, 2020: Petty cash fund Cash on hand…

A: Assets: It is a resource that will generate future benefits and revenue for the company. It…

Q: 45. At what amount will the account "Cash" appear on the December 31, 2022 balance sheet? The cash…

A: The bank reconciliation statement is a statement prepared to reconcile the bank balance and the cash…

Q: An entity reported the following data on December 31,2019: Cash in bank, net of bank overdraft of…

A: Cash in bank net of bank o/d of 100000 = 1200,000 Cash in bank (Gross) = 1200,000 + 100,000 =…

Q: 1. SaKanya Company provided the following information on December 31, 2020: Cash in Bank (net of…

A: Current liabilities are those liabilities which are being settled or paid in short period of time,…

Q: On December 31, 2020, Allan Company had the following cash balances: Cash on hand and in bank…

A: Answer : P5,913,000

Q: 14. On December 31, 2019, Cherry Company had the following cash balances: Cash in Bank Petty cash…

A: Solution Concepts used Cash and cash equivalent includes the cash and other highly liquid assets…

Q: A company has P1,833,000 cash balance per bank statement, P652,000 deposit in transit, P563,000 NSF…

A: Since you have asked multiple questions, we will solve the first question for you . If you want any…

Q: An entity has P2,201,000 cash balance per books, P521,000 deposit in transit, P543,000 outstanding…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: 35. The balance sheet of Longgan Company showed a cash balance of P91,/50. An examination of the…

A: Every company should reconciled their balances of bank with the bank statements and cash balances…

Q: December 31, 2021, is composed of the following: · Cash on Hand- P500,000 · Demand…

A: SOLUTION NOTE= 1- CHECK MAILED IN NEXT CALENDAR YEAR WOULD RESULT IS ADDING BACK THE CHECK BALANCE…

Q: The following information pertains to Fish Cake Company on December 31, 2021: Bank statement…

A: Bank reconciliation is a reconciliation of bank balance as per cash book and bank passbook. It is…

Q: Kraft Enterprises owns the following assets at December 31, 2020. Cash in bank—savings account…

A: Cash reporting in balance sheet: In balance sheet cash and cash equivalents should be reported. Cash…

Q: The statement of financial position of the Money Company on December 31, 2020 shows cash of…

A: Notes 1. Cheque recevied from customer but not yet deposited are includible in Cash A/c. Therefore…

Q: 49. The accountant of Jepjep Holdings presented the following account balances as of December 31,…

A: Cash and cash equivalents: Cash and cash equivalents are those term assets that are either in cash…

Q: 10. Grebe Inc. had the following as at December 31, 2020: $112,000 $992,000 Cash balances in the…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: A count of the undeposited receipts under the custody of Tina Cot, the cashier of Kenya Corporation,…

A: Cash Shortage: The Cash Shortage is the difference between the declining amount and the amount…

Q: 1. Ludwig Co. is preparing its November 30, 2020 bank reconciliation. The following information was…

A: Bank reconciliation: It is a statement drawn up by the business to verify the cash book balance with…

Q: On Oct. 31, 2021, Dark Co's cash balance per records is P7,450, while the balance per bank statement…

A: Bank reconciliation: It is a statement which is prepared to reconcile the balance as per cash book…

Q: 9. On December 31, 2022, the cash account of Mobile Legends Company shows the following composition:…

A: Cash and Cash Equivalent It is the company's assets that are cash or or cash equivalent , which can…

Q: 91,350.00 As of February 29, 2020 the bank statement showed an ending balance of The unadjusted cash…

A: It is pertinent to note that bank reconciliation is a statement in which balance as per bank…

Q: Kabugao Company provided the following information on December 31, 2019: Cash in bank, net of bank…

A: Current assets: Current assets are all those assets that are expected to be sold or used as a result…

Q: BBB Company's check book balance on December 31,2020 was P5,000,000. addition, BBB Company held the…

A: Answer: Cash reported on December 31, 2020: P4,800,000

Q: Marie Company, a publicly-listed entity, had the following account balances on December 31, 2021:…

A: Cash is an assets recorded in the financial position of the business organization. Characteristics…

Good morning

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- 1. On June 30, 2019, Franz Inc. borrowed P1,800,000 for one year from the bank with an interest of 12%. As security for the loan, Franz pledged its accounts receivable amounting to P2,500,000 to the bank. The bank charged the company 8.46% of the accounts receivable pledged as service charge deducted from the amount borrowed. How much was the cash received by the company and the interest expense recognized for the year ended December 31, 2019? A. P 1,800,000; 211,500 B. P 1,548,000; 306,000 C. P 1,588,500; P 319,500 D. P 1,584,000; P 306,000 E. P 1,588,500; P 324,000 F. P 1,584,000; P 216,000 G. None of the choicesIndie Company had the following account balances at December 31, 2021:Cash in Metrobank (includes P300,000 of compensating balance against short term borrowing arrangements. The compensating balance is not legally restricted as to withdrawal by Indie Company) - P1,875,000Cash in BPI - P180,000Cash on hand (includes a customers check for P15,000 dated January 5, 2022) - P125,000Cash restricted for acquisition of machinery (expected to be disbursed in 2022) - P1,600,000How much is the total cash reported in the current asset section of Indie Company's December 31, 2021 statement of financial position?Indie Company had the following account balances at December 31, 2021: Cash in Metrobank (includes P300,000 of compensating balance against short term borrowing arrangements. The compensating balance is not legally restricted as to withdrawal by Indie Company) - P1,875,000 Cash in BPI - P180,000Cash on hand (includes a customers check for P15,000 dated January 5, 2022) - P125,000 Cash restricted for acquisition of machinery (expected to be disbursed in 2022) - P1,600,000 How much is the total cash reported in the current asset section of Indie Company's December 31, 2021 statement of financial position?

- .On December 31, 2021, Alfonso Company had the following cash balances:Cash in bank, 15,000,000Petty cash fund, 50,000Time deposit 5,000,000Savings deposit 2,000,000Cash in bank includes P500,000 of compensating balance against short term borrowing arrangement at December 31, 2021. The compensating balance is legally restricted as to withdrawal by Alfonso. A check of P300,000 dated January 15, 2022 in payment of accounts payable was recorded and mailed on December 31, 2021. In the current assets section of the December 31, 2021 statement of financial position, what amount should be reported as “cash and cash equivalents”? 14,850,000 16,850,000 21,800,000 21,850,000On February 1, 2023 MANGOSTEN Company factored receivable with a carrying amount of ₱ 300,000 to ACKEE Company. ACKEE Company assesses a finance charge of 3% of the receivables and retains 5% of the receivables. Relative to this transaction, assume MANGOSTEEN factors receivables on a without recourse basis. Using the same information on the previous number, what amount of cash was received? A. ₱ 276,000 B. ₱ 285,000 C. ₱ 291,000 D. ₱ 300,00014 On December 31, 2022, the cash account of AA Company shows the following composition: Petty cash fund, P180,000; Cash in bank (payroll fund), P2,000,000; Interest and dividend fund, P250,000; Tax fund, P120,000; Cash in bank (current account), P3,000,000; Certificate of deposit (terms 90 days), P1,000,000; Certificate of deposit (terms 180 days), P1,500,000; Cash in foreign bank-restricted, P500,000; Money market fund, (60 days), P500,000; Money market funds (6 months), P900,000; Customer’s check dated February 15, 2021, P60,000; Customer’s check dated December 30, 2020 returned for lack of funds, P40,000; A 30-day BSP treasury bill, P1,000,000; A 3-year BSP treasury bill acquired three months prior to maturity, P1,200,000; Sinking fund cash, P800,000;Contingent fund, P900,000 Fund for the acquisition of fixed asset, P500,000; Travelers’ checks, P60,000; and Cashiers’ checks, P100,000. What is the correct cash and cash equivalents balance to be reported by AA Company on December…

- AAA Corporation's checkbook balance on December 31, 2020, was P800,000. In addition, AAA held the following items in its safe on December 31: Check payable to AAA Corporation, dated January 2, 2021, not included in December 31 checkbook balance P200,000 Check payable to AAA Corporation, deposited December 20, and included in December 31 checkbook balance, but returned by bank on December 30, stamped "NSF." The check was redeposited January 2, 2021, and cleared January 7 40,000 Post-dated checks 15,000 Check drawn on AAA Corporation's account, payable to a vendor, dated and recorded December 31, but not mailed until January 15, 2021 100,000 The proper amount to be shown as cash on AAA's balance sheet at December 31, 2020, isThe balance sheet at December 31,2019 of Universal Robina Corporation showed a cashbalance of P183,500. An examination of the books disclosed the following:Cash sales of P24,000 from January 1 to 5, 2020 were pre dated as of December 28 to 31, 2019and charged to the cash account. Customers’ checks totaling P9,000 deposited with andreturned by the bank “NSF” on December 27, 2019 were not recorded in the books. Checks ofP11,200 in payment of liabilities were prepared before December 31,2019 and recorded in thebooks, but withheld by the treasurer. Post-dated checks totaling P6,800 are being held by thecashier as part of cash. The company’s experiences shows that post-dated checks are eventuallyrealized. The cash account includes P40,000 being reserved for the purchase of an IPAD whichwill be delivered soon. The cash balance that should be shown on December 31, 2019 balancesheet is ________.a.P 92,500 b. P 154,900 c. P 114,900 d. P163,900 Juan Gabriel Company had the following account…Greenfield Company had the following cash balances at December 31, 2019: Cash in banks includes $300,000 of compensating balances against short-term borrowing arrangements at December 31, 2019. The compensatingbalances are not legally restricted as to withdrawal by Greenfield. In thecurrent assets section of Green-field's December 31, 2019, balance sheet,what total amount should be reported as cash?a. $1,020,000b. $1,320,000c. $3,020,000d. $3,320,000

- Caring enterprises had the following account balances on Decrmber 31, 2020; Cash in BPI Bank- 2,250,000; Cash allowed for the acquisition of machinery- 1,600,000; Revolving Fund- 125,000. Cadh in Bank included 600,000 of compensating balance against short-term borrowing arrangement. The compensating balance is not legally restricted as to withdrawal. That total amount should be reported as cash on December 31, 2020Merry Company's checkbook balance at December 31, 2021 was P190,000. In addition, Merry Company held the following items in its safe on that date.*Check payable to Merry Company amounting to P65,000 dated January 2, 2022 in payment of a sale made in December 2021, was included in December 31 checkbook balance.*Check payable to Merry Company was deposited on December 15, but returned by the bank on December 22 stamped "DAIF." The check was redeposited by Merry Company on December 27, 2021. No entry was made in the books to record the return and the redeposit of this P20,000 check.*Check drawn on Merry Company's account, payable to a vendor, was dated and recorded on December 28. This check amounting to P15,000, however, was not yet mailed to the payee as of December 31, 2021.What is the correct amount shown as Cash on Merry Company's December 31, 2021 statement of financial position?1. Tranvia Company revealed the following information on December 31, 2020:Cash in checking account 350,000Cash in money market account 750,000Treasury bill, purchased November 1, 2020maturing January 31, 2021 3,500,000Time deposit purchased December 1, 2020maturing March 31, 2021 4,000,000 What amount should be reported as cash and cash equivalents on December 31, 2020? 2. Affable Company provided the following information at year-end comprising the cashaccount:Cash in bank – demand deposit 5,000,000Cash on hand 400,000Postage stamps unused 5,000Certificate of time deposit 1,500,000Money order 50,000Manager check 100,000Traveler check 1,000,000Postdated customer check 500,000 What total amount should be reported as cash at year end? 3. Thor Company provided the following data on December 31, 2020:Checkbook balance 4,000,000Bank statement balance 5,000,000Check drawn on Thor’s account, payable to supplier,dated and recorded on December 31, 2020 but notmailed until January 31, 2021…