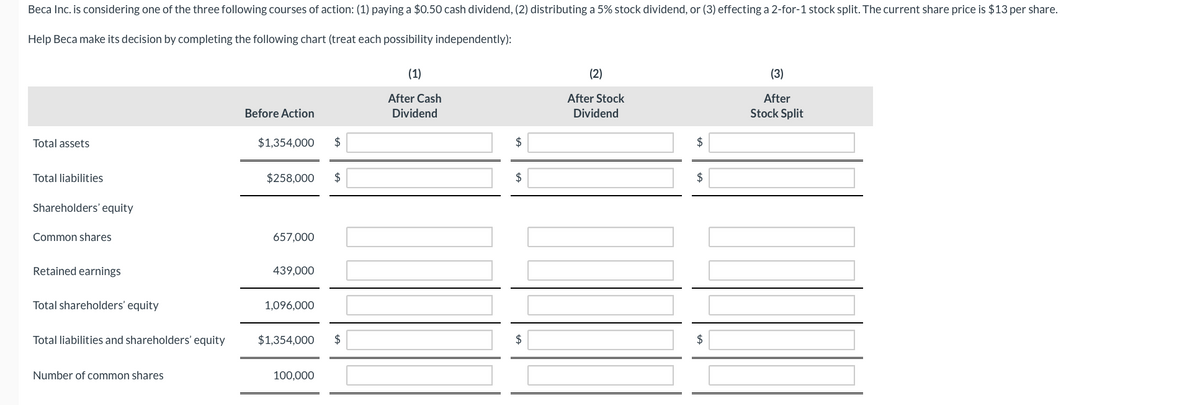

Beca Inc. is considering one of the three following courses of action: (1) paying a $0.50 cash dividend, (2) distributing a 5% stock dividend, or (3) effecting a 2-for-1 stock split. The current share price is $13 per share. Help Beca make its decision by completing the following chart (treat each possibility independently): Total assets Total liabilities Shareholders' equity Common shares Retained earnings Total shareholders' equity Total liabilities and shareholders' equity Number of common shares Before Action $1,354,000 $ $258,000 $ 657,000 439,000 1,096,000 $1,354,000 $ 100,000 (1) After Cash Dividend $ $ $ (2) After Stock Dividend $ $ $ (3) After Stock Split

Beca Inc. is considering one of the three following courses of action: (1) paying a $0.50 cash dividend, (2) distributing a 5% stock dividend, or (3) effecting a 2-for-1 stock split. The current share price is $13 per share. Help Beca make its decision by completing the following chart (treat each possibility independently): Total assets Total liabilities Shareholders' equity Common shares Retained earnings Total shareholders' equity Total liabilities and shareholders' equity Number of common shares Before Action $1,354,000 $ $258,000 $ 657,000 439,000 1,096,000 $1,354,000 $ 100,000 (1) After Cash Dividend $ $ $ (2) After Stock Dividend $ $ $ (3) After Stock Split

Chapter15: Dividend Policy

Section: Chapter Questions

Problem 12P

Related questions

Question

h

Transcribed Image Text:Beca Inc. is considering one of the three following courses of action: (1) paying a $0.50 cash dividend, (2) distributing a 5% stock dividend, or (3) effecting a 2-for-1 stock split. The current share price is $13 per share.

Help Beca make its decision by completing the following chart (treat each possibility independently):

Total assets

Total liabilities

Shareholders' equity

Common shares

Retained earnings

Total shareholders' equity

Total liabilities and shareholders' equity

Number of common shares

Before Action

$1,354,000

$258,000 $

657,000

439,000

1,096,000

$1,354,000

$

100,000

$

(1)

After Cash

Dividend

$

$

$

(2)

After Stock

Dividend

$

$

$

(3)

After

Stock Split

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning