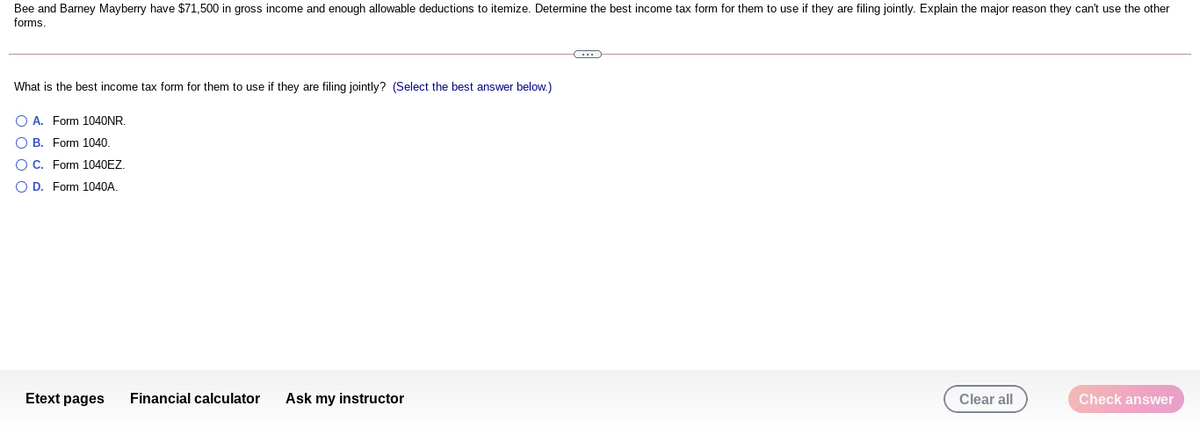

Bee and Barney Mayberry have $71,500 in gross income and enough allowable deductions to itemize. Determine the best income tax form for them to use if they are filing jointly. Explain the major reason they can't use the other forms, What is the best income tax form for them to use if they are filing jointly? (Select the best answer below.) O A. Form 1040NR. O B. Form 1040. OC. Form 1040EZ. O D. Form 1040A,

Bee and Barney Mayberry have $71,500 in gross income and enough allowable deductions to itemize. Determine the best income tax form for them to use if they are filing jointly. Explain the major reason they can't use the other forms, What is the best income tax form for them to use if they are filing jointly? (Select the best answer below.) O A. Form 1040NR. O B. Form 1040. OC. Form 1040EZ. O D. Form 1040A,

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 26CE

Related questions

Question

100%

Transcribed Image Text:Bee and Barney Mayberry have $71,500 in gross income and enough allowable deductions to itemize. Determine the best income tax form for them to use if they are filing jointly. Explain the major reason they can't use the other

forms.

What is the best income tax form for them to use if they are filing jointly? (Select the best answer below.)

O A. Form 1040NR.

O B. Form 1040.

O C. Form 1040EZ.

O D. Form 1040A.

Etext pages

Financial calculator

Ask my instructor

Clear all

Check answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT