before the exit, the Series A investors have 15%, the Series B investors own 26% of the stock, and the C Round investors own 28% of the company, once all Preferred stock is converted. As a group, the VCs have invested $27,000,000. They all have Participating Preferred shares with a 1.5X Liquidation Preference. If the company is sold for $ 110,000,000 what is the effective ownership of the

before the exit, the Series A investors have 15%, the Series B investors own 26% of the stock, and the C Round investors own 28% of the company, once all Preferred stock is converted. As a group, the VCs have invested $27,000,000. They all have Participating Preferred shares with a 1.5X Liquidation Preference. If the company is sold for $ 110,000,000 what is the effective ownership of the

Chapter15: Dividend Policy

Section: Chapter Questions

Problem 12P

Related questions

Question

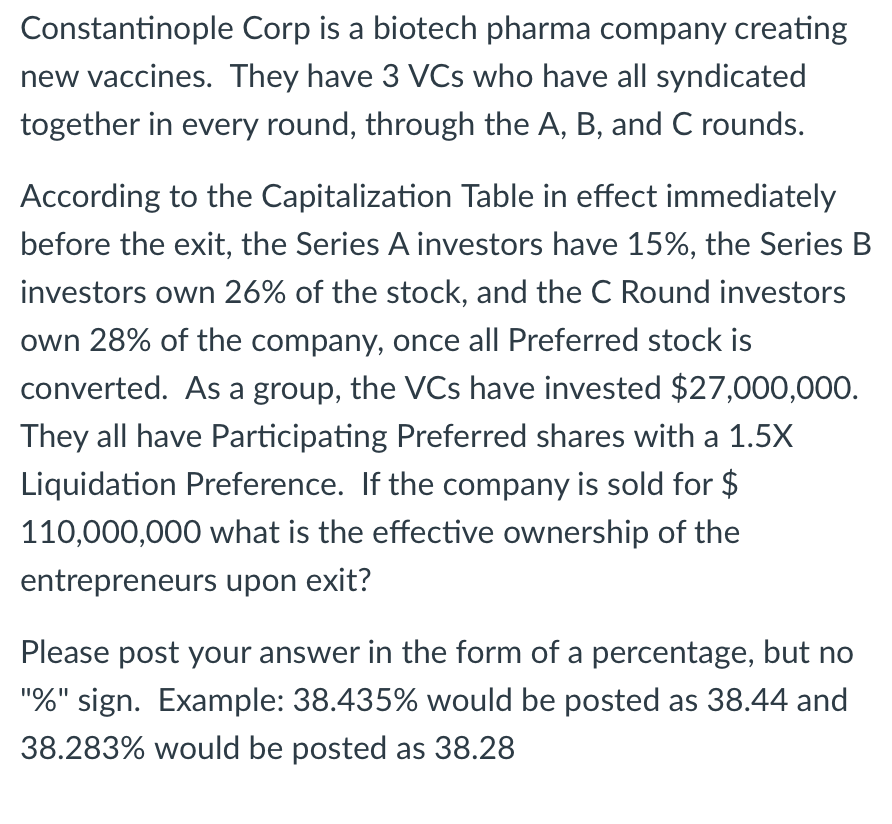

Transcribed Image Text:Constantinople Corp is a biotech pharma company creating

new vaccines. They have 3 VCs who have all syndicated

together in every round, through the A, B, and C rounds.

According to the Capitalization Table in effect immediately

before the exit, the Series A investors have 15%, the Series B

investors own 26% of the stock, and the C Round investors

own 28% of the company, once all Preferred stock is

converted. As a group, the VCs have invested $27,000,000.

They all have Participating Preferred shares with a 1.5X

Liquidation Preference. If the company is sold for $

110,000,000 what is the effective ownership of the

entrepreneurs upon exit?

Please post your answer in the form of a percentage, but no

"%" sign. Example: 38.435% would be posted as 38.44 and

38.283% would be posted as 38.28

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning