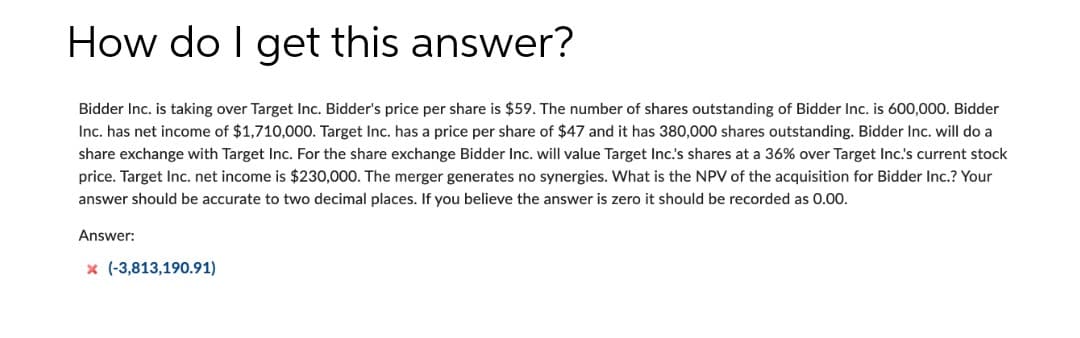

How do I get this answer? Bidder Inc. is taking over Target Inc. Bidder's price per share is $59. The number of shares outstanding of Bidder Inc. is 600,000. Bidder Inc. has net income of $1,710,000. Target Inc. has a price per share of $47 and it has 380,000 shares outstanding. Bidder Inc. will do a share exchange with Target Inc. For the share exchange Bidder Inc. will value Target Inc.'s shares at a 36% over Target Inc.'s current stock price. Target Inc. net income is $230,000. The merger generates no synergies. What is the NPV of the acquisition for Bidder Inc.? Your answer should be accurate to two decimal places. If you believe the answer is zero it should be recorded as 0.00. Answer: x (-3,813,190.91)

How do I get this answer? Bidder Inc. is taking over Target Inc. Bidder's price per share is $59. The number of shares outstanding of Bidder Inc. is 600,000. Bidder Inc. has net income of $1,710,000. Target Inc. has a price per share of $47 and it has 380,000 shares outstanding. Bidder Inc. will do a share exchange with Target Inc. For the share exchange Bidder Inc. will value Target Inc.'s shares at a 36% over Target Inc.'s current stock price. Target Inc. net income is $230,000. The merger generates no synergies. What is the NPV of the acquisition for Bidder Inc.? Your answer should be accurate to two decimal places. If you believe the answer is zero it should be recorded as 0.00. Answer: x (-3,813,190.91)

Chapter20: Financing With Derivatives

Section: Chapter Questions

Problem 12P

Related questions

Question

Transcribed Image Text:How do I get this answer?

Bidder Inc. is taking over Target Inc. Bidder's price per share is $59. The number of shares outstanding of Bidder Inc. is 600,000. Bidder

Inc. has net income of $1,710,000. Target Inc. has a price per share of $47 and it has 380,000 shares outstanding. Bidder Inc. will do a

share exchange with Target Inc. For the share exchange Bidder Inc. will value Target Inc.'s shares at a 36% over Target Inc.'s current stock

price. Target Inc. net income is $230,000. The merger generates no synergies. What is the NPV of the acquisition for Bidder Inc.? Your

answer should be accurate to two decimal places. If you believe the answer is zero it should be recorded as 0.00.

Answer:

x (-3,813,190.91)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College