Beginning inventory, 9/1/2021 7,500 units @ $10.00 Purchases: 9/7 9/25 Sales: 4,500 units @ $10.40 12,000 units @ $11.75 9/10 9/29 14,000 units were on hand at the end of September. 4,000 units 6,000 units Required: 1. Assuming that CNB uses a periodic inventory system and employs the average cost method, determine cost of goods sold for September and September's ending inventory. 2. Assuming that CNB uses a perpetual inventory system and employs the average cost method, determine cost of goods sold for September and September's ending inventory.

Beginning inventory, 9/1/2021 7,500 units @ $10.00 Purchases: 9/7 9/25 Sales: 4,500 units @ $10.40 12,000 units @ $11.75 9/10 9/29 14,000 units were on hand at the end of September. 4,000 units 6,000 units Required: 1. Assuming that CNB uses a periodic inventory system and employs the average cost method, determine cost of goods sold for September and September's ending inventory. 2. Assuming that CNB uses a perpetual inventory system and employs the average cost method, determine cost of goods sold for September and September's ending inventory.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 51E: Inventory Costing Methods On June 1, Welding Products Company had a beginning inventory of 210 cases...

Related questions

Topic Video

Question

Transcribed Image Text:Beginning inventory, 9/1/2021 7,500 units @ $10.00

Purchases:

9/7

4,500 units @ $10.40

12,000 units @ $11.75

9/25

Sales:

9/10

9/29

14,000 units were on hand at the end of September.

4,000 units

6,000 units

Required:

1. Assuming that CNB uses a periodic inventory system and employs the average cost method, determine

cost of goods sold for September and September's ending inventory.

2. Assuming that CNB uses a perpetual inventory system and employs the average cost method, determine

cost of goods sold for September and September's ending inventory.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

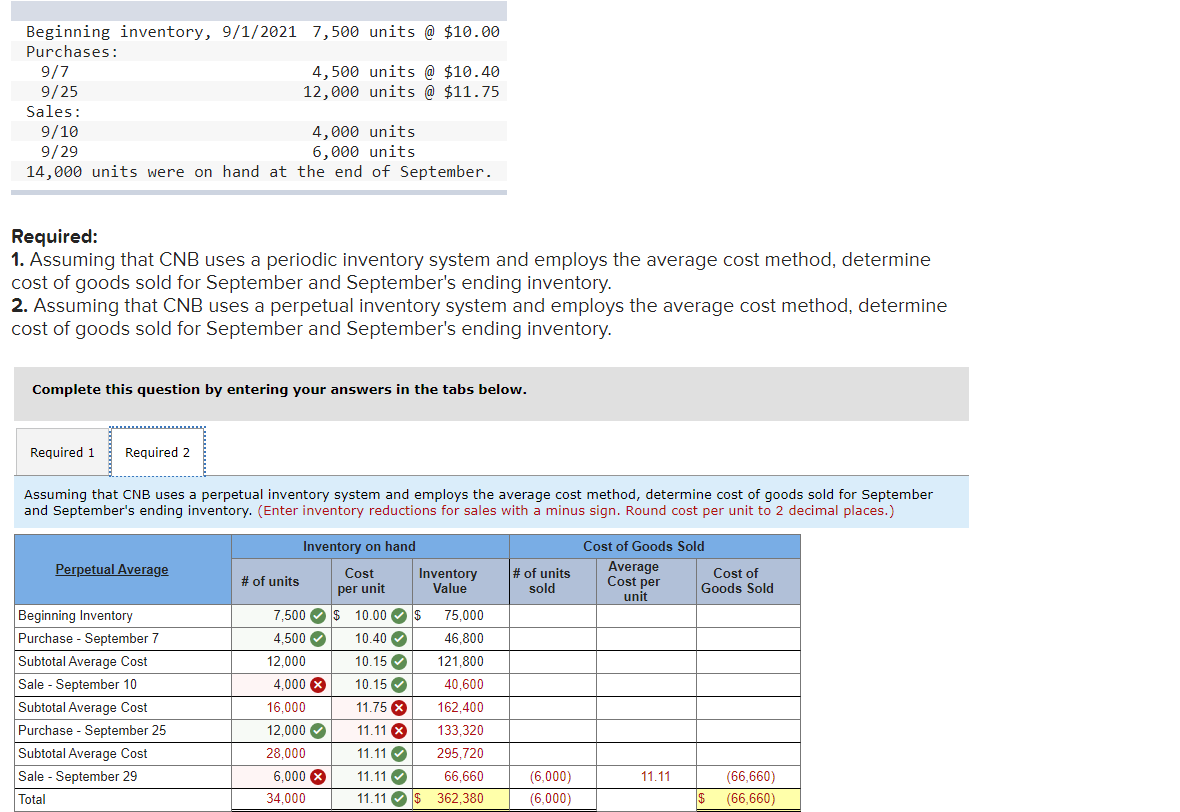

Assuming that CNB uses a perpetual inventory system and employs the average cost method, determine cost of goods sold for September

and September's ending inventory. (Enter inventory reductions for sales with a minus sign. Round cost per unit to 2 decimal places.)

Inventory on hand

Cost of Goods Sold

Perpetual Average

Average

Çost per

unit

# of units

Inventory

Value

Cost of

Goods Sold

Cost

# of units

per unit

sold

Beginning Inventory

7,500 O $ 10.00 O $

75,000

Purchase - September 7

4,500 O

10.40 O

46,800

Subtotal Average Cost

12,000

10.15 O

121,800

Sale - September 10

4,000 8

10.15 O

40,600

Subtotal Average Cost

16,000

11.75 X

162,400

Purchase - September 25

12,000 O

11.11 8

133,320

Subtotal Average Cost

28,000

11.11 O

295,720

Sale - September 29

6,000 X

11.11 O

66,660

(6,000)

11.11

(66,660)

Total

34,000

11.11 O $

362,380

(6,000)

$ (66,660)

Transcribed Image Text:Beginning inventory, 9/1/2021 7,500 units @ $10.00

Purchases:

9/7

9/25

Sales:

9/10

9/29

14,000 units were on hand at the end of September.

4,500 units @ $10.40

12,000 units @ $11.75

4,000 units

6,000 units

Required:

1. Assuming that CNB uses a periodic inventory system and employs the average cost method, determine

cost of goods sold for September and September's ending inventory.

2. Assuming that CNB uses a perpetual inventory system and employs the average cost method, determine

cost of goods sold for September and September's ending inventory.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

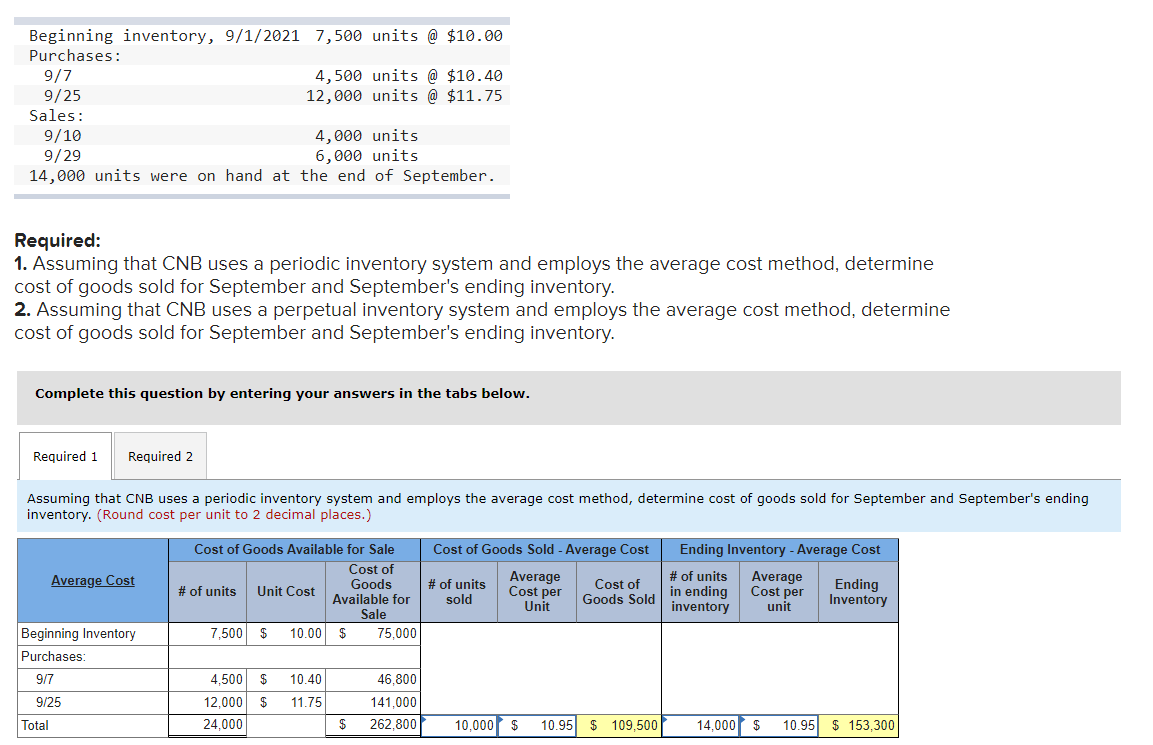

Assuming that CNB uses a periodic inventory system and employs the average cost method, determine cost of goods sold for September and September's ending

inventory. (Round cost per unit to 2 decimal places.)

Cost of Goods Available for Sale

Cost of Goods Sold - Average Cost

Ending Inventory - Average Cost

Cost of

Goods

Available for

Sale

Average

Cost per

Unit

# of units

in ending

inventory

Average

Cost per

unit

Average Cost

Ending

Inventory

# of units

Cost of

# of units

Unit Cost

sold

Goods Sold

Beginning Inventory

7,500 $

10.00

$

75.000|

Purchases:

9/7

4,500 $

10.40

46,800

9/25

12,000 $

11.75

141,000

Total

24,000

$

262,800

10,000 $

10.95 $ 109,500

14,000 $

10.95 $ 153,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,