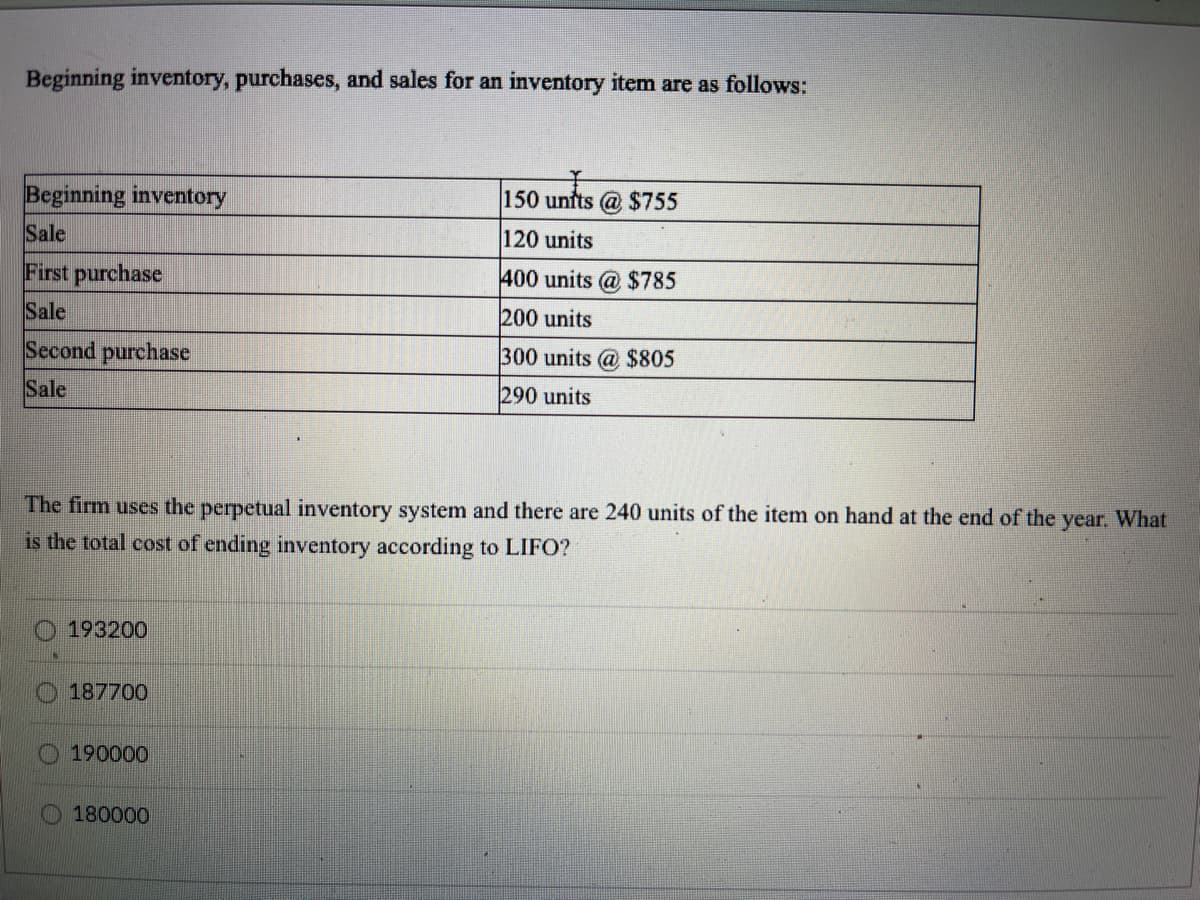

Beginning inventory, purchases, and sales for an inventory item are as follows: Beginning inventory Sale 150 units @ $755 120 units First purchase 400 units @ $785 Sale 200 units Second purchase 300 units @ $805 Sale 290 units The firm uses the perpetual inventory stem and there are 240 units of the item on hand at the end of the year. What is the total cost of ending inventory according to LIFO? 193200 187700 190000 180000

Beginning inventory, purchases, and sales for an inventory item are as follows: Beginning inventory Sale 150 units @ $755 120 units First purchase 400 units @ $785 Sale 200 units Second purchase 300 units @ $805 Sale 290 units The firm uses the perpetual inventory stem and there are 240 units of the item on hand at the end of the year. What is the total cost of ending inventory according to LIFO? 193200 187700 190000 180000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 6MCQ: Refer to the information for Morgan Inc. above. If Morgan uses a perpetual inventory system, what is...

Related questions

Topic Video

Question

Transcribed Image Text:Beginning inventory, purchases, and sales for an inventory item are as follows:

Beginning inventory

Sale

150 unfts @ $755

120 units

First purchase

400 units

$785

Sale

200 units

Second purchase

300 units @ $805

Sale

290 units

The firm uses the perpetual inventory system and there are 240 units of the item on hand at the end of the year. What

is the total cost of ending inventory according to LIFO?

O 193200

187700

190000

O 180000

Expert Solution

Step 1

Under the Perpetual Inventory method, every issue and receipt of the inventory is recorded in the inventory report.

Inventory card is shown below.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College