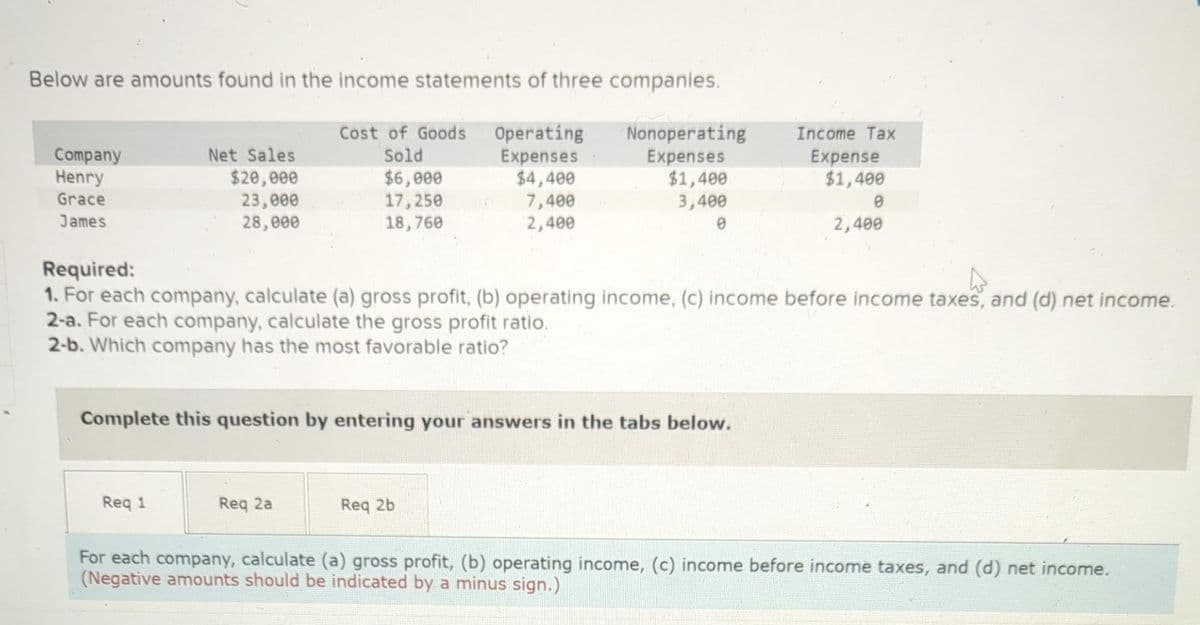

Below are amounts found in the income statements of three companies. Cost of Goods Operating Sold Expenses $4,400 7,400 2,400 Company Henry Grace James Net Sales $20,000 23,000 28,000 $6,000 17,250 18,760 Nonoperating Expenses $1,400 3,400 0 Income Tax Expense $1,400 0 2,400 Required: 4 1. For each company, calculate (a) gross profit, (b) operating income, (c) income before income taxes, and (d) net income. 2-a. For each company, calculate the gross profit ratio. 2-b. Which company has the most favorable ratio?

Below are amounts found in the income statements of three companies. Cost of Goods Operating Sold Expenses $4,400 7,400 2,400 Company Henry Grace James Net Sales $20,000 23,000 28,000 $6,000 17,250 18,760 Nonoperating Expenses $1,400 3,400 0 Income Tax Expense $1,400 0 2,400 Required: 4 1. For each company, calculate (a) gross profit, (b) operating income, (c) income before income taxes, and (d) net income. 2-a. For each company, calculate the gross profit ratio. 2-b. Which company has the most favorable ratio?

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.1E

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:Below are amounts found in the income statements of three companies.

Nonoperating

Expenses

Company

Henry

Grace

James

Net Sales

$20,000

23,000

28,000

Req 1

Cost of Goods Operating

Sold

Expenses

$4,400

7,400

2,400

$6,000

17,250

18,760

Req 2a

Required:

1. For each company, calculate (a) gross profit, (b) operating income, (c) income before income taxes, and (d) net income.

2-a. For each company, calculate the gross profit ratio.

2-b. Which company has the most favorable ratio?

Complete this question by entering your answers in the tabs below.

$1,400

3,400

Req 2b

Income Tax

Expense

$1,400

0

2,400

For each company, calculate (a) gross profit, (b) operating income, (c) income before income taxes, and (d) net income.

(Negative amounts should be indicated by a minus sign.)

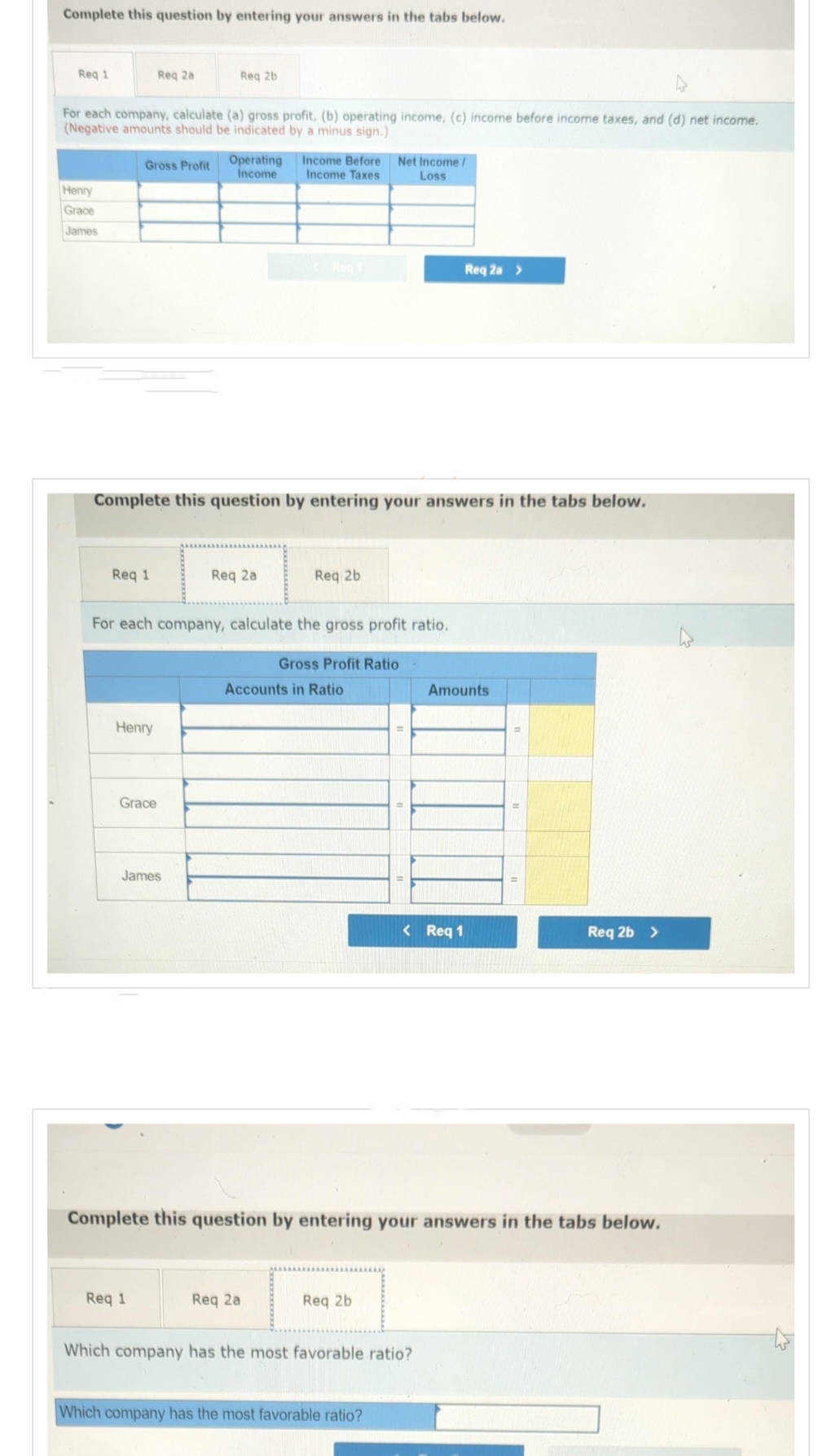

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Req 1

Henry

Grace

James

For each company, calculate (a) gross profit, (b) operating income, (c) income before income taxes, and (d) net income.

(Negative amounts should be indicated by a minus sign.)

Gross Profit

Req 1

Reg 2a

Henry

Grace

Complete this question by entering your answers in the tabs below.

Req 2b

James

Req 1

Operating

Income

For each company, calculate the gross profit ratio.

Req 2a

Income Before Net Income /

Income Taxes Loss

Req 2b

Req 2a

Gross Profit Ratio

Accounts in Ratio

Req 2b

Complete this question by entering your answers in the tabs below.

Req 2a >

< Req 1

Which company has the most favorable ratio?

Which company has the most favorable ratio?

Amounts

Req 2b >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning