Revision of depreciation A building with a cost of $240,000 has an estimated residual value of $96,000, has an estimated useful life of 9 years, and is depreciated by the straight-line method. a. What is the amount of the annual depreciation? Do not round intermediate calculations. b. What is the book value at the end of the fifth year of use? c. If at the start of the sixth year it is estimated that the remaining life is 5 years and that the residual value is $70,000, what is the depreciation expense for each of the remaining 5 years?

Revision of depreciation A building with a cost of $240,000 has an estimated residual value of $96,000, has an estimated useful life of 9 years, and is depreciated by the straight-line method. a. What is the amount of the annual depreciation? Do not round intermediate calculations. b. What is the book value at the end of the fifth year of use? c. If at the start of the sixth year it is estimated that the remaining life is 5 years and that the residual value is $70,000, what is the depreciation expense for each of the remaining 5 years?

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 7BCRQ

Related questions

Question

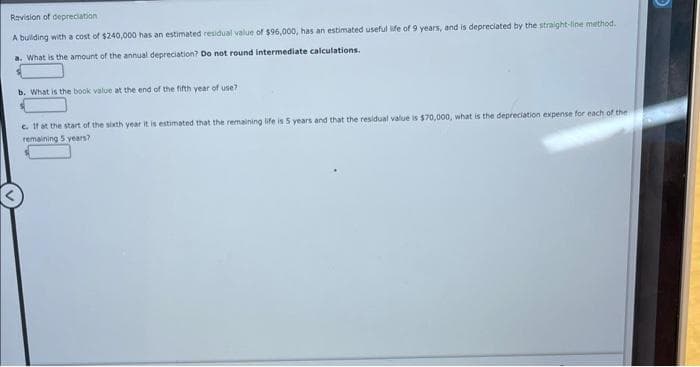

Transcribed Image Text:Revision of depreciation

A building with a cost of $240,000 has an estimated residual value of $96,000, has an estimated useful life of 9 years, and is depreciated by the straight-line method.

a. What is the amount of the annual depreciation? Do not round intermediate calculations.

b. What is the book value at the end of the fifth year of use?

e. If at the start of the sixth year it is estimated that the remaining life is 5 years and that the residual value is $70,000, what is the depreciation expense for each of the

remaining 5 years?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,