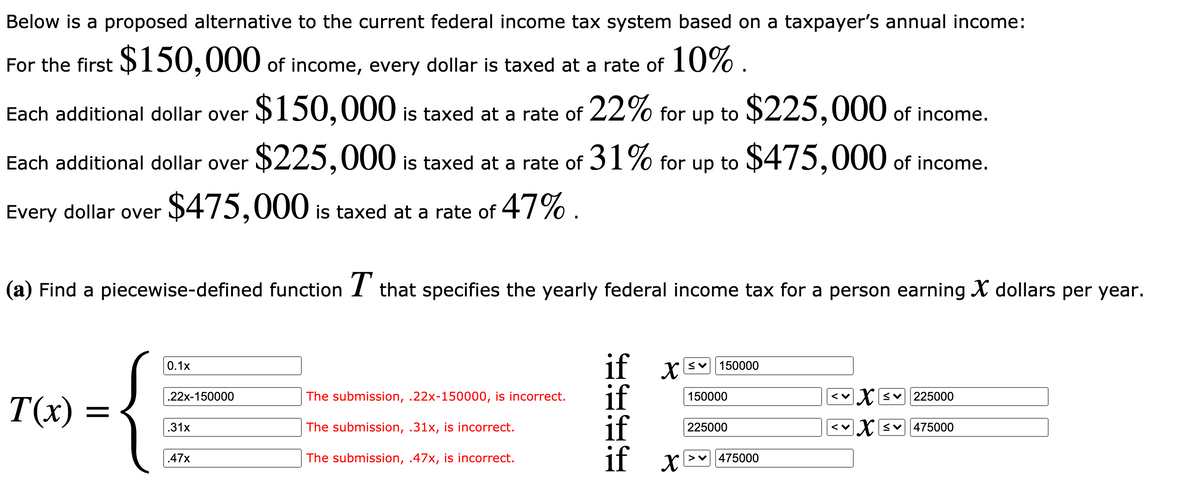

Below is a proposed alternative to the current federal income tax system based on a taxpayer's annual income: For the first $150,000 of income, every dollar is taxed at a rate of 10% . Each additional dollar over $150,000 is taxed at a rate of 22% for up to $225,000 of income. Each additional dollar over -$225,000 is taxed at a rate of 31% for up to $475,000 of income. Every dollar over $475,000 is taxed at a rate of 47% . (a) Find a piecewise-defined function I that specifies the yearly federal income tax for a person earning X dollars per year. if x if if 0.1x sv 150000 .22x-150000 The submission, .22x-150000, is incorrect. 150000 Xsv 225000 T(x) = .31x The submission, .31x, is incorrect. 225000 Xsv 475000 if r>v 475000 .47x The submission, .47x, is incorrect.

Below is a proposed alternative to the current federal income tax system based on a taxpayer's annual income: For the first $150,000 of income, every dollar is taxed at a rate of 10% . Each additional dollar over $150,000 is taxed at a rate of 22% for up to $225,000 of income. Each additional dollar over -$225,000 is taxed at a rate of 31% for up to $475,000 of income. Every dollar over $475,000 is taxed at a rate of 47% . (a) Find a piecewise-defined function I that specifies the yearly federal income tax for a person earning X dollars per year. if x if if 0.1x sv 150000 .22x-150000 The submission, .22x-150000, is incorrect. 150000 Xsv 225000 T(x) = .31x The submission, .31x, is incorrect. 225000 Xsv 475000 if r>v 475000 .47x The submission, .47x, is incorrect.

Chapter12: Sequences, Series And Binomial Theorem

Section12.3: Geometric Sequences And Series

Problem 12.57TI: What is the total effect on the economy of a government tax rebate of $1,000 to each household in...

Related questions

Concept explainers

Contingency Table

A contingency table can be defined as the visual representation of the relationship between two or more categorical variables that can be evaluated and registered. It is a categorical version of the scatterplot, which is used to investigate the linear relationship between two variables. A contingency table is indeed a type of frequency distribution table that displays two variables at the same time.

Binomial Distribution

Binomial is an algebraic expression of the sum or the difference of two terms. Before knowing about binomial distribution, we must know about the binomial theorem.

Topic Video

Question

Transcribed Image Text:Below is a proposed alternative to the current federal income tax system based on a taxpayer's annual income:

For the first $150,000 of income, every dollar is taxed at a rate of 10% .

$150,000 is taxed at a rate of 22% for up to $225,000 of income.

Each additional dollar over

$225,000 is taxed at a rate of 31% for up to $475,000 of income.

Each additional dollar over

Every dollar over

$475,000 is taxed at a rate of 47% .

(a) Find a piecewise-defined function I that specifies the yearly federal income tax for a person earning X dollars per year.

if x

if

if

if x-

0.1x

150000

.22x-150000

The submission, .22x-150000, is incorrect.

150000

くv

225000

T(x)

.31x

The submission, .31x, is incorrect.

225000

< Xsv475000

.47x

The submission, .47x, is incorrect.

475000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, algebra and related others by exploring similar questions and additional content below.Recommended textbooks for you