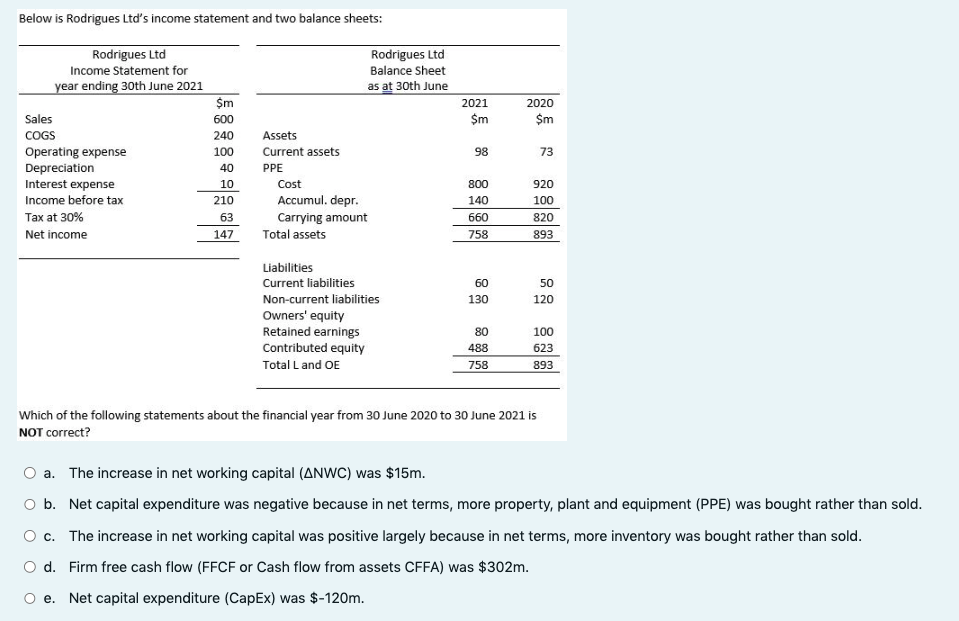

Below is Rodrigues Ltd's income statement and two balance sheets: Rodrigues Ltd Income Statement for year ending 30th June 2021 Sales COGS Operating expense Depreciation Interest expense Income before tax Tax at 30% Net income $m 600 240 100 40 10 210 63 147 Assets Current assets PPE Rodrigues Ltd Balance Sheet as at 30th June Cost Accumul. depr. Carrying amount Total assets Liabilities Current liabilities Non-current liabilities Owners' equity Retained earnings Contributed equity Total Land OE 2021 $m 98 800 140 660 758 60 130 80 488 758 2020 $m 73 920 100 820 893 50 120 100 623 893

Below is Rodrigues Ltd's income statement and two balance sheets: Rodrigues Ltd Income Statement for year ending 30th June 2021 Sales COGS Operating expense Depreciation Interest expense Income before tax Tax at 30% Net income $m 600 240 100 40 10 210 63 147 Assets Current assets PPE Rodrigues Ltd Balance Sheet as at 30th June Cost Accumul. depr. Carrying amount Total assets Liabilities Current liabilities Non-current liabilities Owners' equity Retained earnings Contributed equity Total Land OE 2021 $m 98 800 140 660 758 60 130 80 488 758 2020 $m 73 920 100 820 893 50 120 100 623 893

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 7E: Multiple-Step and Single-Step Income Statements, and Statement of Comprehensive Income On December...

Related questions

Question

Transcribed Image Text:Below is Rodrigues Ltd's income statement and two balance sheets:

Rodrigues Ltd

Income Statement for

year ending 30th June 2021

Sales

COGS

Operating expense

Depreciation

Interest expense

Income before tax

Tax at 30%

Net income

$m

600

240

100

40

10

210

63

147

Assets

Current assets

PPE

Cost

Accumul. depr.

Carrying amount

Total assets

Rodrigues Ltd

Balance Sheet

as at 30th June

Liabilities

Current liabilities

Non-current liabilities

Owners' equity

Retained earnings

Contributed equity

Total L and OE

2021

$m

98

800

140

660

758

60

130

80

488

758

2020

$m

73

920

100

820

893

50

120

100

623

893

Which of the following statements about the financial year from 30 June 2020 to 30 June 2021 is

NOT correct?

O a. The increase in net working capital (ANWC) was $15m.

O b. Net capital expenditure was negative because in net terms, more property, plant and equipment (PPE) was bought rather than sold.

O c.

The increase in net working capital was positive largely because in net terms, more inventory was bought rather than sold.

O d. Firm free cash flow (FFCF or Cash flow from assets CFFA) was $302m.

e.

Net capital expenditure (CapEx) was $-120m.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning