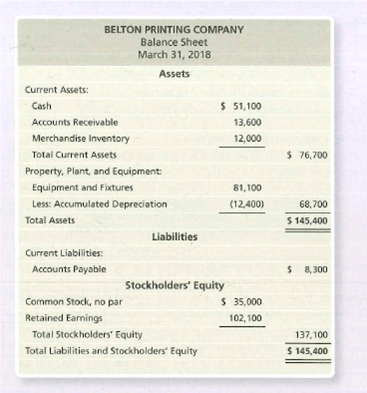

BELTON PRINTING COMPANY Balance Sheet March 31, 2018 Assets Current Assets: Cash $ 51,100 Accounts Receivable 13,600 Merchandise Inventory 12,000 Total Current Assets $ 76,700 Property, Plant, and Equipment: Equipment and Fixtures 81, 100 Less: Accumulated Depreciation (12,400) 68,700 Total Assets $ 145,400 Liabilities Current Liabilities: Accounts Payable $ 8,300 Stockholders' Equity Common Stock, no par S 35,000 Retained Earnings 102, 100 Total Stockholders' Equity 137,100 Total Liabilities and Stockholders' Equity $ 145,400

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Completing a comprehensive budgeting problem—merchandising company

Belton Printing Company of Baltimore has applied for a loan. Its bank has requested a

As Belton Printings controller, you have assembled the following additional information:

- April dividends of $7,000 were declared and paid.

- April capital expenditures of $17,000 budgeted for cash purchase of equipment.

- April

depreciation expense, $800. - Cost of goods sold, 55% of sales.

- Desired ending inventory For April is $24,800.

- April selling and administrative expenses includes salaries of $29,000, 20% of which Will be paid in cash and the remainder paid next month.

- Additional April selling and administrative expenses also include miscellaneous expenses of 10% of sales, all paid in April.

- April budgeted sales, $86,000, 80% collected in April and 20% in May.

- April cash payments of March 31 liabilities incurred for March purchases of inventory, $8,300.

- April purchases of inventory, $22,900 for cash and $37,200 on account. Half the credit purchases will be paid in April and half in May.

Requirements

- Prepare the sales budget for April.

- Prepare the inventory, purchases, and cost of goods sold budget for April.

- Prepare the selling and administrative expense budget for April.

- Prepare the schedule of cash receipts from customers for April.

- Prepare the schedule of cash payments for selling and administrative expenses for April.

- Prepare the

cash budget for April. Assume the company does not use short-term financing to maintain a minimum cash balance. - Prepare the budgeted income statement for April.

- Prepare the budgeted balance sheet at April 30, 2018.

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images