Q: A unit investment trust (uit) is unmanaged pool of investment that is often composed of

A: UIT (UNIT INVESTMENT TRUST) : is a exchanged traded mutual fund offering fixed portfolio of…

Q: Which capital investment methods require the use of a present value table?

A: Net Present Value: It is a measure of profitability for a project used primarily in capital…

Q: What is the Capital Asset Pricing Model (CAPM)?What are the assumptions that underlie themodel?

A: The CAPM is an equilibrium model which stipulates the association among required rates of return and…

Q: What are the absolute measures of investment worth?

A: There are various approaches that can be utilized to decide a value or worth for the venture. Net…

Q: Apply the procedure to find the true IRR, or return on invested capital, of the mixed investment?

A: The internal rate of return (IRR) is a capital budgeting metric used to gauge the benefit of…

Q: Why do most assets of the same type show positive covariances of returns with each other?

A: Covariance is a way of measuring the directional relationship between the returns on two assets and…

Q: What distinguishes a capital investment from other investments?

A: Investments: It is the method by which an investor increases his value over some time for future…

Q: asset value not given

A: Acquisition goodwill is the difference between the consideration paid and the fair value of the net…

Q: Explain Simple versus Nonsimple Investments?

A: The question is based on the concept of different way of investments.

Q: What would you choose? Other investment assets or Alternatives to fixed income and equities

A: Allocation of the investment is a much wider and troublesome task. the proper allocation may lead to…

Q: What are investment returns?

A: Investment returns are a performance measure used to evaluate a speculation’s adequacy or to think…

Q: the Capital Asset Pricing M

A: Explanation : In simple words, Capital asset pricing model for valuing the cost of capital contains…

Q: why is Capital Asset Pricing Model relevant

A: The Capital Asset Pricing Model, popularly known as CAPM, is an important model that is often used…

Q: Why should age, income, nearness to goal, risk tolerance, and existing assets be considered when…

A: Introduction : Asset portfolio refers to the group of stocks and securities that are managed and…

Q: A particular investment's rate of return is referred to as a "return on investment.

A: In response to the question The phrase "financial market" refers to items that are often seen in the…

Q: In general terms, what is the Capital AssetPricing Model (CAPM)? What assumptions weremade when it…

A: CAPM: The capital asset pricing model (CAPM) is a method utilized to determine a hypothetically…

Q: In the case of the net present value technique, explain how the cost of capital is used as a…

A: The question tells about the net present value technique and how the cost of capital is used as a…

Q: Explain the process of Return on Invested Capital?

A: It represents the amount of return earned by all the investors. It can be calculated by dividing…

Q: What is meant by asset transformation and how is it the basis for differentiating between indirect…

A: Finance transformation can be defined as a business-wide combination of process, system, and culture…

Q: Explain the problem of a capital-investment?

A: For the financing of capital investment, generally, the company considers operating cash flow of its…

Q: How do economies of scale and lumpy assets affect financialforecasting?

A: Economies of scale are cost advantages reaped by companies when production becomes efficient.…

Q: What are investment assets ?

A: Investment Assets: Investment assets are termed as tangible or intangible things that are acquired…

Q: Which types of investments are valued at amortized cost? Explain the rationale for this accounting.

A:

Q: What is liquid asset?

A: A liquid asset can be described as the asset which can be sold into the market easily and can be…

Q: Explain an example how to calculate rate of return on total assets.

A:

Q: Capital investment decisions are not affected by:

A: We will answer the first question since the exact one was not specified. Please submit a new…

Q: What is the return on invested capital (RIC)?

A: Return on investment (ROI): This financial ratio evaluates how efficiently the assets are used in…

Q: How can we invest in two assets with similar return characteristics?

A: An asset is something that provides benefits in the future to its owner. There are two types of…

Q: How does the capital asset pricing model (CAPM) influence financial decisions regarding risk and…

A: CAPM is related to the connection between the securities and their expected returns. CAPM is…

Q: asset turnover ratio?

A: Asset turnover ratio = Sales/((Total assets at the beginning of the year + Total assets at the end…

Q: asset

A: The term CAPM or capitam asset pricing model is a model which shows the relationship between risk…

Q: Capital investment decisions involve investments in long-term operational assets. TRUE OR FALSE?

A: Capital investment decision: These decisions are made by the management to utilise the capital funds…

Q: The computation of total asset requirement is similar with judgmental approach' true or false Net…

A: The answers for true or false questions and relevant explanation are presented hereunder : What is…

Q: Define risk-free asset?

A: Risk-free means that anything which does not have any kind of risk associated with it. They are free…

Q: how was capital asset pricing model (CAPM) created? GIVE reference

A: Meaning CAPM Capital asset pricing model, It is created to explain the investor that he/she will get…

Q: Why is the compressed adjusted present value approachappropriate for situations with a changing…

A: Compresses Adjusted Present Value shows Net Present Value(NPV) of a project after considering the…

Q: Is capital maintenance-oriented towards proprietary theory or entity theory?

A: Given: The relation of capital maintenance.

Q: What is capitalization and what are its capabilities?

A: Capitalization may likewise state as the idea of changing over some thought into a business or…

Q: What would you choose? OTHER INVESTMENT ASSETS or ALTERNATIVES TO FIXED INCOME AND EQUITIES

A: Portfolio investments: Portfolio investment is the type of investment in which various types of…

Q: How can we invest in two assets with dissimilar return characteristics?

A: Diversification is one of the tactics to keep in mind while forming a portfolio. Investing all the…

Q: Why is the fixed asset riskier than current asset?

A: In financial accounting, the company's financial statements assets are classified into two…

Q: Explain the concept of capitalization effects?

A: Capitalization means recording an expense or cost on the assets side of the balance sheet and…

Q: How to compare different assets in investment selection process?

A: “Since you have posted multiple questions, we will solve first question for you. If you want any…

Q: What do the Asset management ratios measure?

A: Asset management (turn over) ratios compare an organization's assets with its turnover. Asset…

Q: When calculating WACC, what capital is excluded and why?

A: when the company has multiple sources of finance in the company, then it is required to calculate…

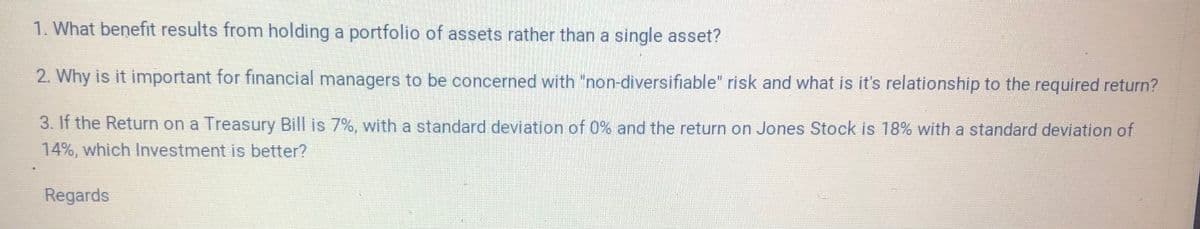

Need answers for this

Step by step

Solved in 4 steps

- You have been hired at the investment firm of Bowers & Noon. One of its clients doesn’t understand the value of diversification or why stocks with the biggest standard deviations don’t always have the highest expected returns. Your assignment is to address the client’s concerns by showing the client how to answer the following questions: Suppose a risk-free asset has an expected return of 5%. By definition, its standard deviation is zero, and its correlation with any other asset is also zero. Using only Asset A and the risk-free asset, plot the attainable portfolios.You have been hired at the investment firm of Bowers & Noon. One of its clients doesn’t understand the value of diversification or why stocks with the biggest standard deviations don’t always have the highest expected returns. Your assignment is to address the client’s concerns by showing the client how to answer the following questions: What is the Capital Asset Pricing Model (CAPM)? What are the assumptions that underlie the model? What is the Security Market Line (SML)?You have been hired at the investment firm of Bowers Noon. One of its clients doesnt understand the value of diversification or why stocks with the biggest standard deviations dont always have the highest expected returns. Your assignment is to address the clients concerns by showing the client how to answer the following questions: d. Construct a plausible graph that shows risk (as measured by portfolio standard deviation) on the x-axis and expected rate of return on the y-axis. Now add an illustrative feasible (or attainable) set of portfolios and show what portion of the feasible set is efficient. What makes a particular portfolio efficient? Dont worry about specific values when constructing the graphmerely illustrate how things look with reasonable data.

- You have been hired at the investment firm of Bowers & Noon. One of its clients doesn’t understand the value of diversification or why stocks with the biggest standard deviations don’t always have the highest expected returns. Your assignment is to address the client’s concerns by showing the client how to answer the following questions: Plot the attainable portfolios for a correlation of 0.35. Now plot the attainable portfolios for correlations of +1.0 and −1.0.You have been hired at the investment firm of Bowers & Noon. One of its clients doesn’t understand the value of diversification or why stocks with the biggest standard deviations don’t always have the highest expected returns. Your assignment is to address the client’s concerns by showing the client how to answer the following questions: Write out the equation for the Capital Market Line (CML), and draw it on the graph. Interpret the plotted CML. Now add a set of indifference curves and illustrate how an investor’s optimal portfolio is some combination of the risky portfolio and the risk-free asset. What is the composition of the risky portfolio?Market equity beta measures the covariability of a firms returns with all shares traded on the market (in excess of the risk-free interest rate). We refer to the degree of covariability as systematic risk. The market prices securities so that the expected returns should compensate the investor for the systematic risk of a particular stock. Stocks carrying a market equity beta of 1.20 should generate a higher return than stocks carrying a market equity beta of 0.90. Nonsystematic risk is any source of risk that does not affect the covariability of a firms returns with the market. Some writers refer to nonsystematic risk as firm-specific risk. Why is the characterization of nonsystematic risk as firm-specific risk a misnomer?

- Which of the following statements is true? A. Because of flotation costs, dollars raised by retaining earnings must work harder than dollars raised by selling new shares. B. All other things being equal, a call option price will increase, and a put option price will decrease if an exercise price increases. C. Security market line (SML) plots return against total risk which is measured by the standard deviation of returns. D. Because potential long-term returns, income from rent-payments, diversification, and inflation hedge, real-estate would be a good investment.If a firm cannot invest retained earnings to earn a rate of returngreater than or equal to the required rate of return on retained earnings, it should return those funds to its stockholders. The cost of equity using the CAPM approach The current risk-free rate of return (rRFrRF) is 4.67% while the market risk premium is 5.75%. The Burris Company has a beta of 0.78. Using the capital asset pricing model (CAPM) approach, Burris’s cost of equity is . The cost of equity using the bond yield plus risk premium approach The Taylor Company is closely held and, therefore, cannot generate reliable inputs with which to use the CAPM method for estimating a company’s cost of internal equity. Taylor’s bonds yield 11.52%, and the firm’s analysts estimate that the firm’s risk premium on its stock over its bonds is 3.55%. Based on the bond-yield-plus-risk-premium approach, Taylor’s cost of internal equity is: 18.84% 15.07% 14.32% 18.08% The…Which of the following statements is CORRECT? a. The SML shows the relationship between companies' required returns and their diversifiable risks. The slope and intercept of this line cannot be influenced by a firm's managers, but the position of the company on the line can be influenced by its managers. b. Suppose you plotted the returns of a given stock against those of the market, and you found that the slope of the regression line was negative. The CAPM would indicate that the required rate of return on the stock should be less than the risk-free rate for a well-diversified investor, assuming investors expect the observed relationship to continue on into the future. c. If investors become less risk averse, the slope of the Security Market Line will increase. d. If a company increases its use of debt, this is likely to cause the slope of its SML to increase, indicating a higher required return on the stock. e. The slope of the SML is determined by the value of beta.

- The possible returns from investing in BestMax share are as follows: State of economy Probability of state of economy Return if state occurs Strong 0.26 96% Normal 0.51 12% Weak 0.23 -83% Based on the above information, calculate the following for BestMax shares: a. Standard deviation of return b. Coefficient of variation c. What does the coefficient of variation reveal about an investment's risk that the standard deviation does not? Explain. d. What is 'risk' in the context of financial decision making? Explain.Consider an economy with just two assets. The details of these are given below. Number of Shares Price Expected Return Standard Deviation A 100 1.5 15 15 B 150 2 12 9 The correlation coefficient between the returns on the two assets is 1=3 and there is also a risk-free asset. Assume the CAPM model is satisfied. (1) What is the expected rate of return on the market portfolio? (2) What is the standard deviation of the market portfolio? (3) What is the beta of stock A? (4) What is the risk-free rate of return?q1- Which of the following statements about the difference between investing in a large portfolio and investing in individual shares is true? Select one: a. For a given level of risk, an investment in a large portfolio will have less return than an investment in a single share. b. For a given level of return, an investment in a large portfolio will have less risk than an investment in a single share. c. For a given level of return, an investment in a large portfolio will have more risk than an investment in a single share. d. We cannot draw any firm conclusions. For a given level of return, Individual shares may have more or less risk than a large portfolio, depending on the individual share and depending on the portfolio.