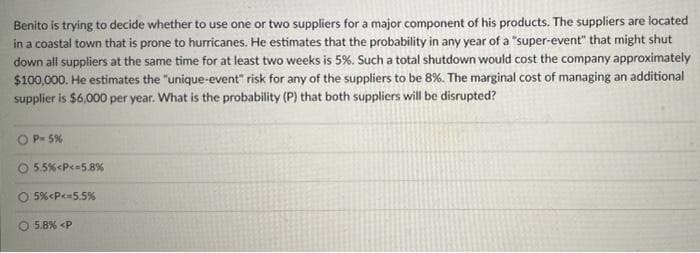

Benito is trying to decide whether to use one or two suppliers for a major component of his products. The suppliers are located in a coastal town that is prone to hurricanes. He estimates that the probability in any year of a "super-event" that might shut down all suppliers at the same time for at least two weeks is 5%. Such a total shutdown would cost the company approximately $100,000. He estimates the "unique-event" risk for any of the suppliers to be 8%. The marginal cost of managing an additional supplier is $6,000 per year. What is the probability (P) that both suppliers will be disrupted? O P- 5%

Benito is trying to decide whether to use one or two suppliers for a major component of his products. The suppliers are located in a coastal town that is prone to hurricanes. He estimates that the probability in any year of a "super-event" that might shut down all suppliers at the same time for at least two weeks is 5%. Such a total shutdown would cost the company approximately $100,000. He estimates the "unique-event" risk for any of the suppliers to be 8%. The marginal cost of managing an additional supplier is $6,000 per year. What is the probability (P) that both suppliers will be disrupted? O P- 5%

Holt Mcdougal Larson Pre-algebra: Student Edition 2012

1st Edition

ISBN:9780547587776

Author:HOLT MCDOUGAL

Publisher:HOLT MCDOUGAL

Chapter11: Data Analysis And Probability

Section11.8: Probabilities Of Disjoint And Overlapping Events

Problem 2C

Related questions

Question

8.

Transcribed Image Text:Benito is trying to decide whether to use one or two suppliers for a major component of his products. The suppliers are located

in a coastal town that is prone to hurricanes. He estimates that the probability in any year of a "super-event" that might shut

down all suppliers at the same time for at least two weeks is 5%. Such a total shutdown would cost the company approximately

$100,000. He estimates the "unique-event" risk for any of the suppliers to be 8%. The marginal cost of managing an additional

supplier is $6,000 per year. What is the probability (P) that both suppliers will be disrupted?

O P- 5%

5.5%<P<=5.8%

O 5%<P<=5.5%

O 5.8% <P

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning