roblem 1- Able Compan

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 91PSB

Related questions

Question

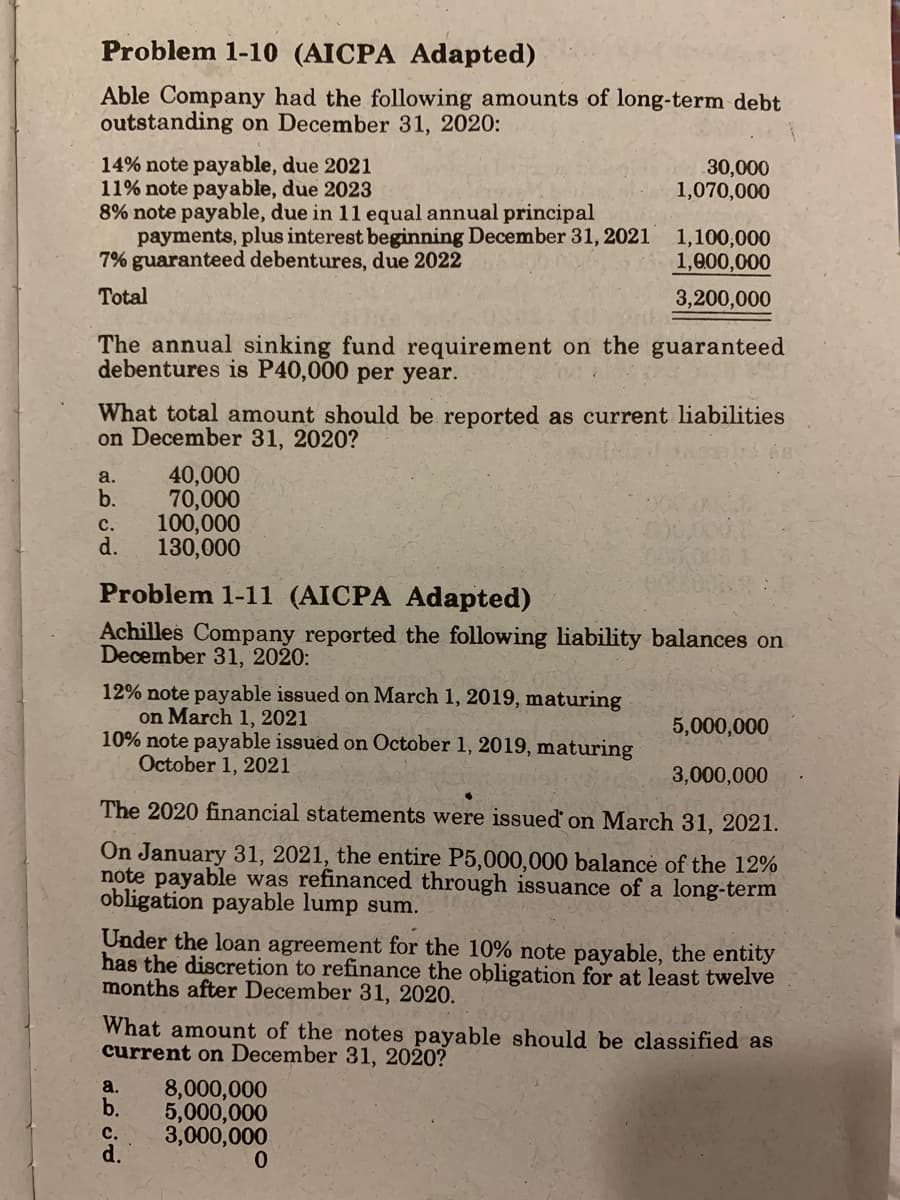

Transcribed Image Text:Problem 1-10 (AICPA Adapted)

Able Company had the following amounts of long-term debt

outstanding on December 31, 2020:

14% note payable, due 2021

11% note payable, due 2023

8% note payable, due in 11 equal annual principal

payments, plus interest beginning December 31, 2021

7% guaranteed debentures, due 2022

30,000

1,070,000

1,100,000

1,000,000

Total

3,200,000

The annual sinking fund requirement on the guaranteed

debentures is P40,000 per year.

What total amount should be reported as current liabilities

on December 31, 2020?

a.

40,000

b.

70,000

100,000

d.

с.

130,000

Problem 1-11 (AICPA Adapted)

Achilles Company reported the following liability balances on

December 31, 2020:

12% note payable issued on March 1, 2019, maturing

on March 1, 2021

10% note payable issued on October 1, 2019, maturing

October 1, 2021

5,000,000

3,000,000

The 2020 financial statements were issued on March 31, 2021.

On January 31, 2021, the entire P5,000,000 balance of the 12%

note payable was refinanced through issuance of a long-term

obligation payable lump sum.

Under the loan agreement for the 10% note payable, the entity

has the discretion to refinance the obligation for at least twelve

months after December 31, 2020.

What amount of the notes payable should be classified as

current on December 31, 2020?

8,000,000

5,000,000

3,000,000

0.

a.

b.

с.

d.

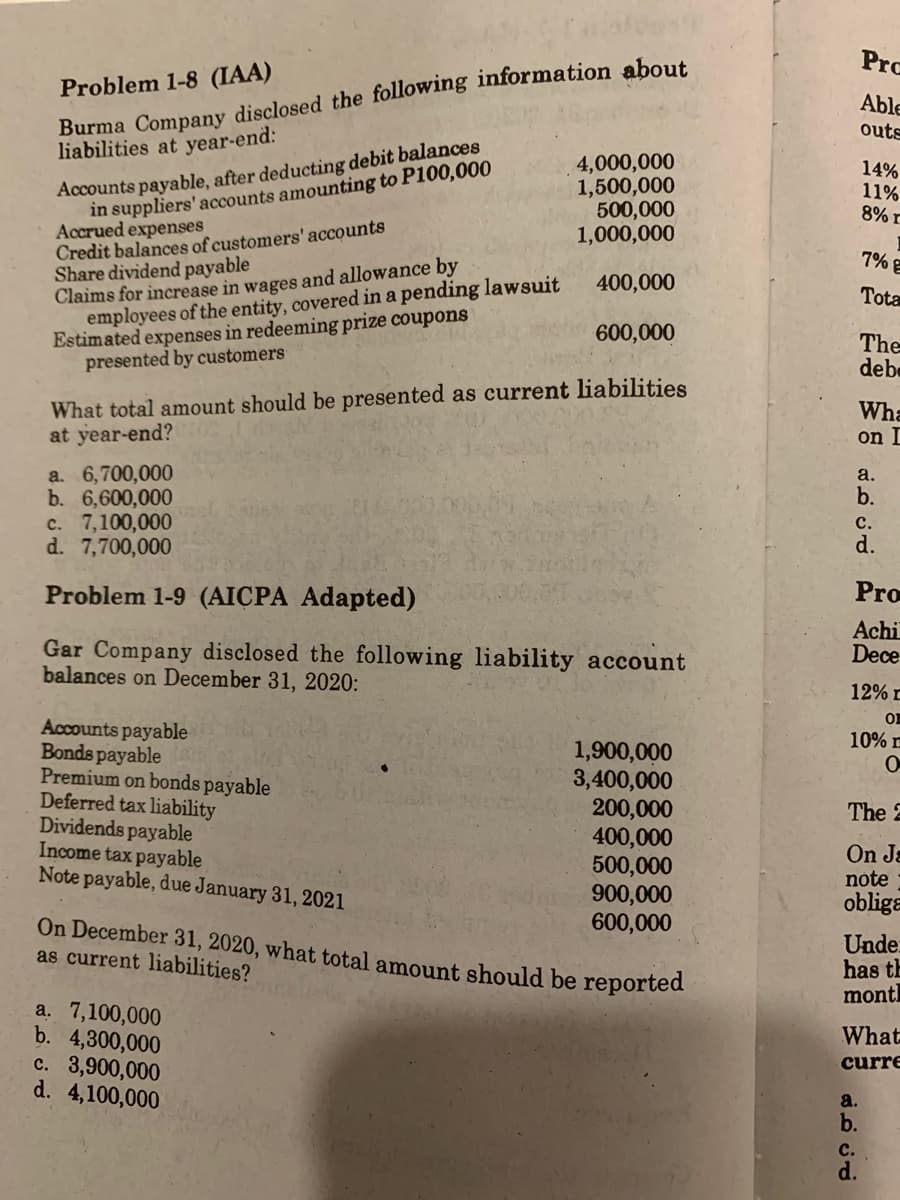

Transcribed Image Text:Burma Company disclosed the following information about

4,000,000

1,500,000

500,000

1,000,000

Pro

Problem 1-8 (IAA)

Able

outs

Accounts payable, after deducting debit balances

in suppliers' accounts amounting to P100,000

Accrued expenses

Credit balances of customers' accounts

Share dividend payable

Claims for increase in wages and allowance by

employees of the entity, covered in a pending lawsuit

Estimated expenses in redeeming prize coupons

presented by customers

liabilities at year-end:

14%

11%

8% r

7% g

400,000

Tota

600,000

The

debe

What total amount should be presented as current liabilities

at year-end?

Wha

on I

a. 6,700,000

b. 6,600,000

c. 7,100,000

d. 7,700,000

a.

b.

с.

d.

Problem 1-9 (AICPA Adapted)

Pro

Gar Company disclosed the following liability account

balances on December 31, 2020:

Achi

Dece

12% r

Accounts payable

Bonds payable

Premium on bonds payable

Deferred tax liability

Dividends payable

Income tax payable

Note payable, due January 31, 2021

10%

1,900,000

3,400,000

200,000

400,000

500,000

900,000

600,000

The 2

On Ja

note

obliga

On December 31, 2020, what total amount should be reported

Under

has th

montl

as current liabilities?

a. 7,100,000

b. 4,300,000

c. 3,900,000

d. 4,100,000

What

curre

a.

b.

с.

d.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning