Bernie Bird Co.'s retirement plan provides for a lump sump benefit. equal to the final monthly salary multiplied by the years of service, to employees who have reached the age of 60 and have rendered at least five years of service. The year of employment and the year in which the employee reaches the age of 60 are counted as full years. Mr. Wooten, who has just turned 50, was employed during the year. Mr. Wooten's current monthly salary is P60,000 and this is expected to increase by 2% per year. The discount rate is 10%. How much are the (1) projected lump sum benefit to be received by Mr. Wooten on his retirement date and (2) current service cost for the year? O 804,54028, 199 O 718,360.27,664 O 826,940:30,036 O 732,34028, 199

Bernie Bird Co.'s retirement plan provides for a lump sump benefit. equal to the final monthly salary multiplied by the years of service, to employees who have reached the age of 60 and have rendered at least five years of service. The year of employment and the year in which the employee reaches the age of 60 are counted as full years. Mr. Wooten, who has just turned 50, was employed during the year. Mr. Wooten's current monthly salary is P60,000 and this is expected to increase by 2% per year. The discount rate is 10%. How much are the (1) projected lump sum benefit to be received by Mr. Wooten on his retirement date and (2) current service cost for the year? O 804,54028, 199 O 718,360.27,664 O 826,940:30,036 O 732,34028, 199

Chapter9: Deductions: Employee And Self- Employed-related Expenses

Section: Chapter Questions

Problem 8DQ

Related questions

Question

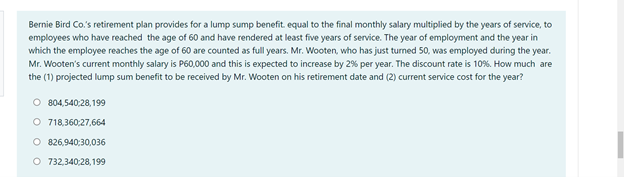

Transcribed Image Text:Bernie Bird Co.'s retirement plan provides for a lump sump benefit. equal to the final monthly salary multiplied by the years of service, to

employees who have reached the age of 60 and have rendered at least five years of service. The year of employment and the year in

which the employee reaches the age of 60 are counted as full years. Mr. Wooten, who has just turned 50, was employed during the year.

Mr. Wooten's current monthly salary is P60,000 and this is expected to increase by 2% per year. The discount rate is 10%. How much are

the (1) projected lump sum benefit to be received by Mr. Wooten on his retirement date and (2) current service cost for the year?

O 804,540:28,199

O 718,360:27,664

O 826,940:30,036

O 732,340:28, 199

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT