Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter15: Distributions To Shareholders: Dividends And Repurchases

Section: Chapter Questions

Problem 5P

Related questions

Question

100%

Please solve for only d)

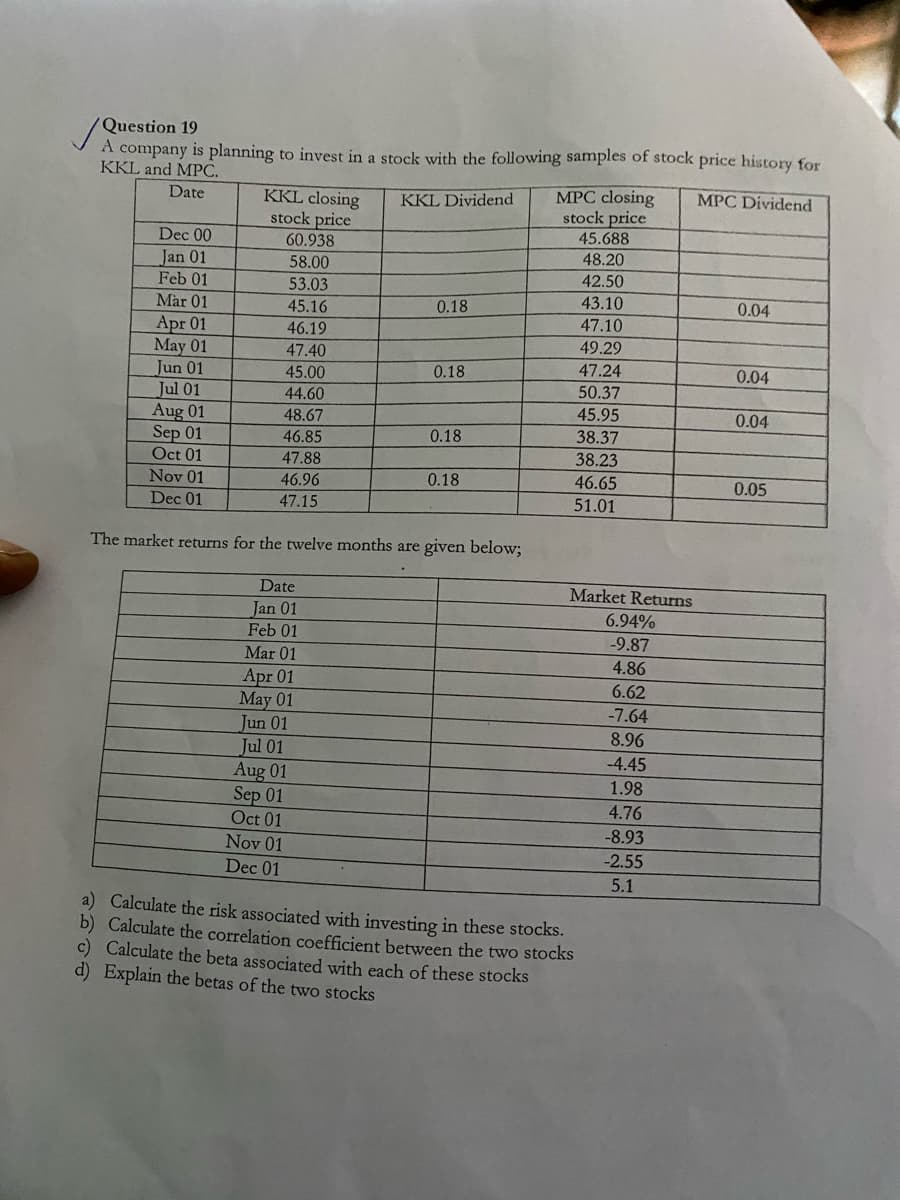

Transcribed Image Text:Question 19

A company is planning to invest in a stock with the following samples of stock price history for

KKL and MPC.

KKL closing

stock price

MPC closing

stock price

45.688

Date

KKL Dividend

MPC Dividend

Dec 00

60.938

48.20

Jan 01

Feb 01

Mar 01

Apr 01

May 01

Jun 01

Jul 01

Aug 01

Sep 01

Oct 01

Nov 01

58.00

42.50

53.03

43.10

47.10

49.29

45.16

0.18

0.04

46.19

47.40

0.18

47.24

0.04

45.00

44.60

50.37

48.67

45.95

0.04

46.85

0.18

38.37

47.88

38.23

46.96

0.18

46.65

0.05

Dec 01

47.15

51.01

The market returns for the twelve months are given below;

Date

Market Returns

Jan 01

Feb 01

6.94%

-9.87

Mar 01

4.86

Apr 01

May 01

Jun 01

Jul 01

Aug 01

Sep 01

Oct 01

6.62

-7.64

8.96

-4.45

1.98

4.76

-8.93

Nov 01

-2.55

Dec 01

5.1

a) Calculate the risk associated with investing in these stocks.

b) Calculate the correlation coefficient between the two stocks

c) Calculate the beta associated with each of these stocks

d) Explain the betas of the two stocks

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT