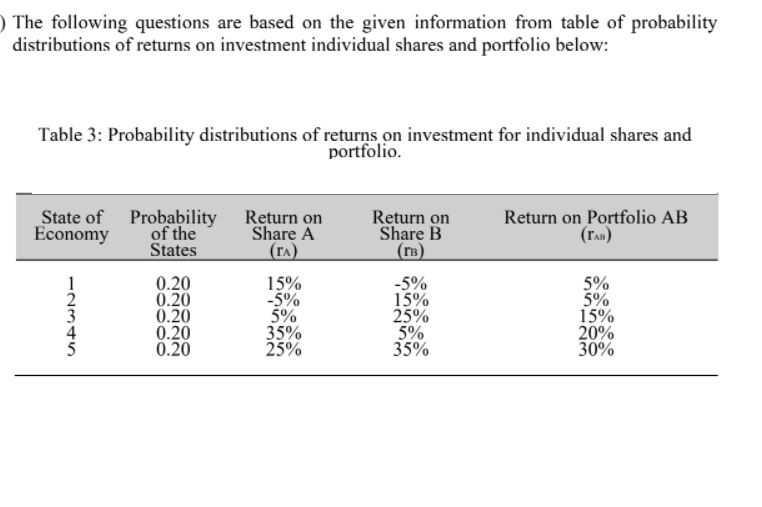

The following questions are based on the given information from table of probability distributions of returns on investment individual shares and portfolio below: Table 3: Probability distributions of returns on investment for individual shares and portfolio.

The following questions are based on the given information from table of probability distributions of returns on investment individual shares and portfolio below: Table 3: Probability distributions of returns on investment for individual shares and portfolio.

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter3: Data Visualization

Section: Chapter Questions

Problem 10P: The file Fortune500 contains data for profits and market capitalizations from a recent sample of...

Related questions

Question

Transcribed Image Text:) The following questions are based on the given information from table of probability

distributions of returns on investment individual shares and portfolio below:

Table 3: Probability distributions of returns on investment for individual shares and

portfolio.

State of Probability

of the

States

Return on

Share A

Return on

Share B

(rB)

Return on Portfolio AB

(ran)

Economy

(ra)

0.20

0.20

0.20

0.20

0.20

15%

-5%

5%

35%

25%

-5%

15%

25%

5%

35%

5%

5%

15%

20%

30%

-234

![Given:

Expected return Share A(fa)

Expected return Share B (fB)

Expected return Portfolio A and B (faB)

15%

15%

15%

By using the above information, demonstrate the rate of risk (variance and standard

déviation) for each of:

(i)

Share A

[Saham A]

(ii)

Share B

[Saham B]

(iii) Portfolio A and B

[Portfolio A dan BỊ

I| ||||](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F545cd8f2-002a-4fd9-8b6f-d7c23c272bcf%2Ff6ff76c0-5d64-4d2c-9221-5e5967ad8f96%2Fw1a5qi_processed.png&w=3840&q=75)

Transcribed Image Text:Given:

Expected return Share A(fa)

Expected return Share B (fB)

Expected return Portfolio A and B (faB)

15%

15%

15%

By using the above information, demonstrate the rate of risk (variance and standard

déviation) for each of:

(i)

Share A

[Saham A]

(ii)

Share B

[Saham B]

(iii) Portfolio A and B

[Portfolio A dan BỊ

I| ||||

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning