Beth's Jewels Cost of Goods Sold Cost of goods sold: Cost of goods sold %24 %24

Q: Dividends Per Share Seventy-Two Inc., a developer of radiology equipment, has stock outstanding as f...

A: The table below shows the calculation of preferred dividend and number of outstanding shares: ...

Q: 1. CtSha Enterprise started a new business on 1 of September 2020. You are required to record the fo...

A: Since you have asked multiple questions, we will solve the first question for you. If you want any s...

Q: While business decisions should be data-driven and usually involve consideration of quantitative fin...

A: Management makes decisions based on quantitative and qualitative factors. Qualitative decisions depe...

Q: Empire Bridal Boutique has a credit balance of $620 in its allowance for bad debts account as of Dec...

A: Formula: Estimated amount uncollectible = Balance amount x Estimated percentage uncollectible. Multi...

Q: 3. Gingerbread, Corp. presents the following information for inventory purchases and sales throughou...

A: Under FIFO method the goods which bought first will be sold first, irrespective of subsequent purcha...

Q: 13. Fusion Corporation has 15,000, 8% preference stock of $100 par value, and 3.5M common stock of $...

A: Step 1 Dividend is the return over the investment made by the investors in the equity interest of th...

Q: 38. Which of the following statements is true?a. LIFO must be used for financial reporting if it is ...

A: First-in-First-Out: In First-in-First-Out method, the costs of the initially purchased items are c...

Q: For which product(s) above would it be more profitable for Faustina to sell at the split-off point r...

A: Here, we have to find out the most profitable product.

Q: TryNErr Corporation issued $1,000,000 of ten-year, 10% bonds payable. The market rate of interest at...

A:

Q: While business decisions should be data-driven and usually involve consideration of quantitative fin...

A: Following are the qualitative factors that should be considered while making a make and buy decision...

Q: Marigold Corp. received $135000 in cash and a used computer with a fair value of $303000 from Ivanho...

A: Formula: Gain on exchange = Cash received on exchange + fair value of computer - Undepreciated. Unde...

Q: Luna Café bears the following costs: The cost of oil for a deep fryer Wages of the workers of the r...

A: Production costs: It refers to costs incurred by a business from manufacturing a product or provi...

Q: Find current ratio, quick ratio, operating cash flow to current liabilites, and working capital for ...

A: As posted multiple sub parts we are answering only first three sub parts kindly repost the unanswere...

Q: Suppose you earn $60,000 per year and pay taxes based on marginal tax rates. The first tax bracket, ...

A: Given: First tax bracket: 5% for $0 to $30,000. Second tax bracket: 20% for $30,001 to $120,000.

Q: Use the formula for computing future value using compound interest to determine the value of an acco...

A: Principal =13000 interest rate =5% quarterly interest =1.25 Period 8 years =32 quarters

Q: Sheffield Inc. and Pharoah Co. have an exchange with no commercial substance. The asset given up by ...

A: When there is no commercial substance, asset should be recorded at the book value of asset given up...

Q: The write-off of the cost of an intangible asset is called a.deterioration. b.functional depreciat...

A: Hey, since there are multiple questions posted, we will answer first question. If you want any speci...

Q: Suppose the amounts presented here are basic financial information (in millions) from the 2020 annua...

A: Financial accounting: Financial accounting is the process of recording, summarizing, and reporting a...

Q: Accounting Question

A:

Q: Blue Corporation, a C-Corporation, has current E&P of $300,000 and accumulated E&P of $1,000...

A: C Corporation is a form of business under federal income tax law under which the shareholders have l...

Q: 19.Gingerbread Corp had a beginning balance in retained earnings of $5,000,000 on January 1, 2020, e...

A: Formula: Ending retained earnings balance =Beginning retained earnings + Net income - dividends paid...

Q: Z & J Merchandising & More is a family-owned auto-parts store. You are the management accoun...

A: A Cash Budget represents the cash receipts and cash payments for the period. It helps the company to...

Q: Swifty Corporation purchased a truck at the beginning of 2020 for $109600. The truck is estimated to...

A: Units of activity method: Under units-of-activity method, depreciation is computed based on the tota...

Q: Q4: To meet increased sales, a large dairy is planning to purchase 100 new delivery Cars. Each truck...

A: Depreciation Expense as per Straight-Line Method (SL) = (Cost of Acquisition of Asset - Salvage Valu...

Q: Question # 1:J Blane commenced business on 1 January 20X6 and prepares her financial statements to 3...

A: Bad debts are the amounts which are estimated that they will not be recovered from the debtors. But ...

Q: Electronically filed tax returns: May not be transmitted from a taxpayer’s home computer Constitut...

A: Income Tax Return is a file prepared by the taxpayer to present it to the tax authorities of his/her...

Q: Cash dividends of $50,000 were declared during the year. Cash dividends payable were $10,000 and $5,...

A: Profits distributed to stockholders are called dividends. Dividends declared and not paid are called...

Q: Majer Corporation makes a product with the following standard costs: Standard Quantityor Hour...

A: Variable overhead efficiency variance = (standard hours - actual hours)*standard rate

Q: Dinham Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one da...

A: Spending variance is the difference between actual expenses and the budgeted expenses. When actual e...

Q: FASB ASC Research Problems FASB ASC Structure. Each ASC reference is structured as a series of four ...

A: A client wishes to change the method by which it values inventory from FIFO to average because it be...

Q: A family friend has asked your help in analyzing the operations of three anonymous companies operati...

A: Residual Income is the difference between the net income generated by a firm and the required income...

Q: 29. On 4/01/2020, the stockholders' equity of Holman Dress Fitters is as follows: Common stock - $10...

A: Introduction: Journal: Recording of a business transactions in a chronological order. First step in ...

Q: ramble Corp. purchased a depreciable asset for $698000 on April 1, 2018. The estimated salvage value...

A: Price = $ 698,000 Salvage Value = $ 68,000 Estimated useful life of years = 5 years

Q: Break-Even Sales and Cost-Volume-Profit Chart For the coming year, Sorkin Company anticipates a unit...

A: Cost-Volume-Profit Analysis: It is the technique of managerial accounting which examines how changes...

Q: You have just been hired by FAB Corporation, the manufacturer of a revolutionary new garage door ope...

A: Budgeting: It is a process of planning the work to be performed. Under this process a formal plan is...

Q: In 2019, the Magtag Company sold 16,000 ovens. Magtag estimated that 14% of the machines would requi...

A: Accounting for warranty expense: When company sale their products on warranty then they need to esti...

Q: Which of the following is NOT an adjustment to an S corporation shareholder's stock basis? Quest...

A: Shareholders: Shareholders are the owners of the limited company. They hold shares of the company wh...

Q: 5. The following list of balances obtained from Agro Trading as at 31 July 2020. PARTICULARS RM | Ca...

A: Financial reporting means releasing the financial reports of the company to its shareholders and in ...

Q: The contribution format income statement for Huerra Company for last year is given below: Tot...

A: Return on investment: It is used to measure the efficiency of the investment of the organisation.

Q: 7. On January 1, 2020 Gingerbread, Corp. purchased a reindeer merry-go-round as an attraction to dra...

A: Capitalized Cost of Asset included all those expenses which are incurred to make the asset ready to ...

Q: Complete the following problem Jan. Issued 1,000 shares of Common Stock, $2 par for $12 per share....

A: As posted multiple sub parts we are answering only first three sub parts kindly repost the unanswere...

Q: A corporate distribution is includible in a shareholder’s gross income to the extent that it is a “d...

A: A dividend is a dispersion of benefits by an organization to its investors. At the point when a comp...

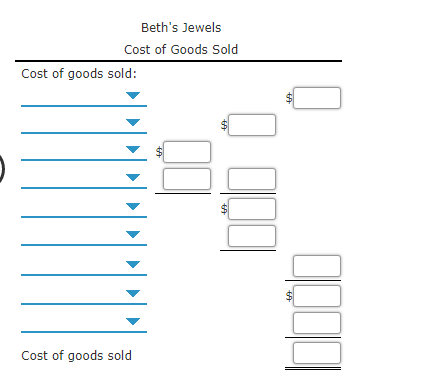

Use the following information to prepare the cost of goods sold section of the income statement for Beth's Jewels.

| Beginning merchandise inventory | $41,000 |

| Ending merchandise inventory | 34,000 |

| Purchases | 52,000 |

| Purchases returns and allowances | 4,700 |

| Purchases discounts | 1,300 |

| Freight-in | 900 |

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- 9. Which of the following is the correct computation for the cost of goods available for sale? a.Net Sales - Cost of Goods Sold b. Sales - Cost of Goods Sold c. Beginning Inventory + Net Purchases d. Net Purchases - Ending Inventory 10. This refers to the shipping cost necessary to bring inventory purchased from the seller to the premises of the company. a. Freight - In b. Freight - Out c. Delivery Expenses d. Travelling Expensesthe net sales 159 150 ID , beginning finished goods inventory 16 500 ID ,Cost of goods manufactured 121 050 ID , ending finished goods inventory 9000 ID , the gross profit areCompute cost of goods sold using the following information: $ Finished goods inventory, beginning Cost of goods manufactured Finished goods inventory, ending 800 4,200 1,150

- Holdaway's cost of goods sold for the year isa. 257,000 b. 260,500 c. 261,000 d. 269,500$0 ric 200 The following summarizes Tesla's merchandising activities for the year. Set up T-accounts for Merchan- dise Inventory and for Cost of Goods Sold. Enter each line item into one or both of the two T-accounts and compute the T-account balances. Cost of merchandise sold to customers.. Merchandise inventory, beginning-of-year.... Merchandise purchases, gross amount Shrinkage on inventory as of year-end.... Transportation-in for merchandise purchases. Cost of merchandise returned by customers (and restored to inventory). Discounts received from suppliers on merchandise purchases Returns to and allowances from suppliers on merchandise purchases $196,000 25,000 192,500 800 2,900 2,100 1,700 4,000 Exercise 5-11 Inventory and cost of sales transactions in T-accounts P1 P2 Check Ending Merch. Inventory, $20,00019 - Which Account Is Debited In Purchasing Commercial Goods. ?A) 320 Sellers AccountB) 391 Calculated VAT AccountC) 120 Buyers AccountD) 153 Commercial Goods AccountE) 150 Raw Materials and Materials Accounts

- 25) The cost of goods on hand and available for sale at any given time and treated as a current asset with a normal debit balance is called as _________________________. a. Sales discount b. Cost of goods sold c. Purchase discount d. Merchandise inventory Clear my choiceApplying the Cost of Goods Sold Model Charest Company has the following data for 2022: Item Units Cost Inventory, 12/31/2021 980 $10,780 Purchases 4,480 49,280 Inventory, 12/31/2022 750 8,250 Required: 1. How many units were sold? 2. Using the cost of goods sold model, determine the cost of goods sold.24 - Which of the following is the approximate amount of Cost of Goods Sold according to the First In First Out (FIFO) method ? a) 49,800 TL B) 36,549 TL NS) 33,480 TL D) 56,451 TL TO) 43,480 TL

- Applying the Cost of Goods Sold Model Hempstead Company has the following data for 2019: Item Units Cost Inventory, 12/31/2018 990 $10,890 Purchases 4,510 49,610 Inventory, 12/31/2019 720 8,040 Required: 1. How many units were sold? ________1 units 2. Using the cost of goods sold model, determine the cost of goods sold.$ ___________How is average selling period computed ?a) It is equal to Cost of the goods sold / 365 b) It is equal to 365 / Net salesc) It is equal to 365 / finished goods inventory turnoverd) It is equal to 365 / Cost of the goods sold5. Total goods available for sale is equal to a. the sum of ending inventory and net purchases. b. the sum of beginning inventory and cost of goods sold. c. the sum of ending inventory and cost of goods sold. d. net purchases minus the increase in inventory.