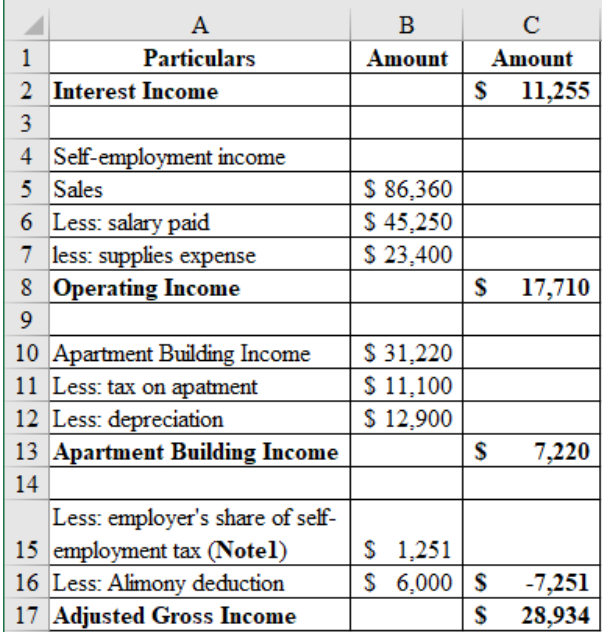

Betty operates a beauty salon as a sole proprietorship. Betty also owns and rents an apartment building. This year Betty had the following income and expenses. Determine Betty’s AGI and complete page 1(through line 8b) and schedule 1 of form 1040 for Betty. You may assume that Betty will owe $2,502 in self-employment tax on her salon income, which $1,251 representing the employer portion of the self-employment tax. You may also assume that her divorce from Rocky was finalized in 2016. Interest income $11,255 Salon sales and revenue $86,360 Salaries paid to beauticians $45,250 Beauty salon supplies $23,400 Alimony paid to her ex-husband Rocky $6,000 Rental revenue from apartment building $31,220 Depreciation on apartment building $12,900 Real estate taxes paid on apartment building $11,100 Real estate taxes paid on personal residence $6,241 Contributions to charity $4,237

Betty operates a beauty salon as a sole proprietorship. Betty also owns and rents an apartment building. This year Betty had the following income and expenses. Determine Betty’s AGI and complete page 1(through line 8b) and schedule 1 of form 1040 for Betty. You may assume that Betty will owe $2,502 in self-employment tax on her salon income, which $1,251 representing the employer portion of the self-employment tax. You may also assume that her divorce from Rocky was finalized in 2016.

Interest income $11,255

Salon sales and revenue $86,360

Salaries paid to beauticians $45,250

Beauty salon supplies $23,400

Alimony paid to her ex-husband Rocky $6,000

Rental revenue from apartment building $31,220

Real estate taxes paid on apartment building $11,100

Real estate taxes paid on personal residence $6,241

Contributions to charity $4,237

Discussion and analysis:

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images