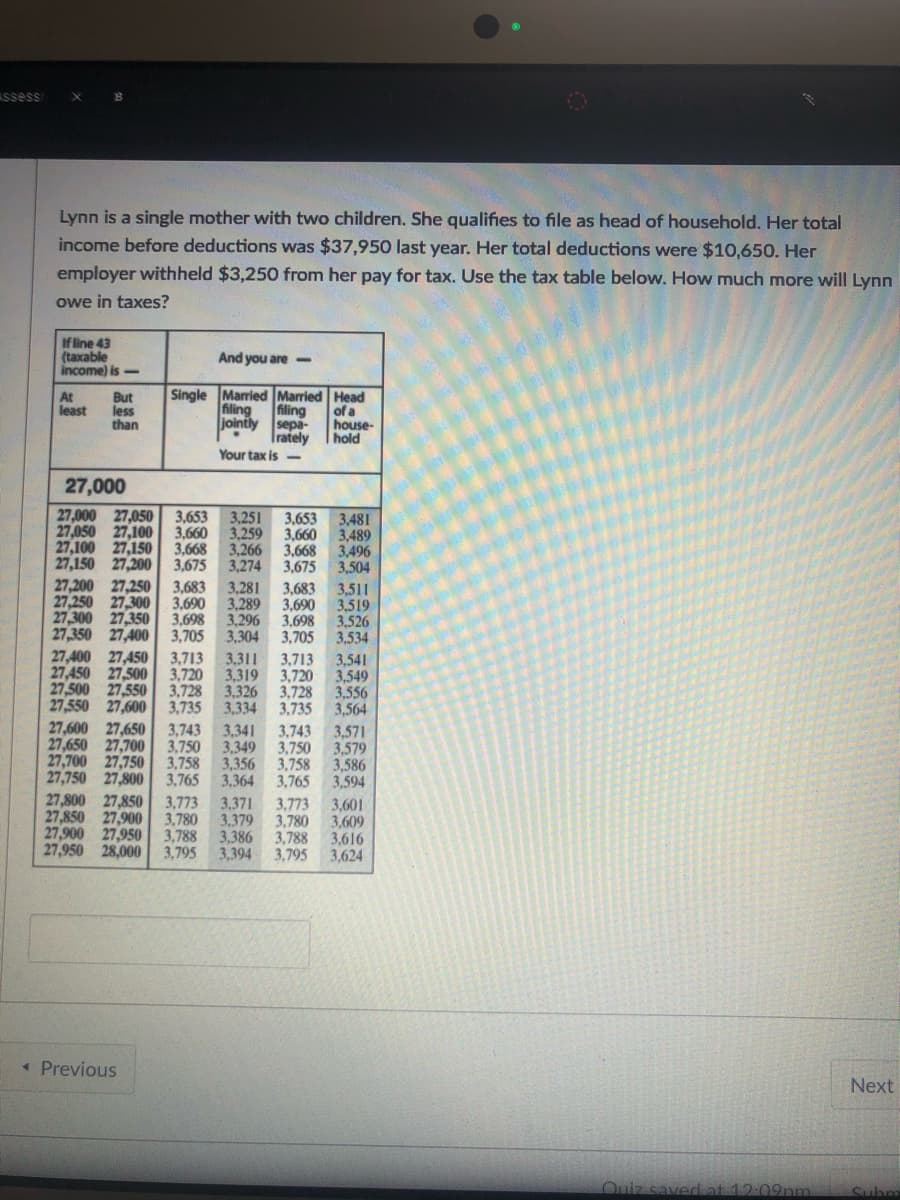

Lynn is a single mother with two children. She qualifies to file as head of household. Her total income before deductions was $37,950 last year. Her total deductions were $10,650. Her employer withheld $3,250 from her pay for tax. Use the tax table below. How much more will Lynn owe in taxes? If line 43 (taxable income) is- And you are- Single Married Married Head of a house- hold At least But less than filing filing jointly sepa- Irately Your tax is - 27,000 27,000 27,050 3,653 3,251 27,050 27,100 3,660 3,259 3,660 27,100 27,150 27,150 27,200 27,200 27,250 27,250 27,300 27,300 27,350 27,350 27,400 3,653 3,481 3,489 3,496 3,504 3,668 3,675 3,266 3,668 3,274 3,675 3,683 3,281 3,683 3,511 3,690 3,519 3,698 3,690 3,289 3,698 3,296 3,705 3,526 3,304 3,534 3,311 3,713 3,541 3,549 3,556 3,564 3,743 3,571 3,750 3,579 3,705 27,400 27,450 27,450 27,500 3,720 27,500 27,550 3,728 27,550 27,600 3,735 27,600 27,650 3,743 27,650 27,700 27,700 27,750 3,758 3,356 27,750 27,800 3,765 3,364 27,800 27,850 27,850 27,900 3,780 27,900 27,950 3,788 27,950 28,000 3,795 3,394 3,713 3,319 3,720 3,326 3,728 3,334 3,735 3,341 3,750 3,349 3,758 3,586 3,765 3,594 3,773 3,773 3,379 3,780 3,386 3,788 3,795 3,371 3,601 3,609 3,616 3,624

Lynn is a single mother with two children. She qualifies to file as head of household. Her total income before deductions was $37,950 last year. Her total deductions were $10,650. Her employer withheld $3,250 from her pay for tax. Use the tax table below. How much more will Lynn owe in taxes? If line 43 (taxable income) is- And you are- Single Married Married Head of a house- hold At least But less than filing filing jointly sepa- Irately Your tax is - 27,000 27,000 27,050 3,653 3,251 27,050 27,100 3,660 3,259 3,660 27,100 27,150 27,150 27,200 27,200 27,250 27,250 27,300 27,300 27,350 27,350 27,400 3,653 3,481 3,489 3,496 3,504 3,668 3,675 3,266 3,668 3,274 3,675 3,683 3,281 3,683 3,511 3,690 3,519 3,698 3,690 3,289 3,698 3,296 3,705 3,526 3,304 3,534 3,311 3,713 3,541 3,549 3,556 3,564 3,743 3,571 3,750 3,579 3,705 27,400 27,450 27,450 27,500 3,720 27,500 27,550 3,728 27,550 27,600 3,735 27,600 27,650 3,743 27,650 27,700 27,700 27,750 3,758 3,356 27,750 27,800 3,765 3,364 27,800 27,850 27,850 27,900 3,780 27,900 27,950 3,788 27,950 28,000 3,795 3,394 3,713 3,319 3,720 3,326 3,728 3,334 3,735 3,341 3,750 3,349 3,758 3,586 3,765 3,594 3,773 3,773 3,379 3,780 3,386 3,788 3,795 3,371 3,601 3,609 3,616 3,624

Chapter8: Taxation Of Individuals

Section: Chapter Questions

Problem 28P

Related questions

Question

Someone help please, thanks

Transcribed Image Text:Lynn is a single mother with two children. She qualifies to file as head of household. Her total

income before deductions was $37,950 last year. Her total deductions were $10,650. Her

employer withheld $3,250 from her pay for tax. Use the tax table below. How much more will Lynn

owe in taxes?

If line 43

(taxable

income) is-

And you are-

Single Married Married Head

of a

house-

hold

At

least

But

less

than

filing filing

jointly sepa-

Irately

Your tax is

-

27,000

27,000 27,050 3,653 3,251

27,050 27,100 3,660 3,259 3,660

27,100 27,150

27,150 27,200

27,200 27,250

27,250 27,300

27,300 27,350

27,350 27,400

3,653 3,481

3,489

3,496

3,504

3,668

3,675

3,266 3,668

3,274

3,675

3,683

3,281

3,683

3,511

3,690 3,519

3,698

3,690

3,289

3,698 3,296

3,705

3,526

3,304

3,534

3,311 3,713 3,541

3,549

3,556

3,564

3,743 3,571

3,750 3,579

3,705

27,400 27,450

27,450 27,500 3,720

27,500 27,550 3,728

27,550 27,600 3,735

27,600 27,650 3,743

27,650 27,700

27,700 27,750 3,758 3,356

27,750 27,800 3,765 3,364

27,800 27,850

27,850 27,900 3,780

27,900 27,950 3,788

27,950 28,000 3,795 3,394

3,713

3,319 3,720

3,326 3,728

3,334

3,735

3,341

3,750 3,349

3,758

3,586

3,765

3,594

3,773

3,773

3,379 3,780

3,386 3,788

3,795

3,371

3,601

3,609

3,616

3,624

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT