Olga is married and files a joint tax return with her husband. What amount of AMT exemption may she deduct under each of the following alternative circumstances? Exhibit 8-5. (Leave no answer blank. Enter zero if applicable.) b. Her AMTI is $1,085,000. Amount of AMT exemption

Olga is married and files a joint tax return with her husband. What amount of AMT exemption may she deduct under each of the following alternative circumstances? Exhibit 8-5. (Leave no answer blank. Enter zero if applicable.) b. Her AMTI is $1,085,000. Amount of AMT exemption

Chapter6: Accounting Periods And Other Taxes

Section: Chapter Questions

Problem 12P: Otto and Monica are married taxpayers who file a joint tax return. For the current tax year, they...

Related questions

Question

Transcribed Image Text:Olga is married and files a joint tax return with her husband.

What amount of AMT exemption may she deduct under each of the following alternative circumstances? Exhibit 8-5.

(Leave no answer blank. Enter zero if applicable.)

b. Her AMTI is $1,085,000.

Amount of AMT exemption

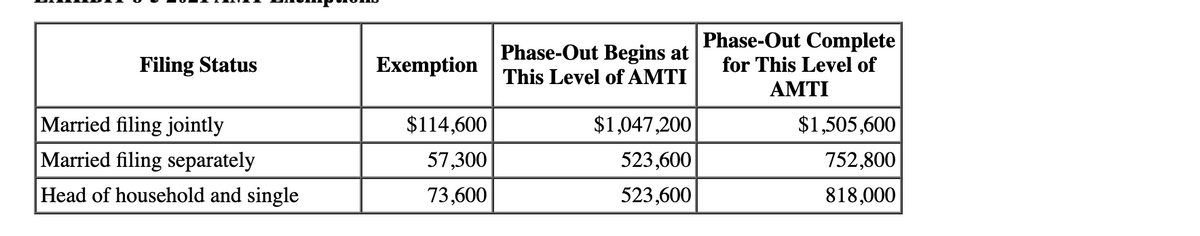

Transcribed Image Text:Phase-Out Complete

for This Level of

Phase-Out Begins at

Filing Status

Exemption

This Level of AMTI

AMTI

Married filing jointly

$114,600

$1,047,200

$1,505,600

Married filing separately

57,300

523,600

752,800

Head of household and single

73,600

523,600

818,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT