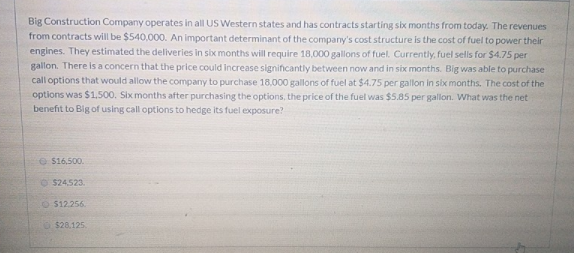

Big Construction Company operates in all US Western states and has contracts starting six months from today. The revenues from contracts will be $540,000. An important determinant of the company's cost structure is the cost of fuel to power their engines. They estimated the deliveries in six months will require 18,000 gallons of fuel. Currently, fuel sells for $4.75 per gallon. There is a concern that the price could increase significantly between now and in six months. Big was able to purchase call options that would allow the company to purchase 18,000 gallons of fuel at $4.75 per gallon in six months. The cost of the options was $1,500, Six months after purchasing the options, the price of the fuel was $5.85 per gallon. What was the net benefit to Big of using call options to hedge its fuel exposure? e $16,500. O $24.523. $12.256. O $28,125.

Big Construction Company operates in all US Western states and has contracts starting six months from today. The revenues from contracts will be $540,000. An important determinant of the company's cost structure is the cost of fuel to power their engines. They estimated the deliveries in six months will require 18,000 gallons of fuel. Currently, fuel sells for $4.75 per gallon. There is a concern that the price could increase significantly between now and in six months. Big was able to purchase call options that would allow the company to purchase 18,000 gallons of fuel at $4.75 per gallon in six months. The cost of the options was $1,500, Six months after purchasing the options, the price of the fuel was $5.85 per gallon. What was the net benefit to Big of using call options to hedge its fuel exposure? e $16,500. O $24.523. $12.256. O $28,125.

Chapter21: Risk Management

Section: Chapter Questions

Problem 5P

Related questions

Question

Transcribed Image Text:Big Construction Company operates in all US Western states and has contracts starting six months from today. The revenues

from contracts will be $540,000. An important determinant of the company's cost structure is the cost of fuel to power their

engines. They estimated the deliveries in six months will require 18,000 gallons of fuel. Currently, fuel sells for $4.75 per

gallon. There is a concern that the price could increase significantly between now and in six months. Big was able to purchase

call options that would allow the company to purchase 18,000 gallons of fuel at $4.75 per gallon in six months. The cost of the

options was $1,500, Six months after purchasing the options, the price of the fuel was $5.85 per gallon. What was the net

benefit to Big of using call options to hedge its fuel exposure?

e $16,500.

O $24.523.

$12.256.

O $28,125.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub