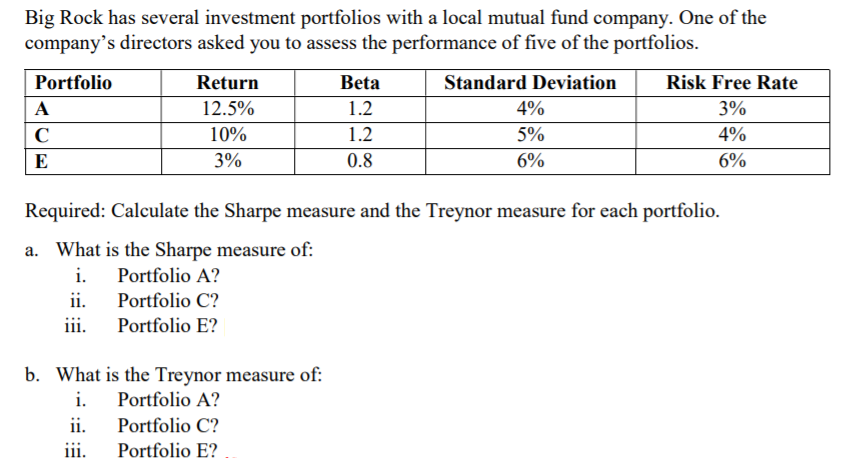

Big Rock has several investment portfolios with a local mutual fund company. One of the company's directors asked you to assess the performance of five of the portfolios. Portfolio Return Beta Standard Deviation Risk Free Rate А 12.5% 1.2 4% 3% 10% 1.2 5% 4% E 3% 0.8 6% 6% Required: Calculate the Sharpe measure and the Treynor measure for each portfolio. a. What is the Sharpe measure of: i. Portfolio A? ii. Portfolio C? iii. Portfolio E? b. What is the Treynor measure of: i. Portfolio A? ii. Portfolio C? iii. Portfolio E?

Q: vny does the Fed use the RRF rate as a supplem the interest on reserve balances rate? Because financ...

A: Federal bank maintain money supply by the increase or decrease the RRP ON Reverse repo rate and IORB...

Q: Lucy bought a house for $100,000. Lucy's annual cost of ownership net of tax savings is exactly equa...

A: Cost of House $1,00,000.00 LTV 80% Buying Cost 5% Selling Cost 8% Annual Growth rate 4.50%

Q: Unequal Lives The Perez Company has the opportunity to invest in one of two mutually exclusive mach...

A: As per the information provided : Initial cost of Machine A - $10 million After-tax inflows - $4 mil...

Q: 29. Annuities. You can buy a car that is advertised for $24,000 on the following terms: (a) pay $24,...

A: The decision to pay now or consider annuity payments can be taken by comparing present value of both...

Q: How to solve for the current price in the given equation

A: Bond valuation refers to a method which is used to compute the current value or present value (PV) o...

Q: 2. Consider a chooser option where the holder has the right to choose between a European call and a ...

A: European call option used to give an owner the right, which used to acquire an underlying security a...

Q: Peter Chan aged 35 is married and has 1 children. His wife, Susan aged 30, is a homemaker but attend...

A: In the form of a policy, insurance is a contract in which an individual or entity receives financial...

Q: If the General Electric bonds you purchased had paid you a total of $8,680 at maturity, how much did...

A: Bond: It is a debt instrument issued by the company (issuer) to raise debt capital. The debtholders...

Q: A nominal rate of interest of 7% compounded continuously is equivalent to an effective annual rate o...

A: Interest rate (r) = 7% Mathematics constant (e) = 2.7182818284590452353602874713527

Q: Your bank pays 12% interest, compounded quarterly. How much should you deposit now to yield an annui...

A: Present value is the amount that should be deposited to the given yield at each of the three months.

Q: The higher the interest rate, the higher my future value will be. O True False

A: The given statement is correct. The future value is a concept of time value of money which states th...

Q: A 5-year project will require an investment of $100 million. This comprises of plant and machinery w...

A: First we need to calculate the cost of equity by using this equation Ke =D1P0+g where D1 =next divid...

Q: Piercy, LLC, has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash F...

A: NPV or Net present value is determined by adding the discounted value of all inflows and outflows to...

Q: CEO wants to assign the budget to each business function for functional strategy execution. As you n...

A: An organization's financial strategy is primarily concerned with the acquisition and utilisation of ...

Q: What is the finance charge for this month?

A: Finance Charge: The finance charge represents the cost of borrowing or the cost of credit. Hence, i...

Q: A fixed-income security pays out a dividend of $5 at the end of each year for 9 years, and a lump su...

A: Annual dividend (D) = $5 Number of annual dividends (n) = 9 Lump sum amount (MV) = $105 Lump sum amo...

Q: Explain a typical ADI’s sources and uses of funds

A: A commercial bank may be a financial institution that accepts deposits, provides bank account servic...

Q: A sum of P1,000 is invested now and left for eight years at which time the principal is withdrawn. T...

A: We will use the concept of time value of money here. The concept says that money earns interest and ...

Q: With a required rate of return of 17%, the IRR of a standard capital budgeting project is equal to 1...

A: Internal rate of return is the rate which the NPV of the project is zero. Net present value is the d...

Q: Find the present value of a perpetuity of P15,000 payable semi-annually if money is worth 8% compoun...

A: A perpetuity is a series of continuous payments made at regular intervals. It can also be understood...

Q: can afford to pay a monthly amount of $963.33, determine how much we can borrow if the term is 30 ye...

A: The mortgages are paid by the monthly payments that carry the payment of interest and payment of the...

Q: The Dividend Discount model requires several conditions to hold in order to be valid. One such condi...

A: The dividend discount model (DDM) is a mathematical method for predicting a company's stock price ba...

Q: A metal plating company is considering four different methods for recovering by-product heavy metals...

A: The rate which makes the total discounted worth of cash flows equal to zero is called IRR or interna...

Q: This is known as:

A: Fund refers to the money which should be kept aside for meeting some specific purpose. In this, the ...

Q: Leah received a loan of $35,000 at 3.5% compounded quarterly. She had to make payments at the end of...

A: The size of monthly payment can be calculated by using loan amortization formula. PMT =P*i1-1(1+i)n ...

Q: 10. NPV versus IRR Piercy, LLC, has identified the following two mutually exclusive projects: Year C...

A: NPV is the difference between present value of cash inflows and INTIAL INVESTMENT NPV =PV of all cas...

Q: A company expects EPS to be $8.81 next year. The industry average P/E ratio is 34.84 and Enterprise ...

A: The method of comparables means the relevant ratios of industry, peer groups or similar kind of comp...

Q: A corporation issues 100 sinking fund bonds of P1,000 face value, redeemable at par in 15 years, wit...

A: Given: Number of bonds = 100 Face Value = P1000 number of periods "n" = 15*2 = 30 Semiannual coupon ...

Q: Lucus Laboratories' last dividend was $1.50. Its current equilibriuem stock price is $15.75 and is ...

A: We need to use the following equations for dividend yield and capital gain yield Dividend yield =Div...

Q: According to MM propositions, which of the following statements best describes the consequence of de...

A: The M&M Theorem, or the Modigliani-Miller Theorem is a capital structure theory developed by Mod...

Q: How can banks safeguard their information security?

A: Protecting information and information systems from illegal access, usage, disclosure, interruption,...

Q: Chuong Ngo borrows $3200 from a bank that advertises a 8% simple interest rate and repays the loan i...

A: Given: Borrowed amount = $3,200 Simple interest = 8% Monthly payments =4

Q: make money, we need to make än investi

A: In money and finance you need money to invest and if you do not invest you will not earn money you m...

Q: 3. If money is worth 8% compounded quarter ly, determine the present value of the following: a. An a...

A: Annuity is a series of equal cash flows occurring at regular intervals. A perpetuity is an annuity t...

Q: Light Motors is taking a look at a new product line that will take a few years to create. New lab eq...

A: Initial Cost Php 1,00,00,000.00 MARR 12% Expense for 4 Years Php 1,50,00,000.00 Time Period 2...

Q: Tatsuo has just been awarded a four-year scholarship to attend the university of his choice. The sch...

A: An annuity is defined as the series of payment made each year for a definite period of time. In annu...

Q: A $290,000 house in Hamilton was purchased with a down payment of 20.00% of its value and a 20 year ...

A: Here,

Q: principle invested

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for yo...

Q: Lucy bought a house for $100,000. Lucy's annual cost of ownership net of tax savings is exactly equa...

A: IRR of a project is the rate of return at which the net present value of the project becomes zero. T...

Q: Complete the tabe: Compounded Month ly Compounded Semi- Annually Com pornded Annually Compounded Qua...

A: Hi, since you have asked a question with multiple sub-parts we will answer only the first three as p...

Q: Elona Zuckerberg is the CFO of Facenote company. made the following statements in a conference call ...

A: The firm capital structure consists of sources of capital which include debt, preference and equity ...

Q: The Bond Market Big Rock’s directors are looking to expand into a new suite of services. Although th...

A: Company raises money through various methods equity, bonds and preferred stock. Each one has advanta...

Q: ow much should the parents place at the end of each year into a savings account that earns an annual...

A: Future Value of Annuity: It represents the future worth of the current periodic annuity payments ma...

Q: Carmella purchased a refrigerator under a conditional sale contract that required 24 monthly payment...

A: Given, Monthly payments $70.26 Term is 24 months Rate is 15% compounded annually. The payment starte...

Q: Southern Timber Company expects to have an EBIT of $10 million in the coming year, and its EBIT is e...

A: According to M&M Model the value of levered firm will be sum of value of unlevered firm plus tax...

Q: Calculate the compounded interest after 7 years and 9 months if 500,000 is placed at an annual rate ...

A: a) Amount invested (A) = 500,000 n = 7 years 9 months = 93 months r = 11.28% per annum = 0.94% per m...

Q: 13. Calculating Profitability Index following set of cash flows if the relevant discount rate is 10 ...

A: Profitability Index = (NPV + Initial Investment ) / Initial Investment NPV can be calculated by ...

Q: Determine the amount of P 45000 after 9 years if the rate is 7% compounded continuously. O 86412 O 8...

A: Amount after 9 years can be calculated with the help of future value function with continuous compou...

Q: Round each z-score to the nearest hundredth. A data set has a mean of x = 6.2 and a standard dev...

A: A difference in given value from standard deviation is known as a Z- score. It denotes how far or cl...

Q: A bond will sell at ____________ if the required return is greater than the coupon rate. Select one...

A: Required return relation with price and coupon rate If required return is greater than coupon rate t...

Step by step

Solved in 2 steps with 2 images

- Blair Rosen. Inc. (BR) is a brokerage firm that specializes in investment portfolios designed to meet the specific risk tolerances of its clients. A client who contacted BR this past week has a maximum of 50,000 to invest. BRs investment advisor decides to recommend a portfolio consisting of two investment funds: an Internet fund and a Blue Chip fund. The Internet fund has a projected annual return of 12%, and the Blue Chip fund has a projected annual return of 9%. The investment advisor requires that at most 35,000 of the clients funds should be invested in the Internet fund. BR services include a risk rating for each investment alternative. The Internet fund, which is the more risky of the two investment alternatives, has a risk rating of 6 per 1,000 invested. The Blue Chip fund has a risk rating of 4 per 1,000 invested. For example, if 10,000 is invested in each of the two investment funds, BRs risk rating for the portfolio would be 6(10) + 4(10) = 100. Finally. BR developed a questionnaire to measure each clients risk tolerance. Based on the responses, each client is classified as a conservative, moderate, or aggressive investor. Suppose that the questionnaire results classified the current client as a moderate investor. BR recommends that a client who is a moderate investor limit his or her portfolio to a maximum risk rating of 240. a. Formulate a linear programming model to find the best investment strategy for this client. b. Build a spreadsheet model and solve the problem using Solver. What is the recommended investment portfolio for this client? What is the annual return for the portfolio? c. Suppose that a second client with 50,000 to invest has been classified as an aggressive investor. BR recommends that the maximum portfolio risk rating for an aggressive investor is 320. What is the recommended investment portfolio for this aggressive investor? d. Suppose that a third client with 50,000 to invest has been classified as a conservative investor. BR recommends that the maximum portfolio risk rating for a conservative investor is 160. Develop the recommended investment portfolio for the conservative investor.Big Rock has several investment portfolios with a local mutual fund company. One of thecompany’s directors asked you to assess the performance of five of the portfolios. Portfolio Return Beta Standard Deviation Risk Free RateA 12.5% 1.2 4% 3%C 10% 1.2 5% 4%E 3% 0.8 6% 6% Calculate the Sharpe measure and the Treynor measure for each portfolio.a. What is the Sharpe measure of:i. Portfolio A?ii. Portfolio C?iii. Portfolio E? b. What is the Treynor measure of:i. Portfolio A?ii. Portfolio C?iii. Portfolio E?1). Big Rock has several investment portfolios with a local mutual fund company. One of thecompany’s directors asked you to assess the performance of five of the portfolios. Portfolio Return Beta Standard Deviation Risk Free Rate A 12.5% 1.2 4% 3% C 10% 1.2 5% 4% E 3% 0.8 6% 6% Required: Calculate the Sharpe measure and the Treynor measure for each portfolio.a. What is the Sharpe measure of:i. Portfolio A?ii. Portfolio C?iii. Portfolio E? b. What is the Treynor measure of:i. Portfolio A?ii. Portfolio C?iii. Portfolio E? 2). When you were at lunch, you overheard a heated conversation between two employees ofBig Rock. One was arguing a case for active fund management strategies and the otherwas arguing a case for passive fund management strategies.…

- Composite Portfolio Performance Measures Big Rock has several investment portfolios with a local mutual fund company. One of thecompany’s directors asked you to assess the performance of five of the portfolios.Portfolio Return Beta Standard Deviation Risk Free RateA 12.5% 1.2 4% 3%C 10% 1.2 5% 4%E 3% 0.8 6% 6% Required: Calculate the Sharpe measure and the Treynor measure for each portfolio.a. What is the Sharpe measure of:i. Portfolio A?ii. Portfolio C?iii. Portfolio E? b. What is the Treynor measure of:i. Portfolio A?ii. Portfolio C?iii. Portfolio E?An insurance fund is analysing the performance of three different fund managers A, B and C. Each manager invests in one third of all asset classes to maintain a well diversified portfolio. The following information is available: A B C Market portfolio Average net return (%) 5 8 9 9 Volatility (%) 18 24 21 20 Beta 0.8 1.1 1.3 A risk free rate is established to be 2%. Calculate for each of the fund managers the expected return using CAPM, ex post Sharpe Ratio, Treynor Ratio, M2 alpha and Jensen’s alpha. Interpret your results.You have just been appointed as a fund manager for Gate Way Fund, of which you will be responsible of a portfolio that consists of two assets. The analysts have provided you with the expected returns and standard deviations of returns of which are listed in the table below: Asset A Asset B Expected Return 7% 11% Standard Deviation 15% 21% Calculate the standard deviation of the portfolio if the assets are equally weighted. The two asset portfolio model can be extended two a portfolio with more assets. Explain the implications of this approach for the understanding of portfolio risk and discuss the practical problems of applying the model in this fashion.

- You have just been appointed as a fund manager for Gate Way Fund, of which you will be responsible of a portfolio that consists of two assets. The analysts have provided you with the expected returns and standard deviations of returns of which are listed in the table below: Asset A Asset B Expected Return 7% 11% Standard Deviation 15% 21% Calculate the expected return of the portfolio if half is invested in asset A. If the covariance of the two assets is 28, calculate the correlation coefficient of the portfolio. Calculate the variance of the portfolio if the investments in the two assets classes is equal. Calculate the standard deviation of the portfolio if the assets are equally weighted. The two asset portfolio model can be extended to a portfolio with more assets. Explain the implications of this approach for the understanding of portfolio risk and discuss the practical problems of applying the model in this fashion.A portfolio manager is considering investing in two mutual funds and the risk free asset (T-Bills). The data for these securities is give by: ER. σ Stock Fund (S) 18% 23% Bond Fund(B) 6% 13% T-Bill 5% 0% The correlation between the two funds is -0.1 One mutual fund’s portfolio, M, is reached by investing 42% in stocks and 58% in bonds. Calculate the expected return, standard deviation and Sharpe Ratio of this and draw the Capital Allocation Line (CAL) that is associated with the portfolio M you calculated in (a). In addition, sketch the minimum variance frontier in the same graph (no further calculations needed). Indicate on your graph which part of the frontier is the efficient set.Suppose you manage an equity fund with the following securities. Use the following data to help build an active portfolio. Input Data Vogt Industries Isher Corporation Hedrock, Incorporated Alpha 0.012 0.006 0.016 Beta 0.277 1.015 1.630 Standard Deviation 0.156 0.168 0.181 Residual Standard Deviation 0.117 0.048 0.113 Information Ratio 0.1026 0.1250 0.1416 Alpha/Residual Variance 0.877 2.604 1.253 Market Data S&P 500 Treasury Bills Expected Raturn 12.00% 2.50% Standard Deviation 20.00% 0.00% Required: Using the information in the table above, please first calculate the initial weight of each stock in an active portfolio, using the Treynor Black approach. Then adjust each weight for beta. (Use cells A5 to D14 from the given information to complete this question.) Treynor-Black Model Vogt Industries Isher Corporation Hedrock, Incorporated…

- As an equity analyst, you have developed the following return forecasts and risk estimates for two different stock mutual funds (Fund T and Fund U}: Forecasted Return CAPM Beta Fund T 9.00% 1.20 Fund U 10.00% 0.80 a. If the risk-free rate is 3.9 percent and the expected market risk premium (£(RM) -RFR} is 6.1 percent, calculate the expected return for each mutual fund according to the CAPM. b. Using the estimated expected returns from part (a) along with your own return forecasts, demonstrate whether Fund T and Fund U are currently priced to fall directly on the security market line (SML), above the SML, or below the SML. c. According to your analysis, are Funds T and U overvalued, undervalued, or properly valued?You want to evaluate three mutual funds using the Sharpe measure for performance evaluation. The risk-free return during the sample period is 4%. The average returns, standard deviations, and betas for the three funds are given below, as are the data for the S&P 500 Index. Average Return Standard Deviation Beta Fund A 18 % 38 % 1.6 Fund B 15 % 27 % 1.3 Fund C 11 % 24 % 1.0 S&P 500 10 % 22 % 1.0 The fund with the highest Sharpe measure isA pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a rate of 8%. The probability distribution of the risky funds is as follows: Expected Return Standard Deviation Stock fund (s) 20% 30% Bond fund (b) 12 15 The correlation between the fund returns is .10.Tabulate and draw the investment opportunity set of the two risky funds. Use investment proportions for the stock fund of 0% to 100% in increments of 20%.