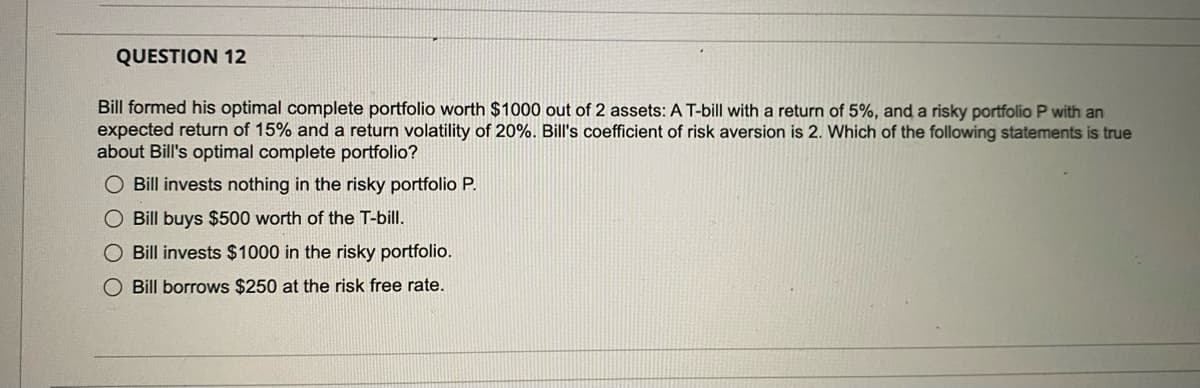

Bill formed his optimal complete portfolio worth $1000 out of 2 assets: A T-bill with a return of 5%, and a risky portfolio P with an expected return of 15% and a return volatility of 20%. Bill's coefficient of risk aversion is 2. Which of the following statements is true about Bill's optimal complete portfolio? O Bill invests nothing in the risky portfolio P. Bill buys $500 worth of the T-bill. O Bill invests $1000 in the risky portfolio. O Bill borrows $250 at the risk free rate.

Q: Rachel purchased a car for $22,000 three years ago using a 4-year loan with an interest rate of 10.8…

A: The concept of time value of money will be used here. We will have to determine the monthly payments…

Q: A business needs $450,000 in five years. How much should be deposited each quarter in a sinking fund…

A: Quarterly deposit required to accumulate future value of $450,000 in five years is calculated using…

Q: (Related to Checkpoint 11.1 and Checkpoint 11.4) (NPV and IRR calculation) East Coast Television is…

A: The internal rate of return is the rate of return at which the net present value is zero. It means…

Q: On 4/1/22, Little Inc. borrowed funds on a 9%, one-year note to finance the construction of a new…

A: Given: 4/1/22 Borrowed funds Construction started = 5/1/22 Construction Completed =9/1/22

Q: Bond Valuation with Annual Payments Jackson Corporation's bonds have 15 years remaining to…

A: Solution:- Bond price means the price at which the bond is currently trading in the market. We…

Q: ly, it is 2022 and Luther Corporation is planning to take the firm public through an IPO. Luther has…

A: Companies raise the money through IPO and get listed on the stock market but raising money is not…

Q: Steinberg Corporation and Dietrich Corporation are identical firms except that Dietrich is more…

A: The value of a firm refers to the measurement of the market value of the business in economic terms.…

Q: Find the present value of an ordinary annuity with payments of $18,579 quarterly for 7 years at 8.4%…

A: Quarterly interest rate = Annual rateFrequency of compounding in a year = 0.0844 = 0.021 or 2.10%…

Q: Assume that the risk-free rate is 3.5% and the required return on the market is 11%. What is the…

A: An asset's expected returns are determined using the CAPM algorithm. It is predicated on the notion…

Q: The firm’s common stock is currently selling for R95 per share. The firm expects to pay cash…

A: Current Selling Price of Common Stock = R95 Cash Dividends = R10 per share Constant Growth rate =…

Q: Suppose you are thinking of purchasing the stock of Moore Oil, Inc. and you expect it to pay a $2…

A: Price of stock can be calculated by using this equation Price of stock(P0) =(Dividend in 1 year…

Q: Ranking conflicts (or conflicts in project choice) can arise between IRR and NPV decision rules when…

A: IRR is the actual rate of return expected from the investment or project. Whereas the NPV means the…

Q: agreed to pay 28% down. What

A: Given Purchase Price of the House =$ 151362 and down payment =28%

Q: 1 2 3 4 5 6 7 8 9 10 1. Find the Yield to Maturity (YTM) for the following government bonds Price…

A: As per Bartleby honor code, when multiple questions are asked, the expert is required only to solve…

Q: 9 A deposit of $720 earns interest rates of 8 percent in the first year and 11 percent in the…

A: Deposit amount (P) = $720 Interest rate in year 1 (r1) = 8% Interest rate in year 2 (r2) = 11%

Q: You invested $11,000 at the end of each year for 7 years in an investment fund. At the end of year…

A: The future value is the value of the investment after a certain period of time. The future value of…

Q: Kathy Hansen has a revolving credit account. The finance charge is calculated on the previous…

A: A revolving credit account is the kind of account that gives you access to a set limit of money i.e.…

Q: Find the amount due if $800 is borrowed for 18 months at 18% simple interest.

A: Amount borrowed (P) = $800 Period (n) = 18 months Interest rate (r) =0.18 Amount due = ?

Q: common stock of Leaning Tower of Pita, Inc., a restaurant chain, will generate the following payoffs…

A: Standard deviation is measure of risk of return of the stock and more is standard deviation than…

Q: Find the future value of the annuity due. Assume that interest is compounded annually, unless…

A: Annuity refers to a series of regular cash flows over a defined period. When the cash flows occur at…

Q: Volkwagen car sales hit record high sales of $6.41 million in 2017. If one of their assembly lines…

A: In SLM method of depreciation calculation, we should: 1. First calculate the depreciable value 2.…

Q: nt Disaggregation of ROE Refer to the balance sheets and income statement below for Facebook Inc.…

A: In 2018 given PAT=21056 Shareholders' Equity =85,183 So RoE =21056/85183=0.2472=24.72%…

Q: Consider an A-rated bond and a B-rated bond. Assume that the one-year probabilities of default for…

A: Greater is the correlation of default between the securities higher is the joint probability of…

Q: Which of the following activities offers the highest risk and return? O a. Trading shares for an…

A: Risk and return are both go together and when risk is high than return is high and risk is low and…

Q: 3. What is the semi-annual coupon rate on the following government bonds? 3 YTM Semi-ann Face valu…

A: Here, To Find: Semi-annual coupon rate =?

Q: The following data have been developed for Ding Corp. State Market Return 1 2 3 4 Probability 0.10…

A: Capital Asset Pricing Model is used to determine the required return on the stock which is risk free…

Q: chemical company is planning to release a new brand of insecticide that will kill many insect pests…

A: Incremental earnings after tax in year 3 will be the same as the net income in year 3. To compute…

Q: Crane Industries, common stock has a beta of 1.5. If the current risk-free rate is 3.6 percent and…

A: The cost of common stock is the cost of issuing the equity capital of the company. The cost of…

Q: Duques Corp. is 100% equity financed. Its cost of equity is 12%. The firm plans to issue bond to…

A: We have to deploy the MM hypothesis and propositions, in the absence of the taxes to answer this…

Q: Holtzman Clothiers's stock currently sells for $19.00 a share. It just paid a dividend of $2.50 a…

A: Compute the stock price at the end of year 1, using the equation as shown below: Stock price=Current…

Q: Find the total amount of money donated for 2 years.

A: The formula to determine the sum of geometric sequence is as follows: Sum = a(1-rn)1-r Where a =…

Q: Given the cash flows from the following information, find the payback period.…

A: Year Cash Flow 0 $ -1,00,000.00 1 $ 20,000.00 2 $…

Q: 8. How much should Liz invest at 9% per year, compounded quarterly, so that she will have $10,000 at…

A: The compounding interest rate results in more interest earning, for example, the bank offers…

Q: Company's 5-year bonds are selling at P820. The bonds face amount is P1,000 and pays an annual…

A: Bonds are long term source of finance for the company and very cheap source of finance because after…

Q: What lump sum do parents need to deposit in an account earning 11%, compounded monthly, so that it…

A: Solution:- When an amount is invested somewhere, it earns interest on it. The amount initially…

Q: XYZ Pvt Ltd is considering investing in a project which has the following cash flows:…

A: Here, Year Cash flows DCF values 0 -2,900,000 1.000 1 800,000 0.926 2 1,000,000 0.857 3…

Q: Belize Dollar= $.4850. The settlement date for the contract is March 16, 2023. Assume that on March…

A: Future contract Worth = 7,500,000 Belize Dollars Settlement rate of 1 Belize Dollars = $0.4850…

Q: Hammett, Inc., has sales of $74,058, costs of $24,908, depreciation expense of $6,308, and interest…

A: Here, Particulars Values Sales $ 74,058.00 Costs $24,908.00 Depreciation expense…

Q: A firm is evaluating a proposal which has an initial investment of R250 000 and has cash flows of…

A: Payback period is an important capital budgeting tool. Essentially payback period is the time…

Q: CCC Corp has a beta of 1.5 and is currently in equilibrium. The required rate of return on the stock…

A:

Q: Cori’s Corporation has an equity value of $14,735. Long-term debt is $8,300. Net working capital,…

A: Fixed Assets = $18,440 Long term debt = $8,300 Current liabilities = $2,325 Shareholders' Equity =…

Q: Simple Simon's Bakery purchases supplies on terms of 1.5/10, net 30. If Simple Simon's chooses to…

A: Trade credit refers to the purchase of goods or services by the customers from the seller and paid…

Q: growing rapidly. Dividends are expected to grow at rates of 25%, 18%, and 12% over the next three…

A: Dividends are cash amount that is paid out the shareholders out the net income because they are…

Q: A gentleman bought a limited edition Wolverine figurine in 1974 for $0.15. In 2012, 38 years later,…

A: The return earned on an investment can be calculated using the future value, present value and…

Q: What is the IRR for the following project if its initial after-tax cost is R5 000 000 and it is…

A: IRR is the rate of return which the project generates over its useful life.

Q: Round your answer to 2 decimal places, if necessary. Do not enter t entering your answer.

A: The future of amount is the amount that is being deposited and also amount of compouding interest…

Q: A mortgage broker is offering a 25-year $280,000 mortgage with a teaser rate. In the first two years…

A: Monthly payments refer to an amount that is being paid at the end of each month for the repayment of…

Q: Say that you purchase a house for $174,000 by getting a mortgage for $155,000 and paying a down…

A: Monthly payments refer to an amount that is being paid at the end of each month for the repayment…

Q: Question 69 If the discount rate is known, what else is required to value an investment? O a. The…

A: Value of investment is calculated using following variables in the following equation Present value…

Q: Can you show how to calculate the variance step by step without using excel

A: Meaning of Variance : It is a measure of spread of values (in this case return of Philips) from the…

Step by step

Solved in 2 steps

- N2 10. There is a risky portfolio of multiple stocks with an expected return of 14% and a standard deviation of 21%. Jason invests 65% of his total wealth on this risky portfolio and the rest 35% on Treasury bills (so, he has constructed a ‘complete portfolio’ of a risky asset and a risk-free asset). One-year T-bill rate is 3%. a. Calculate the expected return and standard deviation of his complete portfolio b. Calculate his risk premium of the risky portfolio as well as of the complete portfolio c. Compute the Sharpe ratio d. Draw the capital allocation lineCh 13] Julia has $5,000.00 to invest in a portfolio. She will build the portfolio from threeassets: Stock A with an expected return of 16.0% and a standard deviation of 42% Stock B with an expected return of 12.0% and a standard deviation of 32% T-Bills with an expected return of 4.00% and a standard deviation of 0%.Assume that she can short sell T-bills, the risk-free asset (or borrow at the risk-free rate).Assume also that she will invest the same amount in Stock A and Stock B. How muchmoney will she invest in Stock A if her goal is to create a portfolio with an expected returnof 20.00%.$(to nearest $0.01)Question 6 Suppose that an investor has £1,000,000 to invest in a portfolio containing stocks A, B and a risk-free asset. The investor must invest all her money, and she is using the Capital Asset Pricing Model (CAPM) to make predictions of the expected return-beta relationship. Her objective is to create a portfolio that has an expected return of 14% and which has a beta of 0.75. If stock A has an expected return of 30% and a beta of 1.9, stock B has an expected return of 20% and a beta of 1.4, and the risk-free rate is 8%, how much money will she invest in stock A? Explain your answer and show your calculations.

- You invest $1,000 in a risky asset with an expected rate of return of 0.17 and a standard deviation of 0.40 and a T-bill with a rate of return of 0.04.What percentages of your money must be invested in the risky asset and the risk-free asset, respectively, to form a portfolio with an expected return of 0.11? A. 62.5% and 37.5% B. 53.8% and 46.2% C. Cannot be determined. D. 75% and 25% E. 46.2% and 53.8%Michael trades T-bills with the annual rate of return equal to 2% and TD stock. The expected rate of return and standard deviation of the rate of return of TD stock are equal to 12% and 25%, respectively . The coefficient of risk aversion of Michael is 2. What is a standard deviation of his optimal portfolio? a. 40% b. 20% c. 25% d. 10% e. 15%Quantitative Problem: You are holding a portfolio with the following investments and betas: Stock Dollar investment Beta A $250,000 1.30 B 100,000 1.70 C 400,000 0.70 D 250,000 -0.20 Total investment $1,000,000 The market's required return is 11% and the risk-free rate is 4%. What is the portfolio's required return? Do not round intermediate calculations. Round your answer to three decimal places. ? %

- 7.a. You manage a risky portfolio with E(r) =18% and σ = 28%. The T-Bill rate is 8%. Your client chooses to invest 70% of a portfolio in your funds and 30% in T-Bill funds. Calculate the Expected return and standard deviation of your client’s portfolio.b. Suppose that your risky portfolio includes the following investments in the given proportions:Stock AStock BStock C25%32%43%c. What is the Sharpe ratio of your risky portfolio? Your client’s?d. Draw the CAL of your portfolio. What is the slope of the CAL? Show the position of your client on your fund’s CALYou invest $10,000 in a complete portfolio. The complete portfolio is composed of a risky asset with an expected rate of return of 15% and a standard deviation of 21% and a treasury bill with a rate of return of 5%. How much money should be invested in the risky asset to form a portfolio with an expected return of 11%? A. $6,000B. $4,000C. $7,000D. $3,000Problem 11-23 Analyzing a Portfolio You want to create a portfolio equally as risky as the market, and you have $2,400,000 to invest. Given this information, fill in the rest of the following table: (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) Asset Investment Beta Stock A $360,000 1.00 Stock B $624,000 1.10 Stock C 1.20 Risk-free asset

- (a)As an investor, you are holding the following investments: Stock Amount invested beta A $40 million 1.4 B $30 million 1.0 C $60 million 0.8 You are planning to sell the holdings of Stock B. The money from the sale will be used topurchase another $20 million of Stock A and another $10 million of Stock C. The risk-free rateis 7 percent and the market risk premium is 6.5 percent. How many percentage points higherwill the required return on the portfolio be after you complete this transaction?Question 1 e) As a risk averse investor Lawrence will only invest in the portfolio if it has a coefficient of variation that is below 0.75. Should Lawrence invest in the portfolio, please provide reason(s) to support your response? f) Assume in 2020 the estimated rate of return of the T&T Stock Exchange Composite Index for the upcoming year was 8%, and the estimated return on a 1-year treasury note for the upcoming year was 2%. Using the beta of each security shown in Table 1 above and the market expected returns calculate an expected rate of return for each securityQUESTION 7 An investor wishes to construct a portfolio consisting of a 70 percent allocation to a stock index and a 30 percent allocation to a risk-free asset. The return on the risk-free asset is 4.5 percent, and the expected return on the stock index is 12 percent. Calculate the expected return on the portfolio. a. 16.50 percent b. 17.50 percent c. 14.38 percent d. 9.75 percent e. 8.25 percent