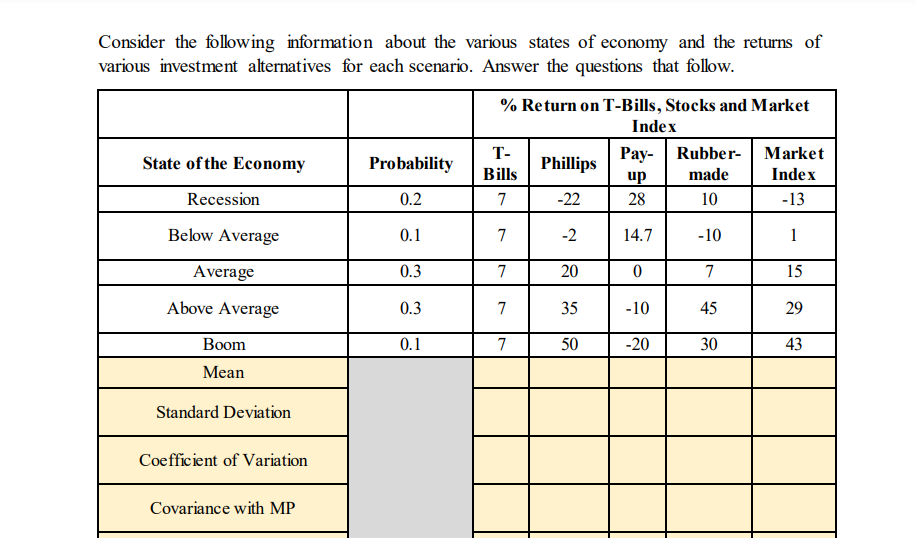

Consider the following information about the various states of economy and the returns of various investment alternatives for each scenario. Answer the questions that follow. State of the Economy Recession Below Average Average Above Average Boom Mean Standard Deviation Coefficient of Variation Covariance with MP Probability 0.2 0.1 0.3 0.3 0.1 % Return on T-Bills, Stocks and Market Index Pay-Rubber- T- Bills 7 7 7 7 7 Phillips -22 -2 20 35 50 up 28 14.7 0 -10 -20 made 10 -10 7 45 30 Market Index -13 1 15 29 43

Consider the following information about the various states of economy and the returns of various investment alternatives for each scenario. Answer the questions that follow. State of the Economy Recession Below Average Average Above Average Boom Mean Standard Deviation Coefficient of Variation Covariance with MP Probability 0.2 0.1 0.3 0.3 0.1 % Return on T-Bills, Stocks and Market Index Pay-Rubber- T- Bills 7 7 7 7 7 Phillips -22 -2 20 35 50 up 28 14.7 0 -10 -20 made 10 -10 7 45 30 Market Index -13 1 15 29 43

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter15: Decision Analysis

Section: Chapter Questions

Problem 4P: Investment advisors estimated the stock market returns for four market segments: computers,...

Related questions

Question

Transcribed Image Text:Consider the following information about the various states of economy and the returns of

various investment alternatives for each scenario. Answer the questions that follow.

State of the Economy

Recession

Below Average

Average

Above Average

Boom

Mean

Standard Deviation

Coefficient of Variation

Covariance with MP

Probability

0.2

0.1

0.3

0.3

0.1

% Return on T-Bills, Stocks and Market

Index

Pay-Rubber-

made

10

-10

7

45

30

T-

Bills

7

7

7

7

7

Phillips

-22

-2

20

35

50

up

28

14.7

0

-10

-20

Market

Index

-13

1

15

29

43

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Can you provide a manual written working of calculating CAPM Req. Return and beta

Solution

Follow-up Question

Using the data generated in the previous question (Question 1)

- Plot the Security Market Line (SML)

- b) Superimpose the

CAPM’s required return on the SML - c) Indicate which investments will plot on, above and below the SML?

Solution

Follow-up Question

Can you show how to calculate the variance step by step without using excel

Solution

Follow-up Question

hello, New to this. why is the variance added to the table

Solution

Follow-up Question

Can you provide a manual written working of calculating covariance with MP? I am very much still confused.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning