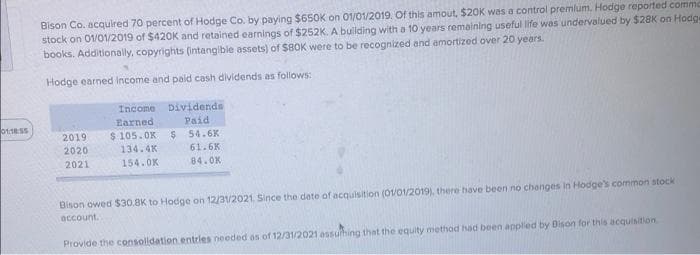

Bison Co. acquired 70 percent of Hodge Co. by paying $650K on 01/01/2019, Of this amout, $20K was a control premlum. Hodge reported comm stock on 0Vov2019 of $420K and retained earnings of $252K. A bullding with a 10 years remaining useful life was undervalued by $28K on Hodg books. Additionally, copyrights (intangible assets) of $80K were to be recognized and amortized over 20 years Hodge earned Income and paid cash dividends as follows: Incone Dividends Earned Paid ess 2019 $105.0x $ 54.6K 2020 134.4K 61.6K 2021 154.0K 84.0K Bison owed $30.8K to Hodge on 12/3V2021 Since the date of acquisition (01Ov2019, there have been no changes in Hodge's common stock account. Provide the consoldation entries needed as of 12/31/2021 assuhing that the equity method had been applied by Bison for this acquisition

Bison Co. acquired 70 percent of Hodge Co. by paying $650K on 01/01/2019, Of this amout, $20K was a control premlum. Hodge reported comm stock on 0Vov2019 of $420K and retained earnings of $252K. A bullding with a 10 years remaining useful life was undervalued by $28K on Hodg books. Additionally, copyrights (intangible assets) of $80K were to be recognized and amortized over 20 years Hodge earned Income and paid cash dividends as follows: Incone Dividends Earned Paid ess 2019 $105.0x $ 54.6K 2020 134.4K 61.6K 2021 154.0K 84.0K Bison owed $30.8K to Hodge on 12/3V2021 Since the date of acquisition (01Ov2019, there have been no changes in Hodge's common stock account. Provide the consoldation entries needed as of 12/31/2021 assuhing that the equity method had been applied by Bison for this acquisition

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 8MC: On July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was...

Related questions

Question

Transcribed Image Text:Bison Co. acqulred 70 percent of Hodge Co. by paying $650K on 01/01/2019. Of this amout, $20K was a control premlum. Hodge reported comm

stock on 01/01/2019 of $420K and retained earnings of $252K. A buliding with a 10 years remaining useful life was undervalued by $28K on Hodge

books. Additionally, copyrights (Intangible assets) of $80K were to be recognized and amortized over 20 years.

Hodge earned Income and paid cash dividends as follows:

Income Dividends

Paid

$ 54.6K

61.6K

Earned

2019

$ 105.OK

2020

134.4K

2021

154.0K

84.0K

Bison owed S$30,8K to Hodge on 12/3V2021. Since the date of acquisition (01/01/2019), there have been no changes in Hodge's common stock

account.

Provide the consolidation entries needed as of 12/31/2021 assuhing that the equity method had been applied by Bison for this acquisition

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College