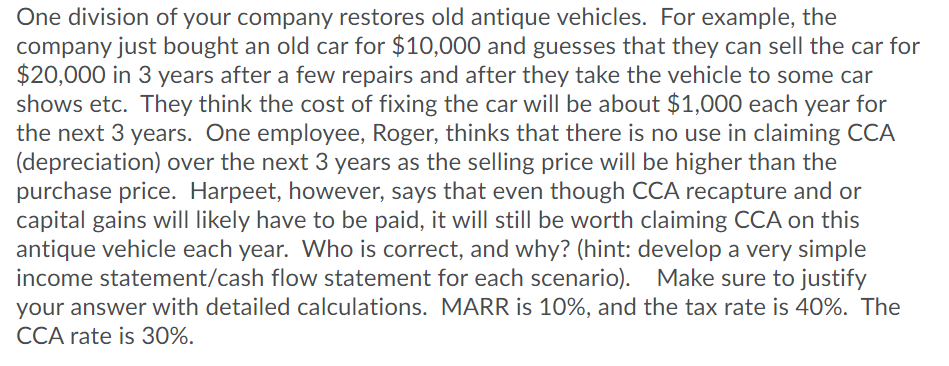

One division of your company restores old antique vehicles. For example, the company just bought an old car for $10,000 and guesses that they can sell the car for $20,000 in 3 years after a few repairs and after they take the vehicle to some car shows etc. They think the cost of fixing the car will be about $1,000 each year for the next 3 years. One employee, Roger, thinks that there is no use in claiming CCA (depreciation) over the next 3 years as the selling price will be higher than the purchase price. Harpeet, however, says that even though CCA recapture and or capital gains will likely have to be paid, it will still be worth claiming CCA on this antique vehicle each year. Who is correct, and why? (hint: develop a very simple income statement/cash flow statement for each scenario). Make sure to justify your answer with detailed calculations. MARR is 10%, and the tax rate is 40%. The CCA rate is 30%.

One division of your company restores old antique vehicles. For example, the company just bought an old car for $10,000 and guesses that they can sell the car for $20,000 in 3 years after a few repairs and after they take the vehicle to some car shows etc. They think the cost of fixing the car will be about $1,000 each year for the next 3 years. One employee, Roger, thinks that there is no use in claiming CCA (depreciation) over the next 3 years as the selling price will be higher than the purchase price. Harpeet, however, says that even though CCA recapture and or capital gains will likely have to be paid, it will still be worth claiming CCA on this antique vehicle each year. Who is correct, and why? (hint: develop a very simple income statement/cash flow statement for each scenario). Make sure to justify your answer with detailed calculations. MARR is 10%, and the tax rate is 40%. The CCA rate is 30%.

Chapter21: Risk Management

Section: Chapter Questions

Problem 5P

Related questions

Question

3

Transcribed Image Text:One division of your company restores old antique vehicles. For example, the

company just bought an old car for $10,000 and guesses that they can sell the car for

$20,000 in 3 years after a few repairs and after they take the vehicle to some car

shows etc. They think the cost of fixing the car will be about $1,000 each year for

the next 3 years. One employee, Roger, thinks that there is no use in claiming CCA

(depreciation) over the next 3 years as the selling price will be higher than the

purchase price. Harpeet, however, says that even though CCA recapture and or

capital gains will likely have to be paid, it will still be worth claiming CCA on this

antique vehicle each year. Who is correct, and why? (hint: develop a very simple

income statement/cash flow statement for each scenario). Make sure to justify

your answer with detailed calculations. MARR is 10%, and the tax rate is 40%. The

CCA rate is 30%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College