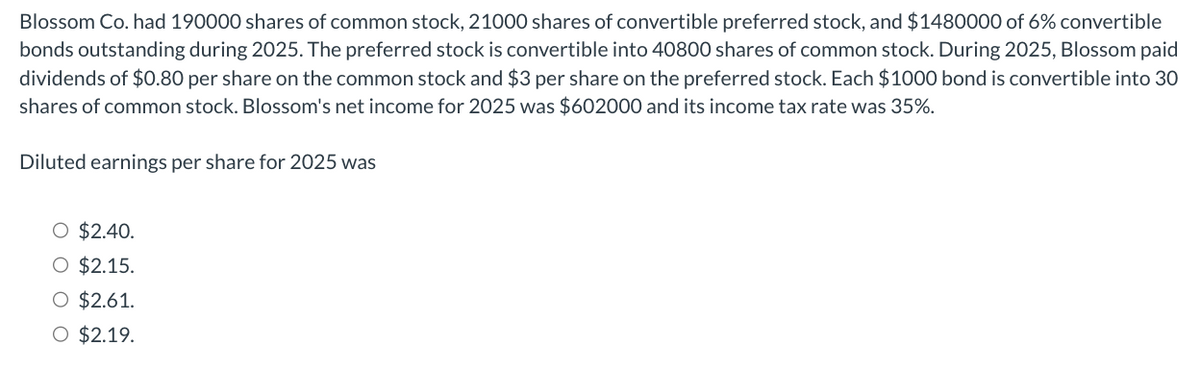

Blossom Co. had 190000 shares of common stock, 21000 shares of convertible preferred stock, and $1480000 of 6% convertible bonds outstanding during 2025. The preferred stock is convertible into 40800 shares of common stock. During 2025, Blossom paid dividends of $0.80 per share on the common stock and $3 per share on the preferred stock. Each $1000 bond is convertible into 30 shares of common stock. Blossom's net income for 2025 was $602000 and its income tax rate was 35%. Diluted earnings per share for 2025 was O $2.40. O $2.15. O $2.61. O $2.19.

Q: A man invests P 20,000 now for the college education of his 2 year old son. If the fund earns 10%…

A: Time value of money is a financial concept which is used to calculate the value of money in present…

Q: The following income statement applies to Finch Company for the current year: Income Statement Sales…

A: The contribution margin approach can be used to calculate the magnitude of operating leverage, which…

Q: For a recent year, McDonald's Company-owned restaurants had the following sales and expenses (in…

A: MARGINAL COSTING INCOME STATEMENT Marginal Costing Income Statement is One of the Important Cost…

Q: tra lech, a phone accessories manufacturer, has presented you with the following financial…

A: The manufacturing account is the record that keeps record of cost of production, it calculate the…

Q: Exercise 4-14A (Algo) Allocating a service center cost to operating departments LO 4-6 Perez…

A: COST ALLOCATION When item of cost are Identifiable directly with some products or departments such…

Q: During an accounting period, a business sells goods on credit for a total selling price of £3,000.…

A: To calculate the cash inflow from sales, we need to determine the amount of cash received from…

Q: Lovell Variety Seeds mass produces wildflower seed packs. Relevant information used for the process…

A: First, let's calculate the total cost of the units started during the period: Total Cost = Beginning…

Q: On January 1, 20X9, Pirate Corporation acquired 80 percent of Sea-Gull Company's common stock for…

A: A consolidated balance sheet is a document that shows the entire financial situation of a parent…

Q: Required: a. Determine the direct materials price variance, direct materials quantity variance, and…

A: Introduction:- Standard costs are estimates of the actual costs in a company’s production process…

Q: Question list Question 1 Question 2 The Sullivan Corporation manufactures lamps. It has set up the…

A:

Q: Barry Pottery Supplies manufacturers supplies used during the pottery process. They have multiple…

A: To calculate the ending balance of work in progress, we need to determine the total cost incurred…

Q: Presented below is the trial balance of Carla Vista Corporation at December 31, 2025. Cash Sales…

A: Current assets are short-term assets, such as cash or cash equivalents, that can be liquidated…

Q: Jack and Jill exchange like-kind real estate assets as listed below: Jack's old asset: FMV…

A: Given that Jill's old asset: FMV $70,000; and his Basis $55,000 Hence Jill had an deffered gain of…

Q: Prepare the journal entries for Fisher for the years of 2020 and 2021.

A: 2020: A) To record the purchase of 40% of Bowden's common stock: Investment in Bowden, Inc. $980,000…

Q: worksheet d adjusting entry to record bad debts expense under the Allowance for Doubtful Accounts…

A: JOURNAL ENTRIES Journal Entry is the First stage of Accounting Process. Journal Entry is the Process…

Q: BAK Corp. is considering purchasing one of two new diagnostic machines. Either machine would make it…

A: Introduction:- Net present value method : It is defined as the difference between the present value…

Q: Fixed manufacturing costs are $31 per unit, and variable manufacturing costs are $93 per unit.…

A: Introduction:- Absorption costing considers all costs of manufacturing as product costs irrespective…

Q: ill is a freshman at Florida State University where his tuition is $4,000. Sydney, his older…

A: There are deduction available for education expenses done and the credit can be taken for education…

Q: Ay 3. Item 3 On January 1, Year 1, Friedman Company purchased a truck that cost $50,000. The truck…

A: Lets understand the basics. Depreciation is a reduction in value of asset due to wear and tear,…

Q: On January 1, 2024, White Water issues $570,000 of 7% bonds, due in 10 years, with interest payable…

A: January 1, 2024: Cash $612,403 To Bonds Payable $570,000 To Premium on Bonds Payable…

Q: A company sells a product for a price of $100 per unit. The variable cost per unit is $50. The…

A: The break even sales are the sales where business earns no profit no loss during the period. The…

Q: Company operates

A: MARGINAL COSTING INCOME STATEMENT Marginal Costing Income Statement is One of the Important Cost…

Q: What is the purpose of the statement of cash flows? a. To show the financial position of a company…

A: The statement of cash flows is a financial statement that shows the inflow and outflow of cash and…

Q: How much was credit purchases for the month of July 2022?

A: Given in the question: Trade Payable at July 31, 2022 = 56,000 Trade Payable at July 1, 2022 =…

Q: Record any necessary adjusting entry for the lower of cost and net realizable value.

A: Lower of cost or net realizable value is one of the method used for inventory valuation. Under this,…

Q: Q.1 From the following Trial Balance of Muneeb Traders prepare Income Statement for the year ended…

A: Balance sheet is the financial statement which is prepared by the entity to depict the financial…

Q: Cash of P14,000 has been set aside to pay taxes due. The cash and taxes payable have been offset and…

A: During the adjustment process, a company may need to make changes to the amount of current…

Q: compare the current year balance in prepaid insurance and insurance expense with the prior year's…

A: When comparing the current year balance in prepaid insurance and insurance expense with the prior…

Q: Question Content Area Periodic Inventory Using FIFO, LIFO, and Weighted Average Cost Methods The…

A: Weighted Average Method :— It is one of the method of inventory valuation in which it is assumed…

Q: Kaspar Corporation makes a commercial-grade cooking griddle. The following information is available…

A: TOTAL COST PER UNIT Total Cost Includes Direct Material, Direct Labour, Manufacturing OH Cost,…

Q: David invests in a limited partnership and pays $250,000 for a 10% interest in the partnership.…

A: Partnerships can provide a range of benefits to their partners, including shared risk, flexibility,…

Q: Which of the following is false? When units produced exceed units sold, income under absorption…

A: Introduction:- Absorption costing, on the other hand, considers all costs of manufacturing as…

Q: On January 5, 2019, Minjin Company acquired 30% of the ordinary shares that carry voting rights at a…

A: Investment is defined as an act by which a person who owns the money or has surplus funds available,…

Q: Pharoah Chemical Corporation produces an oil-based chemical product which it sells to paint…

A: Incremental revenue per unit = $13.50 - $10.00 = $3.50 per unit

Q: On April 30, Ava, age 42, received a distribution from her qualified plan of $150,000. She had an…

A: To calculate the taxable amount of the distribution and any applicable penalty, we need to first…

Q: Entries for Uncollectible Receivables, using Allowance Method ournalize the following transactions…

A: Accounts receivable: Accounts receivable refers to the amounts to be received within a short period…

Q: All but which of the following may not be seized to satisfy a debtor's financial obligations?…

A: In most jurisdictions, there are laws and regulations in place that dictate which types of property…

Q: www.daveramsey.com’s Financial Peace University (FPU), Dave recommends Seven Baby Steps. One of…

A: Effective interest rate is interest rate after considering the impact of compounding on the interest…

Q: Exercise 8-3 (Algo) Direct Materials Budget [LO8-4] Two grams of musk oil are required for each…

A: Calculation of direct materials budget for Year 2 as follows: The transcript of above image is as…

Q: provides estimates concerning the company's costs: Fixed Cost per Month Cost per Car Washed $0.80 $…

A: Flexible budget is prepared for the actual activities and hence is flexible in nature while planned…

Q: The budget director of Heather's Florist has prepared the following sales budget. The company had…

A: Cash will be reported on collection basis and Accounts receivable will be collected by one month…

Q: Jana and Cindy are planning to launch UP-PACK, a business that upcycles disposable masks into high…

A: To create a 6-month cash budget, we need to calculate the cash inflows and outflows for each month.…

Q: certain machine the following were spent for its During the first 10 years of the life of…

A: Year (1) Cashflows (2) PV factor / annuity factor @7% (3) Discounted Cashflows (4) = (2)*(3)…

Q: of treasury stock on September 1, and issued 60000 shares on November 1. The weighted average shares…

A: Basic earnings per share = (Net income - Preferred dividend) / Weighted average no. of common shares…

Q: Clonex Labs, Inc., uses the weighted-average method in its process costing system. The following…

A: The equivalent units are calculated on the basis of percentage of the work completed during the…

Q: 3-a. Prepare Wells Technical Institute's income statement for the year. 3-b. Prepare Wells Technical…

A: A financial statement known as an income statement lists a company's sales, costs, and net income…

Q: Suppose a company issues a zero coupon bond natures in 10 years Calculate the price given

A: The zero coupon bonds are bonds that do not pay coupon during the life of bond but pay the par value…

Q: October. Sales (8,800 units) Variable expenses Contribution margin Fixed expenses NOI the company…

A: Operating income is the income available after deductions of variable cost and fixed cost from the…

Q: Pacific Fishing Inc.'s actively traded non-strategic investments as of December 31, 2023, are as…

A: Under fair value adjustment we need to record investment at fair value. If there is any gain or loss…

Q: 3 ces ! Required information [The following information applies to the questions displayed below.]…

A: Current asset is an cash and cash equivalent and other assets which can be realized in normal…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

- Percy Company has 15,000 shares of common stock outstanding during all of 2019. It also has 2 convertible securities outstanding at the end of 2019. These are: 1. Convertible preferred stock: 1,000 shares of 9%, 100 par, preferred stock were issued in 2015 for 140 per share. Each share of preferred stock is convertible into 3.5 shares of common stock. The current dividends have been paid. To date, no preferred stock has been converted. 2. Convertible bonds: Bonds with a face value of 100,000 and an interest rate of 10% were issued at par on July 1, 2019. Each 1,000 bond is convertible into 35 shares of common stock. To date, no bonds have been converted. Percy earned net income of 54,000 during 2019. Its income tax rate is 30%. Required: Compute the 2019 diluted earnings per share. What earnings per share amount(s) would Percy report on its 2019 income statement?Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.Winona Company began 2019 with 10,000 shares of 10 par common stock and 2,000 shares of 9.4%, 100 par, convertible preferred stock outstanding. On April 2 and June 1, respectively, the company issued 2,000 and 6,000 additional shares of common stock. On November 16, Winona declared a 2-for-1 stock split. The preferred stock was issued in 2018. Each share of preferred stock is currently convertible into 4 shares of common stock. To date, no preferred stock has been converted. Current dividends have been paid on both preferred and common stock. Net income after taxes for 2019 totaled 109,800. The company is subject to a 30% income tax rate. The common stock sold at an average market price of 24 per share during 2019. Required: 1. Prepare supporting calculations for Winona and compute its: a. basic earnings per share b. diluted earnings per share 2. Show how Winona would report the earnings per share on its 2019 income statement. Include an accompanying note to the financial statements. 3. Next Level Assume Winona uses IFRS. Discuss what Winona would do differently for computing earnings per share, and then repeat Requirement 1 under IFRS.

- On July 2, 2018, McGraw Corporation issued 500,000 of convertible bonds. Each 1,000 bond could be converted into 20 shares of the companys 5 par value stock. On July 3, 2020, when the bonds had an unamortized discount of 7,400 and the market value of the McGraw shares was 52 per share, all the bonds were converted into common stock. Required: 1. Prepare the journal entry to record the conversion of the bonds under (a) the book value method and (b) the market value method. 2. Compute the companys debt-to-equity ratio (total liabilities divided by total shareholders equity, as described in Chapter 6) under each alternative. Assume the companys other liabilities are 2 million and shareholders equity before the conversion is 3 million. 3. Assume the company uses IFRS and issued the bonds for 487,500 on July 2, 2018. On this date, it determined that the fair value of each bond was 930 and the fair value of the conversion option was 45 per bond. Prepare the journal entry to record the issuance of the bonds.Kent Corporation was organized on January 1, 2014. On that date, it issued 200,000 shares of 10 par value common stock at 15 per share (400,000 shares were authorized). During the period January 1, 2014, through December 31, 2019, Kent reported net income of 750,000 and paid cash dividends of 380,000. On January 5, 2019, Kent purchased 12,000 shares of its common stock at 12 per share. On December 28, 2019, 8,000 treasury shares were sold at 8 per share. Kent used the cost method of accounting for treasury shares. What is Kents total shareholders equity as of December 31, 2019? a. 3,290,000 b. 3,306,000 c. 3,338,000 d. 3,370,000Tama Companys capital structure consists of common stock and convertible bonds. At the beginning of 2019, Tama had 15,000 shares of common stock outstanding; an additional 4,500 shares were issued on May 4. The 7% convertible bonds have a face value of 80,000 and were issued in 2016 at par. Each 1,000 bond is convertible into 25 shares of common stock; to date, none of the bonds have been converted. During 2019, the company earned net income of 79,200 and was subject to an income tax rate of 30%. Required: Compute the 2019 diluted earnings per share.

- Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73Waseca Company had 5 convertible securities outstanding during all of 2019. It paid the appropriate interest (and amortized any related premium or discount using the straight line method) and dividends on each security during 2019. Each of the convertible securities is described in the following table: Additional data: Net income for 2019 totaled 119,460. The weighted average number of common shares outstanding during 2019 was 40,000 shares. No share options or warrants arc outstanding. The effective corporate income tax rate is 30%. Required: 1. Prepare a schedule that lists the impact of the assumed conversion of each convertible security on diluted earnings per share. 2. Prepare a ranking of the order in which each of the convertible securities should be included in diluted earnings per share. 3. Compute basic earnings per share. 4. Compute diluted earnings per share. 5. Indicate the amount(s) of the earnings per share that Waseca would report on its 2019 income statement.Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?

- Outstanding Stock Lars Corporation shows the following information in the stockholders equity section of its balance sheet: The par value of common stock is S5, and the total balance in the Common Stock account is $225,000. There are 13,000 shares of treasury stock. Required: What is the number of shares outstanding? Use the following information for Exercises 10-58 and 10-59: Stahl Company was incorporated as a new business on January 1, 2019. The company is authorized to issue 600,000 shares of $2 par value common stock and 80,000 shares of 6%, S20 par value, cumulative preferred stock. On January 1, 2019, the company issued 75,000 shares of common stock for $15 per share and 5,000 shares of preferred stock for $25 per share. Net income for the year ended December 31, 2019, was $500,000.Lyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.