Blossom Inc. is a construction company specializing in custom patios. The patios are conste concrete, brick, fiberglass, and lumber, depending on customer preference. On June 1, 202 general ledger for Blossom Inc. contains the following data. Raw Materials Inventory S4,100 Manufacturing Overhead Applied $31, Work in Process Inventory S5,250 Manufacturing Overhead Incurred S28, Subsidiary data for Work in Process Inventory on June 1 are as follows. Job Cost Sheets Customer Job Cost Element Rodgers Stevens Linton Direct materials S600 S700 $800 Direct labor 300 600 500 Manufacturing overhead 375 750 625 S1,275 $2,050 S1,925 uring June, raw materials purchased on account were $5,000, and $4,700 of factory wages were aid. Additional overhead costs consisted of depreciation on equipment $800 and miscellaneous sts of $400 incurred on account.

Blossom Inc. is a construction company specializing in custom patios. The patios are conste concrete, brick, fiberglass, and lumber, depending on customer preference. On June 1, 202 general ledger for Blossom Inc. contains the following data. Raw Materials Inventory S4,100 Manufacturing Overhead Applied $31, Work in Process Inventory S5,250 Manufacturing Overhead Incurred S28, Subsidiary data for Work in Process Inventory on June 1 are as follows. Job Cost Sheets Customer Job Cost Element Rodgers Stevens Linton Direct materials S600 S700 $800 Direct labor 300 600 500 Manufacturing overhead 375 750 625 S1,275 $2,050 S1,925 uring June, raw materials purchased on account were $5,000, and $4,700 of factory wages were aid. Additional overhead costs consisted of depreciation on equipment $800 and miscellaneous sts of $400 incurred on account.

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter2: Accounting For Materials

Section: Chapter Questions

Problem 17E: Davis Co. uses backflush costing to account for its manufacturing costs. The trigger points are the...

Related questions

Question

I need the answer as soon as possible

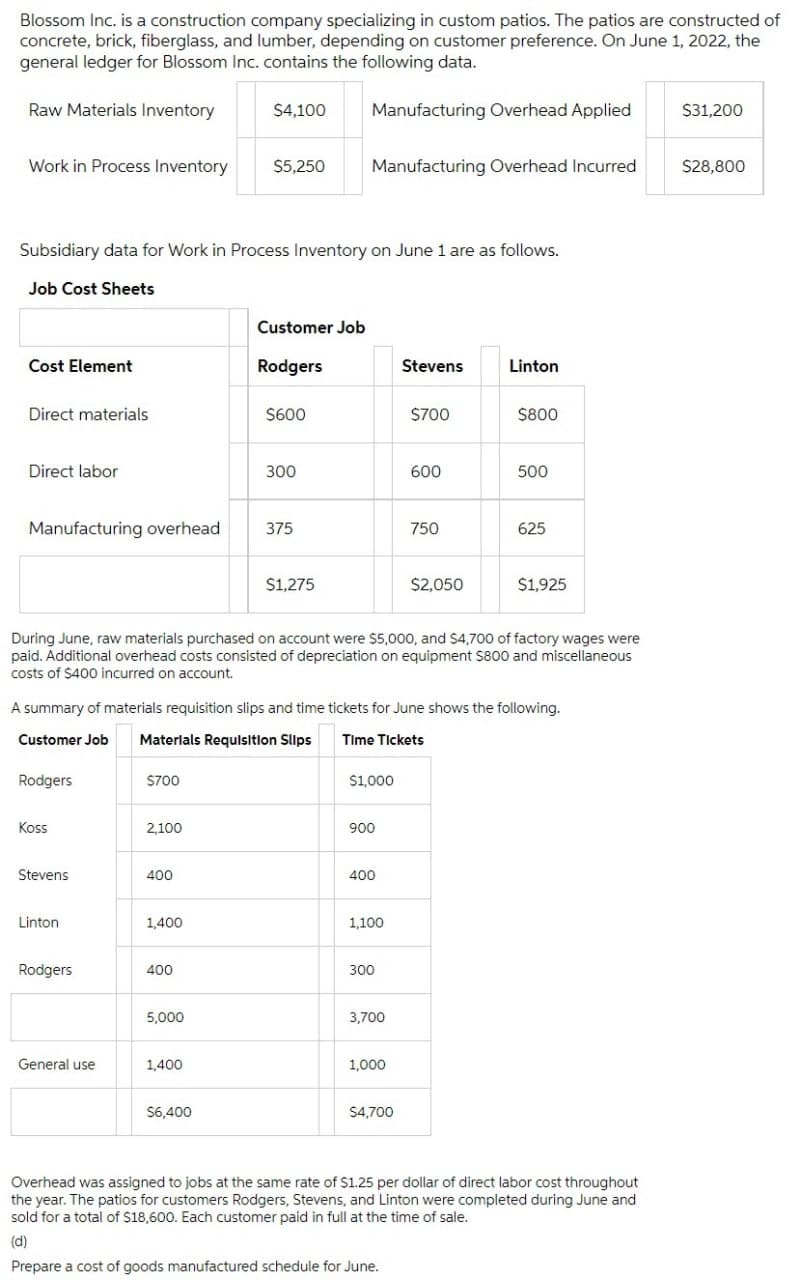

Transcribed Image Text:Blossom Inc. is a construction company specializing in custom patios. The patios are constructed of

concrete, brick, fiberglass, and lumber, depending on customer preference. On June 1, 2022, the

general ledger for Blossom Inc. contains the following data.

Raw Materials Inventory

$4,100

Manufacturing Overhead Applied

$31,200

Work in Process Inventory

S5,250

Manufacturing Overhead Incurred

$28,800

Subsidiary data for Work in Process Inventory on June 1 are as follows.

Job Cost Sheets

Customer Job

Cost Element

Rodgers

Stevens

Linton

Direct materials

$600

$700

$800

Direct labor

300

600

500

Manufacturing overhead

375

750

625

$1,275

$2,050

$1,925

During June, raw materials purchased on account were $5,000, and $4,700 of factory wages were

paid. Additional overhead costs consisted of depreciation on equipment S800 and miscellaneous

costs of $400 incurred on account.

A summary of materials requisition slips and time tickets for June shows the following.

Customer Job

Materlals Requlsitlon Slips

Time Tickets

Rodgers

S700

$1,000

Koss

2,100

900

Stevens

400

Linton

1,400

1,100

Rodgers

400

300

5,000

3,700

General use

1,400

1,000

S6,400

S4,700

Overhead was assigned to jobs at the same rate of $1.25 per dollar of direct labor cost throughout

the year. The patios for customers Rodgers, Stevens, and Linton were completed during June and

sold for a total of $18,600. Each customer paid in full at the time of sale.

(d)

Prepare a cost of goods manufactured schedule for June.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,