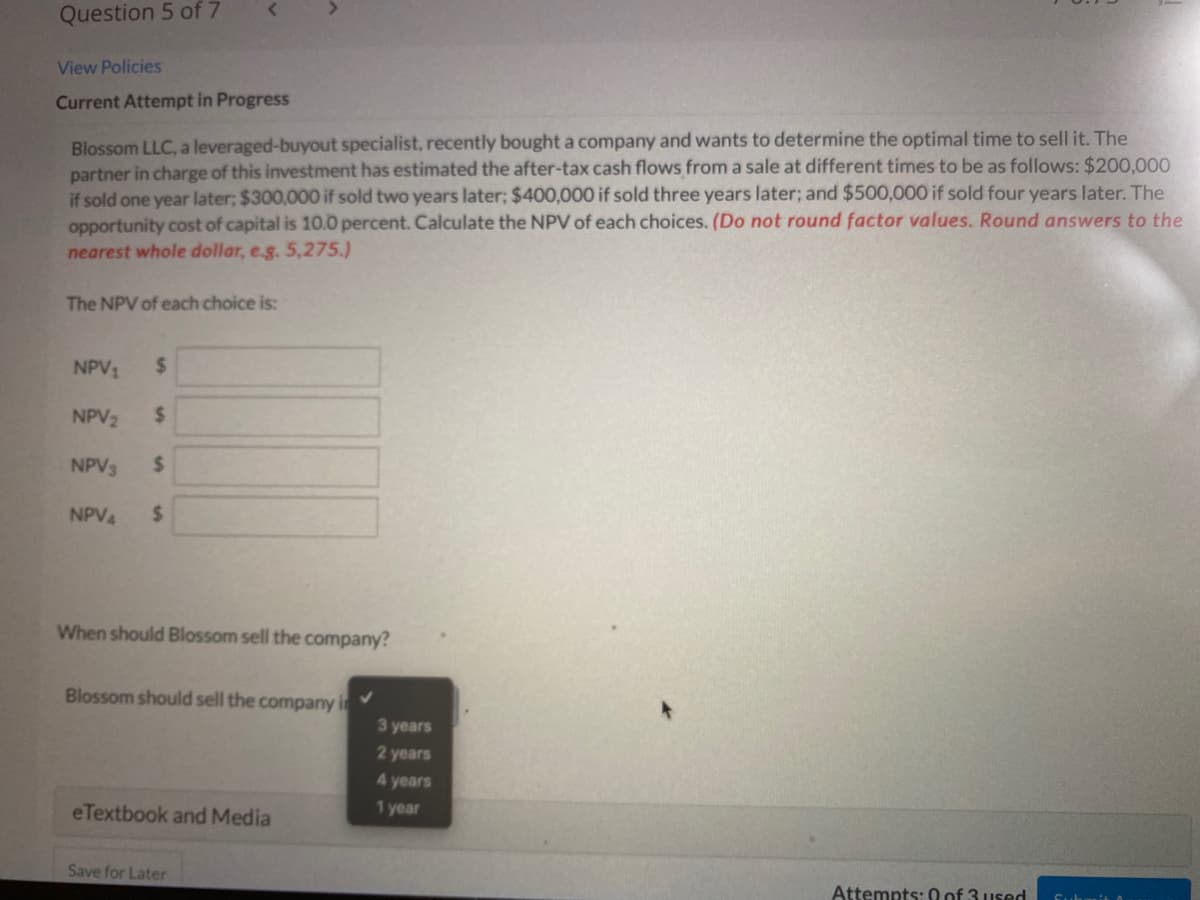

Blossom LLC, a leveraged-buyout specialist, recently bought a company and wants to determine the optimal time to sell it. The partner in charge of this investment has estimated the after-tax cash flows from a sale at different times to be as follows: $200,000 if sold one year later; $300,000 if sold two years later; $400,000 if sold three years later; and $500,000 if sold four years later. The opportunity cost of capital is 10.0 percent. Calculate the NPV of each choices. (Do not round factor values. Round answers to the nearest whole dollar, e.g. 5,275.) The NPV of each choice is: NPV %24 NPV2 %24 NPV3 %24 NPV4 %24 When should Blossom sell the company? Blossom should sell the company in 3 years 2 years 4 years eTextbook and Media 1 year

Blossom LLC, a leveraged-buyout specialist, recently bought a company and wants to determine the optimal time to sell it. The partner in charge of this investment has estimated the after-tax cash flows from a sale at different times to be as follows: $200,000 if sold one year later; $300,000 if sold two years later; $400,000 if sold three years later; and $500,000 if sold four years later. The opportunity cost of capital is 10.0 percent. Calculate the NPV of each choices. (Do not round factor values. Round answers to the nearest whole dollar, e.g. 5,275.) The NPV of each choice is: NPV %24 NPV2 %24 NPV3 %24 NPV4 %24 When should Blossom sell the company? Blossom should sell the company in 3 years 2 years 4 years eTextbook and Media 1 year

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter14: Valuation: Market-based Approach

Section: Chapter Questions

Problem 18PC

Related questions

Question

Transcribed Image Text:Question 5 of 7

View Policies

Current Attempt in Progress

Blossom LLC, a leveraged-buyout specialist, recently bought a company and wants to determine the optimal time to sell it. The

partner in charge of this investment has estimated the after-tax cash flows from a sale at different times to be as follows: $200.000

if sold one year later; $300,000 if sold two years later; $400,000 if sold three years later; and $500,000 if sold four years later. The

opportunity cost of capital is 10.0 percent. Calculate the NPV of each choices. (Do not round factor values. Round answers to the

nearest whole dollar, eg. 5,275.)

The NPV of each choice is:

NPV1

2$

NPV2

%24

NPV3

%24

NPV4

%24

When should Blossom sell the company?

Blossom should sell the company i

3 years

2 years

4 years

eTextbook and Media

1 year

Save for Later

Attempts: 0 of 3 used

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning