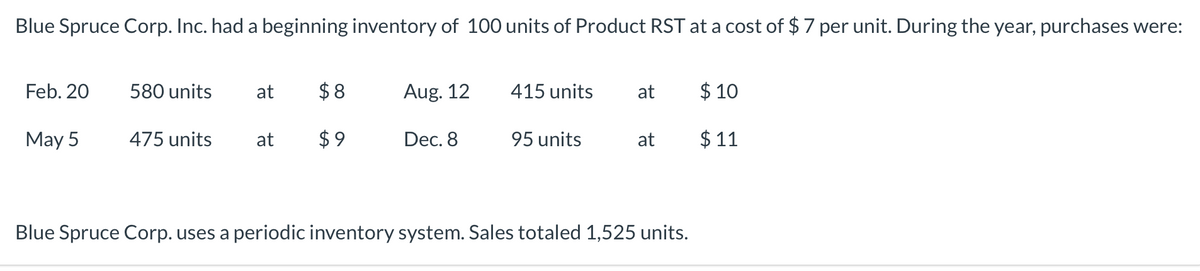

Blue Spruce Corp. Inc. had a beginning inventory of 100 units of Product RST at a cost of $ 7 per unit. During the year, purchases were: Feb. 20 580 units at $8 Aug. 12 415 units at $ 10 May 5 475 units at $9 Dec. 8 95 units at $ 11 Blue Spruce Corp. uses a periodic inventory system. Sales totaled 1,525 units.

Blue Spruce Corp. Inc. had a beginning inventory of 100 units of Product RST at a cost of $ 7 per unit. During the year, purchases were: Feb. 20 580 units at $8 Aug. 12 415 units at $ 10 May 5 475 units at $9 Dec. 8 95 units at $ 11 Blue Spruce Corp. uses a periodic inventory system. Sales totaled 1,525 units.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 11RE: Johnson Corporation had beginning inventory of 20,000 at cost and 35,000 at retail. During the year,...

Related questions

Question

Transcribed Image Text:Blue Spruce Corp. Inc. had a beginning inventory of 100 units of Product RST at a cost of $7 per unit. During the year, purchases were:

Feb. 20

580 units

at

$ 8

Aug. 12

415 units

at

$ 10

May 5

475 units

at

$9

Dec. 8

95 units

at

$ 11

Blue Spruce Corp. uses a periodic inventory system. Sales totaled 1,525 units.

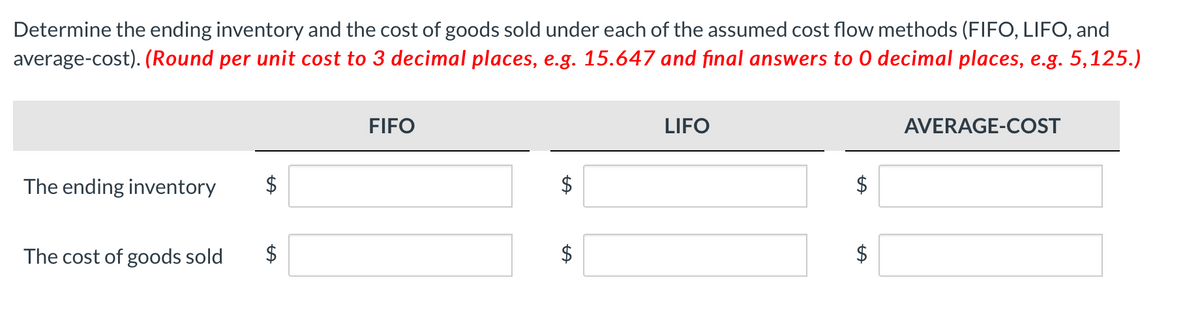

Transcribed Image Text:Determine the ending inventory and the cost of goods sold under each of the assumed cost flow methods (FIFO, LIFO, and

average-cost). (Round per unit cost to 3 decimal places, e.g. 15.647 and final answers to 0 decimal places, e.g. 5,125.)

FIFO

LIFO

AVERAGE-COST

The ending inventory

$

The cost of goods sold

$

$

%24

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,