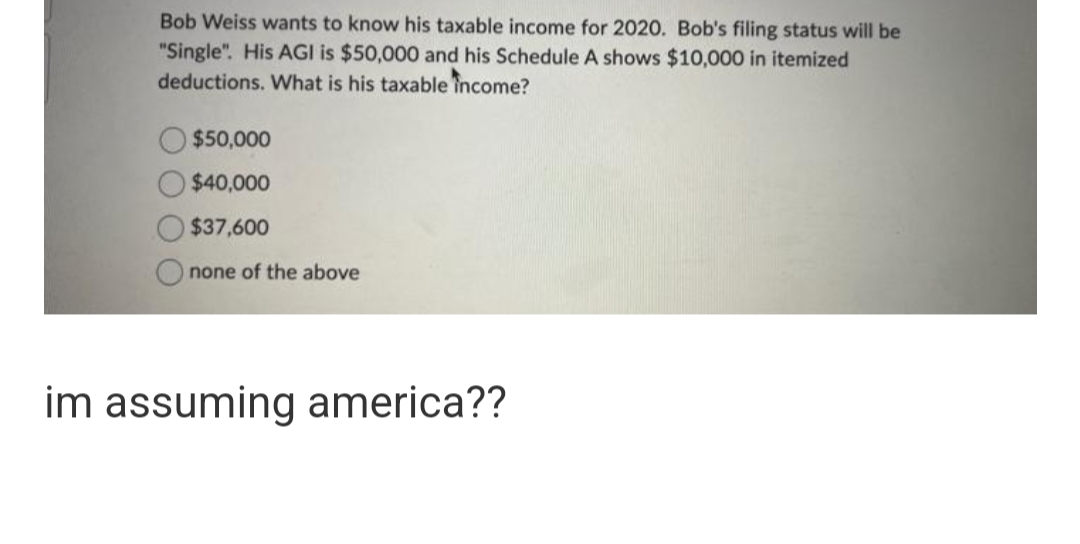

Bob Weiss wants to know his taxable income for 2020. Bob's filing status will be "Single". His AGI is $50,000 and his Schedule A shows $10,000 in itemized deductions. What is his taxable income? $50,000 $40,000 $37,600 none of the above

Q: ● ● ● BASIC PRINCIPLES OF A SOUND TAX SYSTEM Fiscal Adequacy - sources of revenue should be…

A: There are two types of taxes levied by any government which is the main source of revenue for the…

Q: Effects of Transactions (Revenue, Expense, Withdrawals) Assume Jon Wallace completed the following…

A: Lets understand the basics. As per balance sheet and accounting equation, total assets are equal to…

Q: at are the forms and characteristics of hedge accounting Bank B granted on 1.10.20X1 to company D a…

A: Accounting for Loan, Loan is the debt which an organization took to meet up the funds requirement…

Q: Complete this question by entering your answers in the tabs below. Required A Required B Required C…

A: Income Taxes - Taxes at the federal and state levels are imposed on the income of people,…

Q: A company that manufactures and sells a single product. Unit sales for each of the four quarters of…

A: Net Income=Sales-Total CostsProfit margin=Net IncomeSales×100

Q: CoEd Novelties manufactures key chains for college bookstores. During 2003, the company had the…

A: The cost is classifed into two catogries i,e product cost and period cost. The product cost is…

Q: Sinovac Corporation, a 75% own subsidiary of Pfizer Corporation sells inventory to its parent at…

A: Consolidated Net Income refers to the net income (or loss) of the Borrower and its Subsidiaries for…

Q: Safety Works manufacturers safety whistle keychains. They have the following information available…

A: Total cost of direct materials for October = 90% of October months production + 10% of November…

Q: Problem 3-8B Complete the full accounting cycle (LO3-3, 3-4, 3-5, 3-6, 3-7) [The following…

A: Trial Balance :— It is the list of all ledger accounts balances which are shown in debit and credit…

Q: On January 1, NewTune Company exchanges 18,100 shares of its common stock for all of the outstanding…

A: INTRODUCTION Receivables: The sum of money that owed by customers a firm for products or services…

Q: can you show this problem using a two way data table?

A: Two way data states a way or the method of displaying the relative frequencies for the categorical…

Q: Monroe Company rents and sells electronic equipment. During September, Monroe engaged in the…

A: Journal entries are the basic method for recording financial transactions in the books of accounts.…

Q: Which of the years would the level of competition in the banking industry in Ghana be welfare…

A: Every business which includes banks as well tries to get the maximum customer base so that their…

Q: Olney Recycling recycles newsprint, cardboard, and so forth, into recycled packaging materials. For…

A: Predetermined Overhead Rate :— It is the ratio which is used to apply overhead to production. It is…

Q: Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in…

A: Section 179 Expenses for the year 2021 Instead of capitalizing and depreciating the asset over time,…

Q: Salvador Manufacturing builds and sells snowboards, skis and poles. The sales price and variable…

A: The Break-even point indicates that total units are to be sold by the business entity to recover its…

Q: . Compute the maximum 2021 depreciation deductions, including §179 expense, but now assume that…

A: Given that karane enterprise a calendar year manufacturer based in college station texas began…

Q: ing is a list elect Company Accounts and Additional Information: Account Name unadjusted account…

A:

Q: M1-2 Matching Financial Statement Items to Financial Statement Categories LO1-1 Mark each item in…

A: Assets :— Assets Include Current Assets non Current Assets both. Current assets which gives Short…

Q: Bernice's Consulting statement of owners equity

A: Workings:

Q: BE2.1 (LO 1), C For each of the following accounts indicate the effects of (a) a debit and (b) a…

A: All assets and losses have a debit balance. but all income, gains, common stock, and liabilities…

Q: At a sales volume of 42,000 units, Choice Corporation's sales commissions (a cost that is variable…

A: Solution Variable cost is the cost which is changed in proportion to company produces. It is fixed…

Q: Trump Co. reported the following values on it's 2020 adjusted trial balance: common stock…

A: Stockholders' equity refers to the amount/funds that belong to the stockholders, and owner. It is…

Q: Paro Company purchased 80% of the voting common stock of Sabon Company for $900,000. There are no…

A: The question is based on the concept of Consolidated Financial Statements. While preparing the…

Q: c) Consider the following data for Firm WDC Firm WDC (Wooden Doors Company) manufactures one type of…

A: INTRODUCTION Weighted average: A weighted average computation accounts for the varied levels of…

Q: 1. Identify the applicable qualitative characteristics referred to in the Conceptual Framework for…

A: The following facts pertain to the question: Director's Bonuses are used to calculate profits.…

Q: Question 10.1 Sleepy Owl Company allows its divisions to operate as autonomous units. Their results…

A: Lets understand the basics. Return is sales is a comparision of operating income earned against the…

Q: (Capital structure analysis) The Karson Transport Company currently has net operating income of…

A: Lets understand the basics. Times interest earned ratio indicates how many time company's earning…

Q: Primare Corporation has provided the following data concerning last month’s manufacturing…

A: Introduction: The total manufacturing costs of goods completed throughout a given accounting period…

Q: Please use Excel Broncos Company leased equipment from Wilson-Tech Leasing on January 1, 2022.…

A: A lease is an arrangement by which one party gets the property for use for a fixed period, generally…

Q: When a business has performed a service but has not yet received payment, it: a. b. C. O d. credits…

A: As we Know That, At the Time of Sale of Goods & Services on Cash Entry are Required :—…

Q: A(n) ________________ occurs when the management of the target company purchases a controlling…

A: A. Greenmail Greenmail is the practice of purchasing or buying a number of shares of other company…

Q: Prepare a journal entry for the purchase of office equipment on February 19 for $31,400, paying…

A: Lets understand the basics. Journal entry is required to make to record event and transactions that…

Q: The Carla Vista Rain Gear Company had $647,600 in taxable income in the year ending September 30,…

A: Company's tax means the rate of tax which is applied on the taxable income of an entity in order to…

Q: QUESTION Build up a unit rate per m³ of excavation work by using an excavator. Data Capital Cost…

A: The excavators are used for excavations in construction work and they are charged based on hourly…

Q: Bulla Corporation has two production departments, Machining and Customizing. The company uses a…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Bostwick Chemicals started business on April 1. The following operations data are available for…

A: Cost Of Goods Sold = Cost of goods sold is the total amount your business paid as a cost directly…

Q: Reconstruct the journal entry for cash receipts from customers, incorporating the change in the…

A: Journal Entry - It records every business transaction in the books of account, it is based on double…

Q: The trial balances before and after adjustment for Crane Company at the end of its fiscal year are…

A: Adjusting entries are the transactions recorded at the end of the period to adjust the advances…

Q: Celtic Company reported the following January purchases and sales data for its only product. The…

A: The inventory can be valued using various methods as LIFO, FIFO and weighted average method. LIFO…

Q: Lambert invests $10,974 for a 1/3 interest in a partnership in which the other partners have capital…

A: Partnership Firm :— When Two or More Assess Come Together to form a Business and Share their Profit…

Q: a. Rebuilt and delivered five pianos in January to customers who paid $19,000 in cash. b. Received a…

A: Income Statement - This is statement which shows the financial performance of the company. In other…

Q: Multi-step Income Statement From the following accounts, listed in alphabetical order, prepare a…

A: An income statement is one that is prepared as a part of a financial statement under which all the…

Q: ABC Company accumulated the following cost information for the year: Salesperson salaries Indirect…

A: Factory overheads are all indirect cost that are there in the manufacturing process so these are…

Q: Prepare a journal entry on August 13 for cash received for services rendered, $10,150. Refer to the…

A: The journal entries are prepared to keep the record of day to day transactions of the business on…

Q: Ali Omar opened a yard care business, Omar’s Yard Care, on March 1, 2023. The following activities…

A: Income statement :— It is one of the financial statement that shows company's profitability during…

Q: Presented below are two independent situations. (Credit account titles are automatically indented…

A: Journal Entry :— It is an act of recording transaction in books of account when it is occurred.…

Q: Carol Stokke receives her April 6 bank statement showing a balance of $1,154.75; her checkbook…

A: A bank reconciliation statement is a summary of banking and business activity that reconciles an…

Q: Glew Corporation has provided the following information: Variable manufacturing overhead Fixed…

A: The cost can we classified into two categories i.e product cost and period cost. The product cost is…

Q: Management of Plascencia Corporation is considering whether to purchase a new model 370 machine…

A: Decision making in managerial accounting is the process by which the decisions relating to different…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- In 2019, Tim, a single taxpayer, has ordinary income of $29,000. In addition, he has $2,000 in short-term capital gains, long-term capital losses of $10,000, and long-term capital gains of $4,000. What is Tim's AGI for 2019? $26,000 $27,000 $29,000 $32,000Arthur Wesson, an unmarried individual who is age 68, reports taxable income of 510,000 in 2019. He records positive AMT adjustments of 80,000 and preferences of 35,000. Arthur itemizes his deductions, and his regular tax liability in 2019 is 153,694. a. What is Arthurs AMT? b. What is the total amount of Arthurs tax liability? c. Draft a letter to Arthur explaining why he must pay more than the regular income tax liability. Arthurs address is 100 Colonels Way, Conway, SC 29526.Emily, who is single, sustains an NOL of 7,800 in 2019. The loss is carried forward to 2020. For 2020, Emilys income tax information before taking into account the 2019 NOL is as follows: The 2019 single standard deduction is 12,200; Emilys itemized deductions will exceed the 2020 single standard deduction (after adjustment for Inflation). The medical expense AGI floor is 10% In 2019. How much of the NOL carryforward can Emily use in 2020, and what is her adjusted gross income and her taxable income?

- During 2019, Inez (a single taxpayer) had the following transactions involving capital assets: a. If Inez has taxable income of 158,000, how much income tax results? b. If Inez has taxable income of 35,000, how much income tax results?Xinran, who is married and files a joint return, owns a grocery store. In 2019 his gross sales were 276,000, and operating expenses were 320,000. Other In 2020, Xinran provides the following information: The 2019 married filing jointly standard deduction is 24,400; Xinrans itemized deductions will exceed the 2020 standard deduction (after adjustment for inflation). The medical expense AGI floor is 10% in 2019. a. What is Xinrans 2019 NOL? b. Determine Xinrans taxable income for 2020.Freda is a cash basis taxpayer. In 2019, she negotiated her salary for 2020. Her employer offered to pay her 21,000 per month in 2020 for a total of 252,000. Freda countered that she would accept 10,000 each month for the 12 months in 2020 and the remaining 132,000 in January 2021. The employer accepted Fredas terms for 2020 and 2021. a. Did Freda actually or constructively receive 252,000 in 2020? b. What could explain Fredas willingness to spread her salary over a longer period of time? c. In December 2020, after Freda had earned the right to collect the 132,000 in 2020, the employer offered 133,000 to Freda at that time, rather than 132,000 in January 2021. The employer wanted to make the early payment so as to deduct the expense in 2020. Freda rejected the employers offer. Was Freda in constructive receipt of the income in 2020? Explain.

- Tom has a successful business with $100,000 of taxable income before the election to expense in 2019. He purchases one new asset in 2019, a new machine which is 7 -year MACRS property and costs $25,000. If you are Tom's tax advisor, how would you advise Tom to treat the purchase for tax purposes in 2019? Why? ______________________________________________________________________________ ______________________________________________________________________________Virginia and Richard are married taxpayers with adjusted gross income of $28,000 in 2019 If Virginia is able to make a $1,500 contribution to her IRA and Richard makes a $1,500 contribution to his IRA, what is the Saver's Credit Virginia and Richard will be eligible for? $0 $1,500 $2,000 $3,000 $4,000During the 2019 tax year, Brian, a single taxpayer, received $ 7,400 in Social Security benefits. His adjusted gross income for the year was $14,500 (not including the Social Security benefits) and he received $ 30,000 in tax-exempt interest income and has no for-AGI deductions, Calculate the amount of the Social Security benefits that Brian must include in his gross income for 2019. SIMPIFIED TAXABLE SOCIAL SECURITY WORKSHEET (FOR MOST PEOPLE) 1. Enter the total amount of Social Security income. 2. Enter one-half of line 1 3. Enter the total of taxable income items on Form 1040 except Social Security income. 4. Enter the amount of tax-exempt interest income. 5. Add lines 2,3, and 4 6. Enter all adjustments for AGl except for student loan interest, the domestic production activities deduction, and the tuition and fees deduction. 7. Subtract line 6 from line 5 . If zero or less, stop here, none of the Social Security benefits are taxable. 8. Enter $ 25,0001 $ 32,000 if married filing jointly; 0 if married filing separately and living with spouse at any time during the year) 9. Subtract line 8 from line 7 . If zero or less, enter -0 - Note: If line 9 is zero or less, stop here; none of your benefits are faxable. Otherwise, go on to line 10 10. Enter $ 9,0001 $12,000 if married filing jointly; 0 if married filing separately and living with spouse at any time during the year) 11. Subtract line 10 from line 9. If zero or less, enter -0 -. 12. Enter the smaller of line 9 or line 10 . 13. Enter one-half of line 12 14. Enter the smaller of line 2 or line 13 . 15. Multiply line 11 by 85 (. 85 ). If line 11 is zero, enter -0 -. 16. Add lines 14 and 15 17. Multiply line 1 by 85(.85) 18. Taxable benefits. Enter the smaller of line 16 or line 17 . 1.____________ 2.____________ 3.____________ 4.____________ 5.____________ 6.____________ 7.____________ 8.____________ 9.____________ 10.____________ 11.____________ 12.____________ 13.____________ 14.____________ 15.____________ 16.____________ 17.____________ 18.____________

- Shelly has 200,000 of QBI from her local jewelry store (a sole proprietorship). Shellys proprietorship paid 30,000 in W-2 wages and has 20,000 of qualified property. Shellys spouse earned 74,400 of wages as an employee, they earned 20,000 of interest income during the year, and they will be filing jointly and using the standard deduction. What is their QBI deduction for 2019?In 2019, Lou has a salary of $53,300 from her job. She also has interest income of $1,600 and dividend income of $ 400. Lou is single and has no dependents. During the year, Lou sold silver coins held as an investment for a $7,000 loss. Calculate the following amounts for Lou: Adjusted gross income $ ____________________ Standard deduction $ ____________________ Taxable income $ ____________________On January 1, 2019, Kunto, a cash basis taxpayer, pays 46,228 for a 24-month certificate. The certificate is priced to yield 4% (the effective interest rate) with interest compounded annually. No interest is paid until maturity, when Kunto receives 50,000. In your computations: a. Compute Kuntos gross income from the certificate for 2019. b. Compute Kuntos gross income from the certificate for 2020. Round any amounts to the nearest dollar.