Bob's Bee Emporium makes organic honey, which Bob sells at farmers' markets. The value of his Bee Emporium in its current location is $100,000. Unfortunately. Bob's bee's frequently fly to the neighboring property, Daisy's Daycare Center, and sting the small children, some of whom have allergic reaction to the bee stings. Daisy's Daycare Center business is worth $100,000, before the cost of treating any of the children, which the Daycare Center has to pay. The cost of treating the children for the bee stings is $15,000 per year. Relocating the Bee Emporium would reduce its value by $25,000. Relocating the Daycare Center would cost S10,000. The table below shows the value of the businesses under the above conditions. Daisy's Daycare Center Present Location Relocate Bob's Bee Emporium Present Location $85,000 $90,000 $100,000 $100,000 Relocate $100,000 $90,000 $75,000 $75,000 If the town imposed an injunction against Bob (meaning he would either have to shut down, relocate, negotiate a solution with Daisy), what would be the potential cooperative surplus? O $10,000 O $15,000 O $20.000 O $0

Bob's Bee Emporium makes organic honey, which Bob sells at farmers' markets. The value of his Bee Emporium in its current location is $100,000. Unfortunately. Bob's bee's frequently fly to the neighboring property, Daisy's Daycare Center, and sting the small children, some of whom have allergic reaction to the bee stings. Daisy's Daycare Center business is worth $100,000, before the cost of treating any of the children, which the Daycare Center has to pay. The cost of treating the children for the bee stings is $15,000 per year. Relocating the Bee Emporium would reduce its value by $25,000. Relocating the Daycare Center would cost S10,000. The table below shows the value of the businesses under the above conditions. Daisy's Daycare Center Present Location Relocate Bob's Bee Emporium Present Location $85,000 $90,000 $100,000 $100,000 Relocate $100,000 $90,000 $75,000 $75,000 If the town imposed an injunction against Bob (meaning he would either have to shut down, relocate, negotiate a solution with Daisy), what would be the potential cooperative surplus? O $10,000 O $15,000 O $20.000 O $0

Chapter4: Income Exclusions

Section: Chapter Questions

Problem 77TA

Related questions

Question

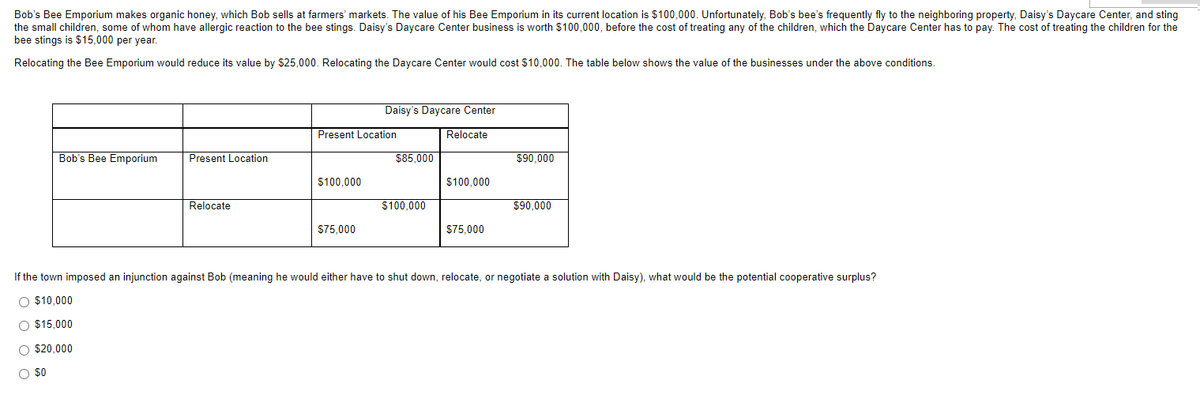

Transcribed Image Text:Bob's Bee Emporium makes organic honey, which Bob sells at farmers' markets. The value of his Bee Emporium in its current location is $100,000. Unfortunately, Bob's bee's frequently fly to the neighboring property, Daisy's Daycare Center, and sting

the small children, some of whom have allergic reaction to the bee stings. Daisy's Daycare Center business is worth $100,000, before the cost of treating any of the children, which the Daycare Center has to pay. The cost of treating the children for the

bee stings is $15,000 per year.

Relocating the Bee Emporium would reduce its value by $25,000. Relocating the Daycare Center would cost $10,000. The table below shows the value of the businesses under the above conditions.

Daisy's Daycare Center

Present Location

Relocate

Bob's Bee Emporium

Present Location

$85,000

$90,000

$100,000

$100,000

Relocate

$100,000

$90,000

$75,000

$75.000

If the town imposed an injunction against Bob (meaning he would either have to shut down, relocate, or negotiate a solution with Daisy), what would be the potential cooperative surplus?

O $10,000

O $15,000

O $20,000

O $0

Expert Solution

Step 1

In the given case, Bob's bee emporium and neighborhood property, Daisy's daycare center, have the value of $100000 each. The daycare center's yearly expenses for treating their children is $15000, which occurred due to the bee emporium.

The town has imposed an injunction against bob bee emporium, and the person has the following options:

a) shut down

b) relocate

c) negotiate a solution with daycare.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning