Bob's only source of income is from his consulting business operated as a sole proprietorship. Assuming that Bob only qualifies for the Basic Personal Credit for 2021, what is the maximum amount of net income for tax purposes (NIFTP) that Bob can carn in 2021 without having any federal taxes payable for 2021?

Bob's only source of income is from his consulting business operated as a sole proprietorship. Assuming that Bob only qualifies for the Basic Personal Credit for 2021, what is the maximum amount of net income for tax purposes (NIFTP) that Bob can carn in 2021 without having any federal taxes payable for 2021?

Chapter13: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 32CE

Related questions

Question

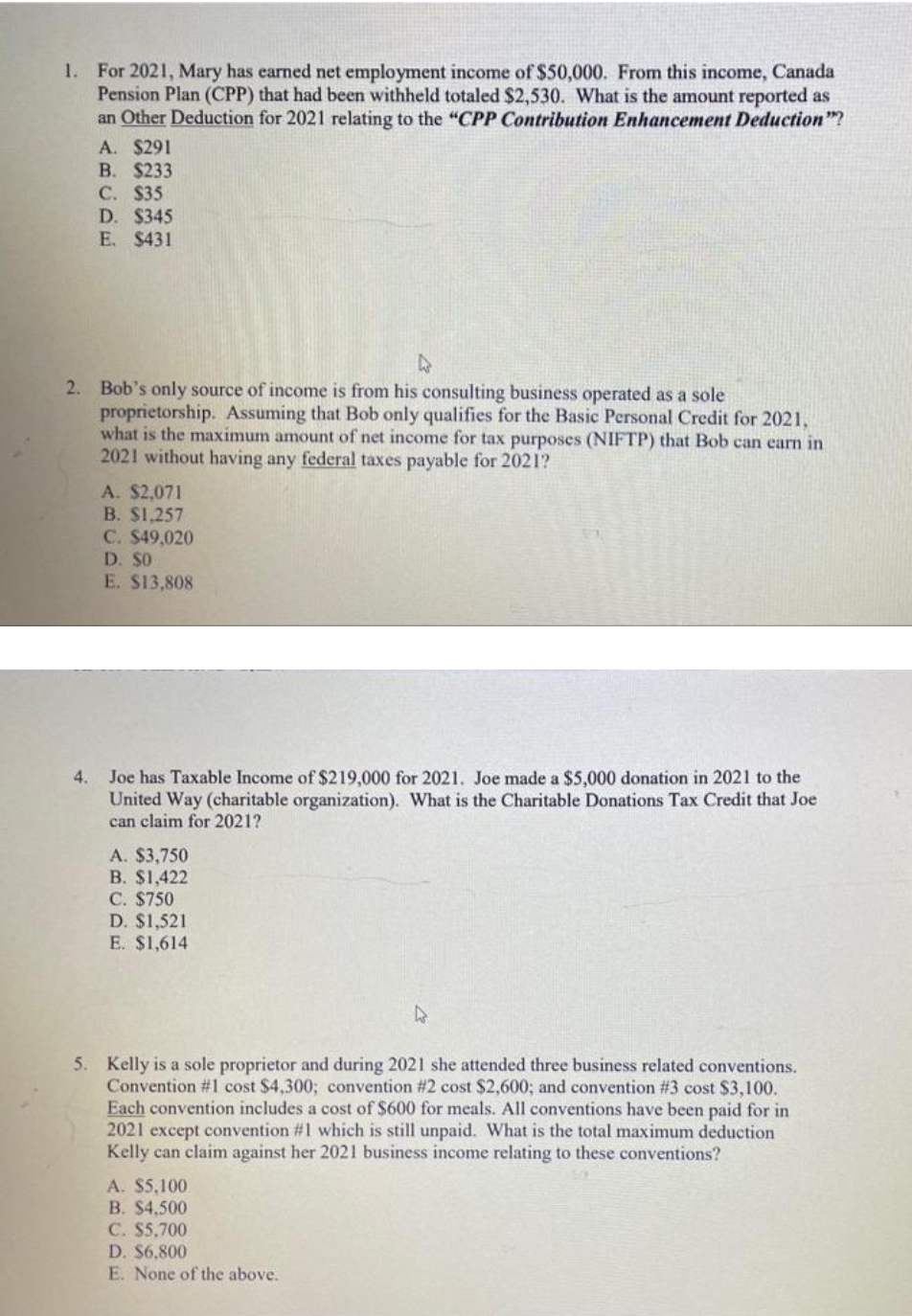

Transcribed Image Text:1. For 2021, Mary has earned net employment income of $50,000. From this income, Canada

Pension Plan (CPP) that had been withheld totaled $2,530. What is the amount reported as

an Other Deduction for 2021 relating to the "CPP Contribution Enhancement Deduction"?

A. $291

B. $233

С. S35

D. $345

E. $431

2. Bob's only source of income is from his consulting business operated as a sole

proprietorship. Assuming that Bob only qualifies for the Basic Personal Credit for 2021.

what is the maximum amount of net income for tax purposes (NIFTP) that Bob can carn in

2021 without having any federal taxes payable for 2021?

A. $2,071

B. $1.257

C. $49,020

D. $O

E. $13,808

Joe has Taxable Income of $219,000 for 2021. Joe made a $5,000 donation in 2021 to the

United Way (charitable organization). What is the Charitable Donations Tax Credit that Joe

can claim for 2021?

4.

A. $3,750

В. $1,422

С. $750

D. $1,521

E. $1,614

5. Kelly is a sole proprietor and during 2021 she attended three business related conventions.

Convention #1 cost $4,300; convention #2 cost $2,600; and convention #3 cost $3,100.

Each convention includes a cost of $600 for meals. All conventions have been paid for in

2021 except convention #1 which is still unpaid. What is the total maximum deduction

Kelly can claim against her 2021 business income relating to these conventions?

A. $5,100

B. $4,500

C. $5,700

D. $6,800

E. None of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT