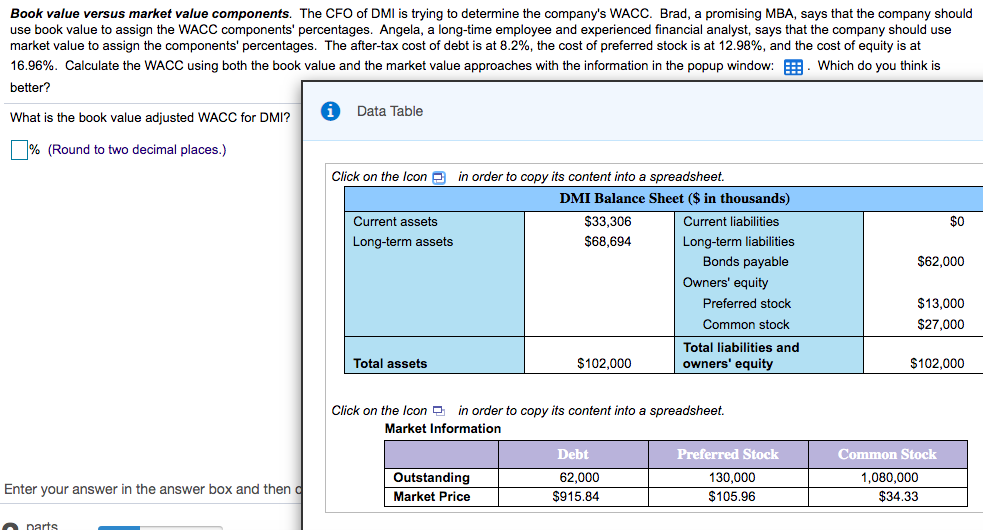

Book value versus market value components. The CFO of DMI is trying to determine the company's WACC. Brad, a promising MBA, says that the company should use book value to assign the WACC components' percentages. Angela, a long-time employee and experienced financial analyst, says that the company should use market value to assign the components' percentages. The after-tax cost of debt is at 8.2%, the cost of preferred stock is at 12.98%, and the cost of equity is at 16.96%. Calculate the WACC using both the book value and the market value approaches with the information in the popup window: . Which do you think is better? Data Table What is the book value adjusted WACC for DMI? % (Round to two decimal places.) Click on the Icon P in order to copy its content into a spreadsheet. DMI Balance Sheet ($ in thousands) Current assets $33,306 Current liabilities $0 Long-term liabilities Bonds payable Long-term assets $68,694 $62,000 Owners' equity Preferred stock $13,000 Common stock $27,000 Total liabilities and Total assets $102,000 owners' equity $102,000

Book value versus market value components. The CFO of DMI is trying to determine the company's WACC. Brad, a promising MBA, says that the company should use book value to assign the WACC components' percentages. Angela, a long-time employee and experienced financial analyst, says that the company should use market value to assign the components' percentages. The after-tax cost of debt is at 8.2%, the cost of preferred stock is at 12.98%, and the cost of equity is at 16.96%. Calculate the WACC using both the book value and the market value approaches with the information in the popup window: . Which do you think is better? Data Table What is the book value adjusted WACC for DMI? % (Round to two decimal places.) Click on the Icon P in order to copy its content into a spreadsheet. DMI Balance Sheet ($ in thousands) Current assets $33,306 Current liabilities $0 Long-term liabilities Bonds payable Long-term assets $68,694 $62,000 Owners' equity Preferred stock $13,000 Common stock $27,000 Total liabilities and Total assets $102,000 owners' equity $102,000

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter16: Capital Structure Decisions

Section: Chapter Questions

Problem 3MC

Related questions

Question

Chapter 11, Question 6

Transcribed Image Text:Book value versus market value components. The CFO of DMI is trying to determine the company's WACC. Brad, a promising MBA, says that the company should

use book value to assign the WACC components' percentages. Angela, a long-time employee and experienced financial analyst, says that the company should use

market value to assign the components' percentages. The after-tax cost of debt is at 8.2%, the cost of preferred stock is at 12.98%, and the cost of equity is at

16.96%. Calculate the WACC using both the book value and the market value approaches with the information in the popup window: . Which do you think is

better?

Data Table

What is the book value adjusted WACC for DMI?

% (Round to two decimal places.)

Click on the Icon e in order to copy its content into a spreadsheet.

DMI Balance Sheet ($ in thousands)

Current assets

$33,306

Current liabilities

$0

Long-term liabilities

Bonds payable

Long-term assets

$68,694

$62,000

Owners' equity

Preferred stock

$13,000

Common stock

$27,000

Total liabilities and

Total assets

$102,000

owners' equity

$102,000

Click on the Icon 9 in order to copy its content into a spreadsheet.

Market Information

Debt

Preferred Stock

Common Stock

Outstanding

Market Price

62,000

130,000

1,080,000

$34.33

Enter your answer in the answer box and then c

$915.84

$105.96

O narts

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning