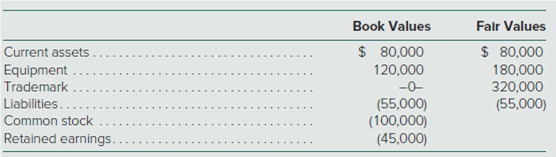

Book Values Falr Values Current assets Equipment Trademark Liabilities.. $ 80,000 120,000 $ 80,000 180,000 320,000 (55,000) -0- Common stock Retained earnings. (100,000) (45,000)

In a pre-2009 business combination, Acme Company acquired all of Brem Company’s assets and liabilities for cash. After the combination Acme formally dissolved Brem. At the acquisition date, the following book and fair values were available for the Brem Company accounts:

In addition, Acme paid an investment bank $25,000 cash for assistance in arranging the combination.

a. Using the legacy purchase method for pre-2009 business combinations, prepare Acme’s entry to record its acquisition of Brem in its accounting records assuming the following cash amounts were paid to the former owners of Brem:

1. $610,000.

2. $425,000.

b. How would these

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Record the acquisition of Brem using the acquisition method assuming $659,900 was paid to the former owners of Brem.