Boreal Landscape Corp. (BLC) is a landscape design company located in North York, Ontario, that prepares its financial statements using ASPE and has a July 31 year end. BLC provides gardening supplies and products as well as full landscape design services for residential properties. BLC is currently working on a project that includes design and installation of landscaping for the Thompson family. The project began in May 2021. The Thompsons pay BLC on a monthly basis for the services and products provided, and have always been prompt with payments. On July 31, 2021, BLC set aside 1,000 square feet of stone for the Thompson project in its warehouse. The total cost of the stone was approximately $5,000, and it was oxnocted to bo instolled ot the amotimo in August BL

Boreal Landscape Corp. (BLC) is a landscape design company located in North York, Ontario, that prepares its financial statements using ASPE and has a July 31 year end. BLC provides gardening supplies and products as well as full landscape design services for residential properties. BLC is currently working on a project that includes design and installation of landscaping for the Thompson family. The project began in May 2021. The Thompsons pay BLC on a monthly basis for the services and products provided, and have always been prompt with payments. On July 31, 2021, BLC set aside 1,000 square feet of stone for the Thompson project in its warehouse. The total cost of the stone was approximately $5,000, and it was oxnocted to bo instolled ot the amotimo in August BL

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 61P

Related questions

Question

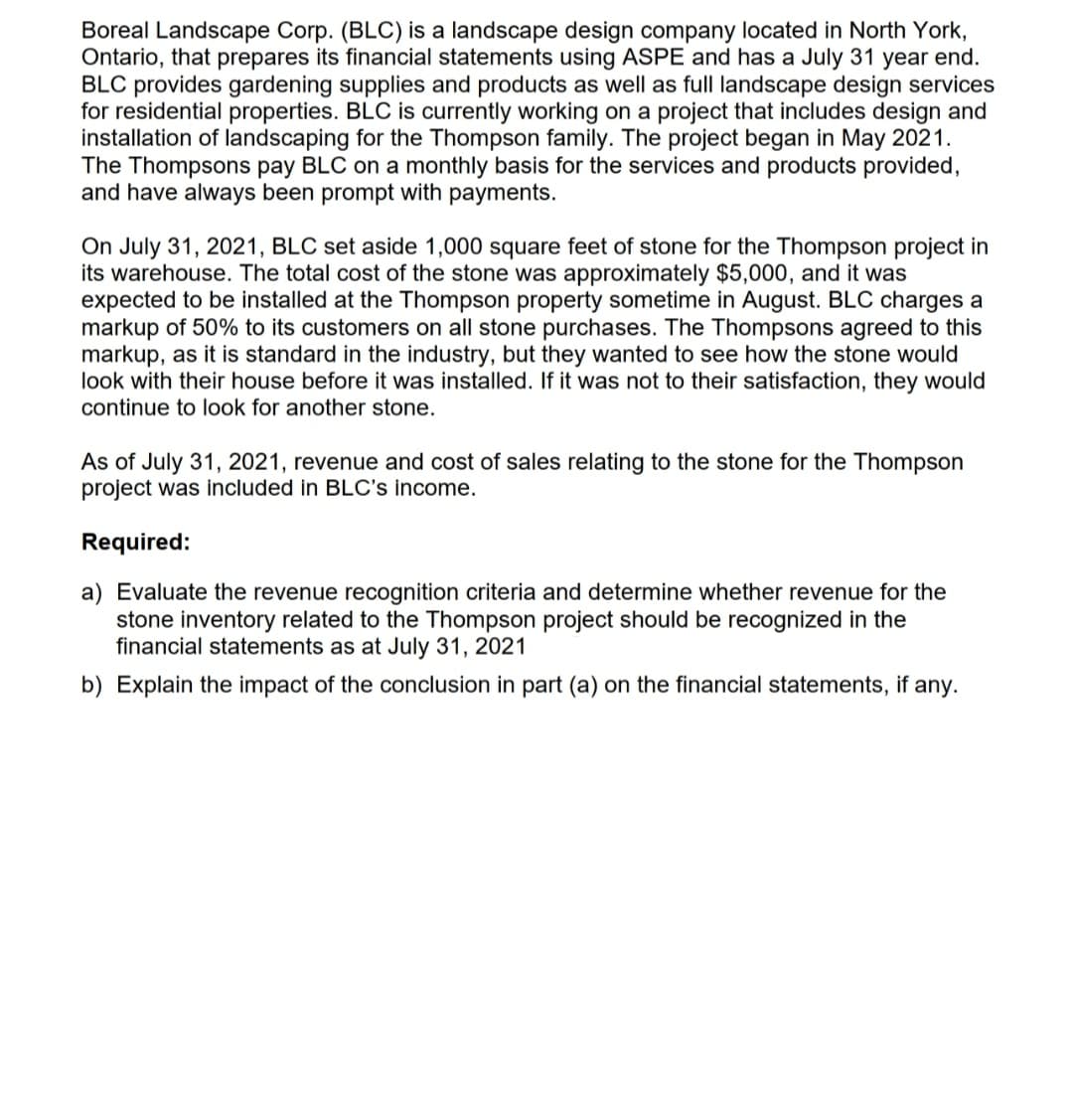

Transcribed Image Text:Boreal Landscape Corp. (BLC) is a landscape design company located in North York,

Ontario, that prepares its financial statements using ASPE and has a July 31 year end.

BLC provides gardening supplies and products as well as full landscape design services

for residential properties. BLC is currently working on a project that includes design and

installation of landscaping for the Thompson family. The project began in May 2021.

The Thompsons pay BLC on a monthly basis for the services and products provided,

and have always been prompt with payments.

On July 31, 2021, BLC set aside 1,000 square feet of stone for the Thompson project in

its warehouse. The total cost of the stone was approximately $5,000, and it was

expected to be installed at the Thompson property sometime in August. BLC charges a

markup of 50% to its customers on all stone purchases. The Thompsons agreed to this

markup, as it is standard in the industry, but they wanted to see how the stone would

look with their house before it was installed. If it was not to their satisfaction, they would

continue to look for another stone.

As of July 31, 2021, revenue and cost of sales relating to the stone for the Thompson

project was included in BLC's income.

Required:

a) Evaluate the revenue recognition criteria and determine whether revenue for the

stone inventory related to the Thompson project should be recognized in the

financial statements as at July 31, 2021

b) Explain the impact of the conclusion in part (a) on the financial statements, if any.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning