FORECASTING THE FUTURE PERFORMANCE OF ABERCROMBIE & FITCH

Use online resources to work on this chapter’s questions. Please note that website information changes over time, and these changes may limit your ability to answer some of these questions.

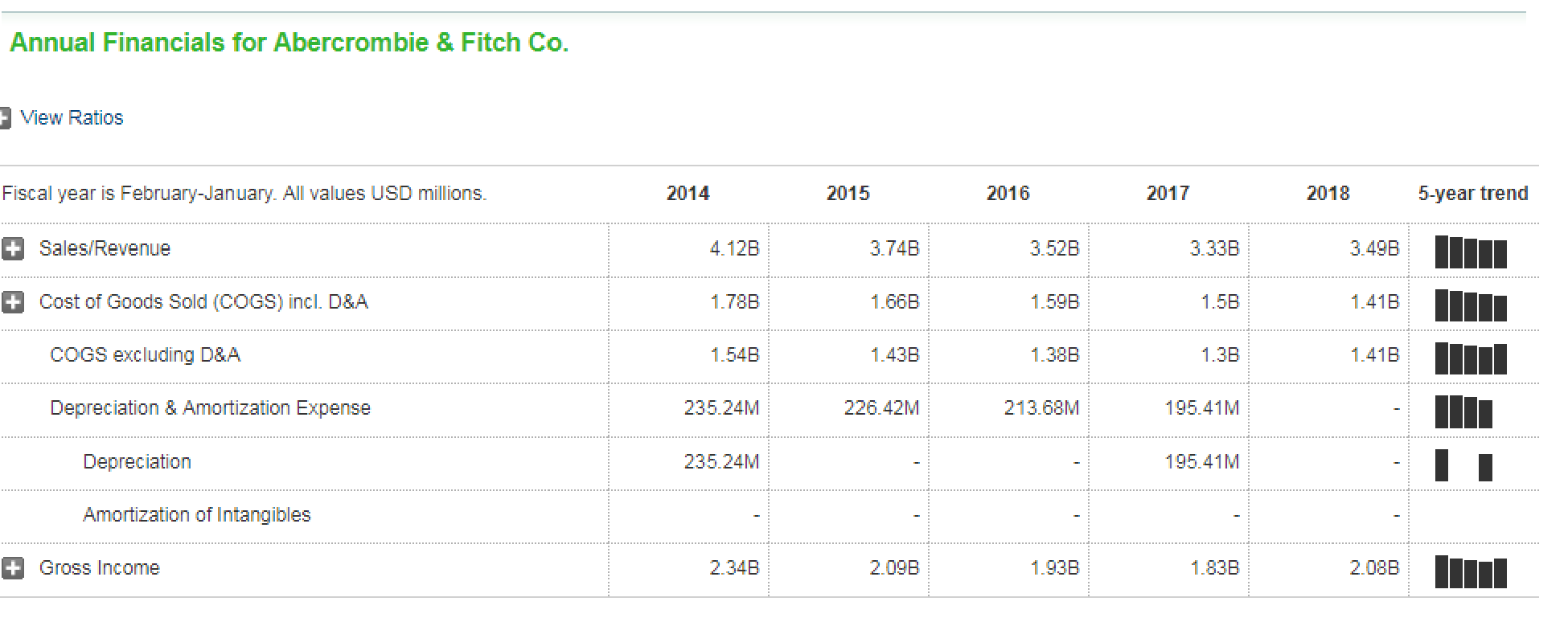

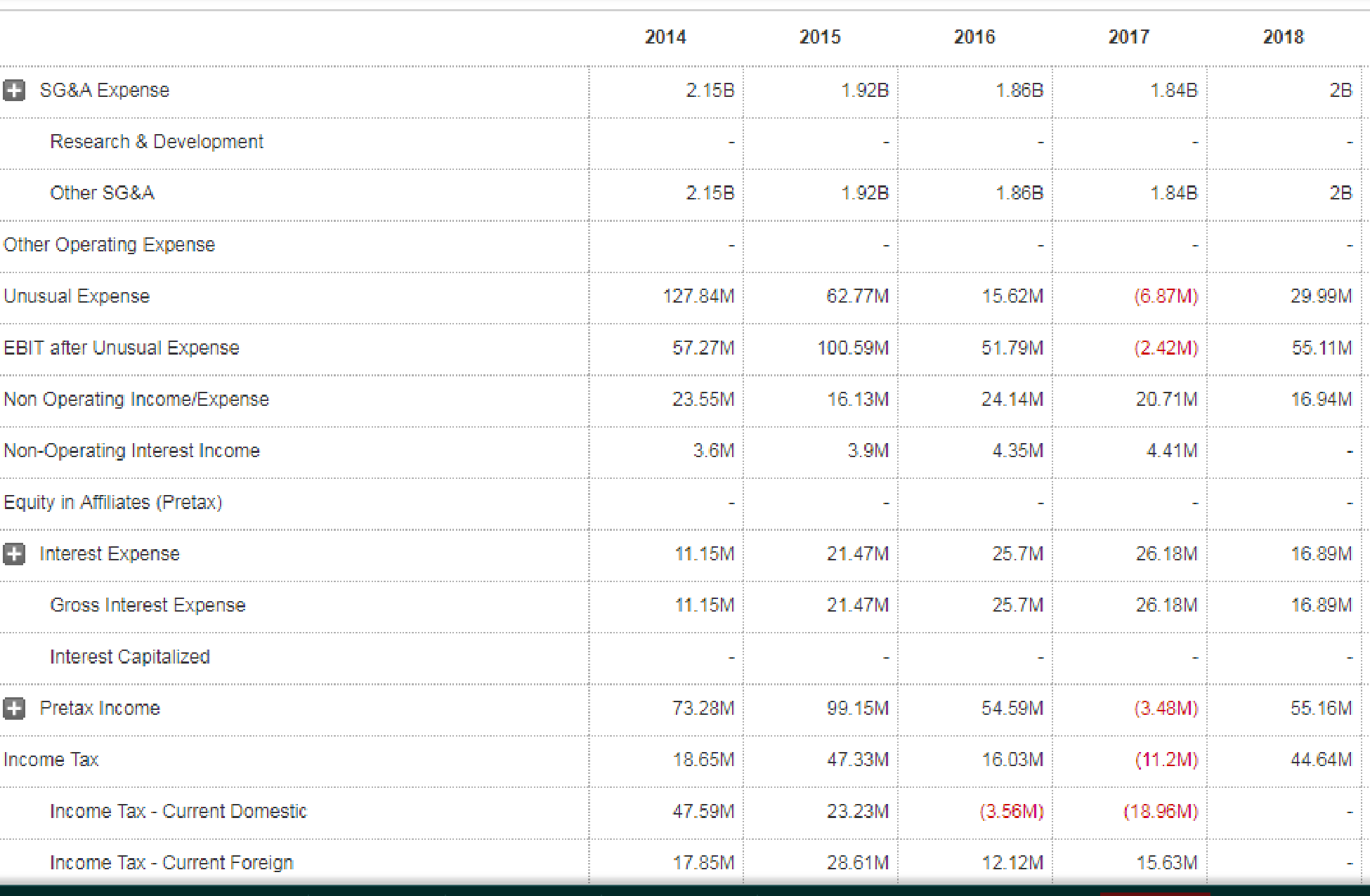

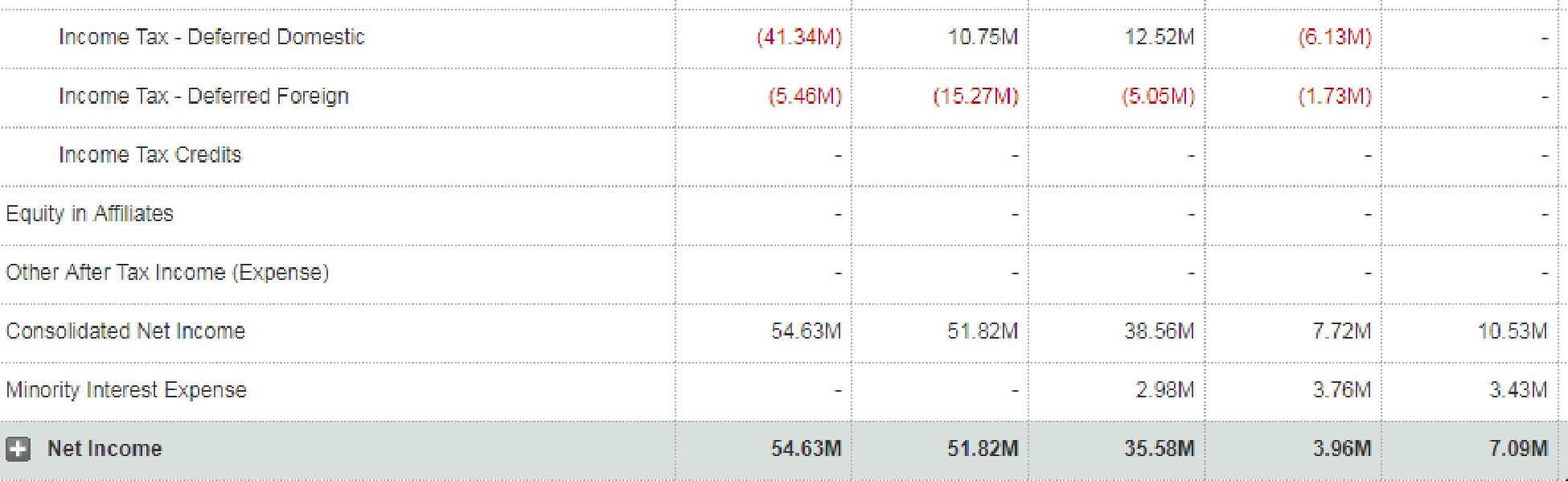

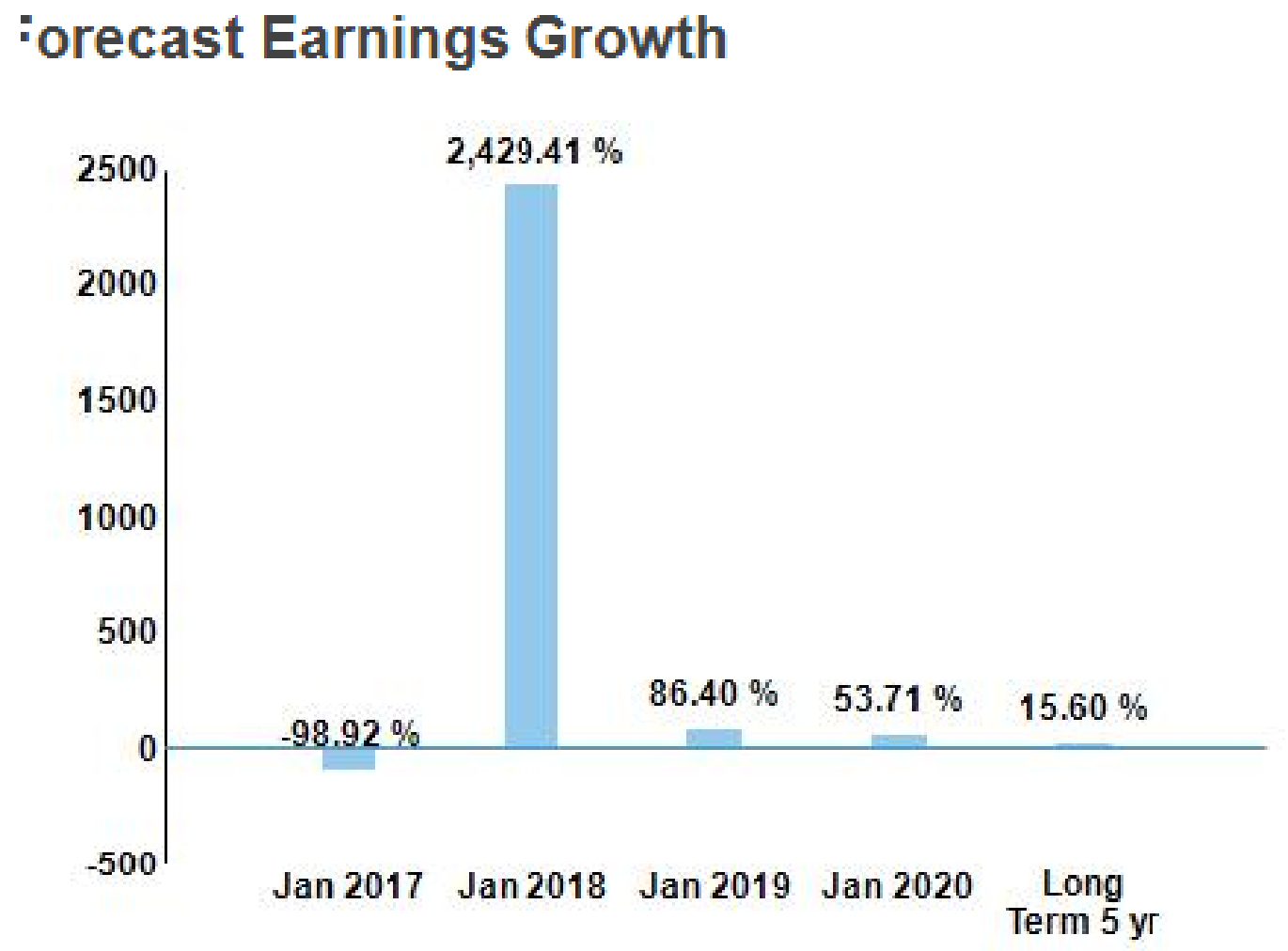

Clothing retailer Abercrombie & Fitch enjoyed phenomenal success in the late 1990s. Between 1996 and 2000, its sales grew almost fourfold—from $335 million to more than $1.2 billion—and its stock price soared by more than 500%. However, in 2002, its growth rate had begun to slow down, and Abercrombie had a hard time meeting its quarterly earnings targets. As a result, the stock price in late 2002 was about half of what it was 3 years earlier. Abercrombie’s struggles resulted from increased competition, a sluggish economy, and the challenges of staying ahead of the fashion curve. From late 2002 until November 2007, the company’s stock rebounded strongly; however, its stock price declined during the 2008 economic downturn. Its stock price rebounded until late October 2011, when it began a downward trend again. Questions remain about the firm’s long-term growth prospects. However the company has been cutting costs and trying to improve productivity with its focus on the supply chain. In addition, it has been actively repurchasing shares, indicating that management believes its shares are undervalued. The company continues to steadily expand stores abroad while closing under-performing domestic stores.

Given the questions about Abercrombie’s future growth rate, analysts have focused on the company’s earnings reports. Financial websites such as Yahoo! Finance, Morningstar, and MSN Money (www.msn.com/en-us/

DISCUSSION QUESTIONS

Based on analysts’ forecasts, what is the expected long-term (5-year) growth rate in earnings?

Want to see the full answer?

Check out a sample textbook solution

Chapter 16 Solutions

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

- With the 2013 data still on the screen, click the Chart sheet tab. The chart presented shows the rates of return for Global Technology for the last five years. Answer the following questions: a. In 2009, the rate of return on assets exceeded the rate of return on common stockholders equity. Why might this have occurred? Be as specific as possible. b. Is the company better off in 2013 than it was in 2009? Why or why not? When the assignment is complete, close the file without saving it again. Worksheet. Modify the RATIOA4 worksheet to have it compute two additional activity ratios: number of days sales in receivables and number of days sales in merchandise inventory. Use the 2012 and 2013 data and assume a 365-day year. Write out the formulas for your ratios in the spaces provided. Days sales in receivables (average collection period) ________________ Days sales in inventory (average sales period) ________________ Preview the printout to make sure that the worksheet will print neatly, and then print the worksheet. Save the completed file as RATIOAT. Chart. Using the RATIOA4 file, prepare a column chart that compares the acid test and current ratios for Global Technology for 2012 and 2013. Complete the Chart Tickler Data Table and use it as a basis for preparing the chart. Enter all appropriate titles, legends, and formats. Enter your name somewhere on the chart. Save the file again as RATIOA4. Print the chart.arrow_forwardUse online resources to work on this chapter's questions. Please note that website information changes over time, and these changes may limit your ability to answer some of these questions. In this chapter's opening vignette, we discussed Apple's decision to establish a dividend payout policy in 2012 and its subsequent decisions to increase quarterly dividends and raise its repurchase program to 175 billion. Let's find out what has happened to Apple's (AAPL) dividend policy since the time of its original announcement. We can address this issue by relying on data provided on internet financial websites such as Yahoo! Finance, Morningstar.com, Google Finance, and MSN Money (www.msn.com/en-us/money/markets). You will have to use a combination of these sites to answer these questions. 6. Review the firm's annual cash flow statements. Has Apple been repurchasing stock, or has it been issuing new stock?arrow_forwardUse online resources to work on this chapter's questions. Please note that website information changes over time, and these changes may limit your ability to answer some of these questions. In this chapter's opening vignette, we discussed Apple's decision to establish a dividend payout policy in 2012 and its subsequent decisions to increase quarterly dividends and raise its repurchase program to 175 billion. Let's find out what has happened to Apple's (AAPL) dividend policy since the time of its original announcement. We can address this issue by relying on data provided on internet financial websites such as Yahoo! Finance, Morningstar.com, Google Finance, and MSN Money (www.msn.com/en-us/money/markets). You will have to use a combination of these sites to answer these questions. 5. Investors are more concerned with future dividends than historical dividends. Look at analysts' earnings estimates for the next year and the 5-year annual growth estimates. On the basis of these data, what would you expect Apples payout policy to be over the next 5 years? (Your answer will only be a guess based on current data.)arrow_forward

- Use online resources to work on this chapter's questions. Please note that website information changes over time, and these changes may limit your ability to answer some of these questions. In this chapter's opening vignette, we discussed Apple's decision to establish a dividend payout policy in 2012 and its subsequent decisions to increase quarterly dividends and raise its repurchase program to 175 billion. Let's find out what has happened to Apple's (AAPL) dividend policy since the time of its original announcement. We can address this issue by relying on data provided on internet financial websites such as Yahoo! Finance, Morningstar.com, Google Finance, and MSN Money (www.msn.com/en-us/money/markets). You will have to use a combination of these sites to answer these questions. 2. Compare this information with other firms in the same industry. Has Apple behaved differently from its peers, or have there been industry-wide shifts? Google Finance provides data on related companies. Click Related companies on the left-hand side of your screen, and then click. Add or remove columns to see additional data, including dividend per share and dividend yield.arrow_forwardOperating, Investing, and Financing Activities The following is information about three different companies. 1. Noon Wakeup Company is a software game development company that creates titles for the Android operating system. The company recently launched its first software title. The company is expanding its operations by hiring additional developers and administrative staff. Noon Wakeup is not yet profitable, but it expects to show a profit within 2 years. Investors view the company as being on the cutting edge with its technology and have continued to invest in the company. Noon Wakeup has not yet borrowed money, but is considering doing so in the future. 2. Steel Grid Company is a textile company located in Waynesboro, NC. The company is experiencing its 20th year of profitability. Management is concerned by the recent economic downturn in the textile business, which has hurt sales in the 3 most recent fiscal years. Next year the company expects to just break even. For this reason, the company is not expanding and is only replacing fully depreciated equipment in its machine intensive manufacturing business. Steel Grid- pridcs itself in paying dividends and having no debt on its balance sheet. 3. Device Driver Company is a technology manufacturing company located in Bloomington, IN. The company has just introduced its 10th new product and is the leader in market share for its industry. The company continues to invest in new equipment and property and to expand by purchasing its competitors. The company has yet to pay dividends, but it is considering doing so in the future. The companys largest current asset is cash, as a result of its high profit margin; because of this, the company has no need for external sources of cash. Required: For each company, prepare a report examining whether you think the companys current cash flows from each activity (operating, investing, and financing) will be positive (the activity provides cash) or negative (the activity uses cash). Provide support for your answers.arrow_forwardZNet Co. is a web-based retail company. The company reports the following for the past year. The company’s CEO believes that sales for next year will increase by 20% and both profit margin (%) and the level of average invested assets will be the same as for the past year. 1. Compute return on investment for the past year. 2. Compute profit margin for the past year. 3. If the CEO’s forecast is correct, what will return on investment equal for next year? 4. If the CEO’s forecast is correct, what will investment turnover equal for next year? Sales . $5,000,000 Operating income . $1,000,000 Average invested assets . $12,500,000arrow_forward

- Your company is considering acquiring a private company (New Co., Inc.). The CFO has asked you to review the financial statements, look for key trends, and develop financial/operational questions to ask the management of New Co. when you meet next week. Calculate average collection period, total asset turnover, inventory turnover, and days in inventory. Calculate average collection period, total asset turnover, inventory turnover, and days in inventory for the four years. Assess the trends in activity of the firm, using your calculations in part 1, over the four year period. Calculate the gross profit margin, operating margin, and net profit margin. Assess the profitability trends of the firm, using your calculations in part 3, over the four- year period. Develop three or four questions to ask the management of New Co. to help your management team understand trends uncovered by the ratio analysis. New Co., Inc. Income Statement 12/31/22 12/31/21 12/31/20 12/31/19 Revenue…arrow_forwardMay I ask for an explanation and solution to the question for a better understanding. Thank you! 17. The following data for the years ended December 31, 2019 and 2020 were presented to the management Zigzag Company: 2020 = Net sales: 1,363,000, Cost of Sales: 911,800, Gross Profit: 451,200; 2019 = Net Sales: 1,250,000, Cost of Sales: 776,000, Gross Profit: 474,000. The management requested you to determine the cause of the decline in gross profit on sales in spite of the favorable information given by the sales division that the quantity sold in 2020 was higher than in 2019 and that the production costs in 2020 were lower than that of 2019 by 6%. The increase (decrease) in net sales due to price factor is: a. (P113,000) b. P113,000 c. (P199,500) d. P199,500arrow_forwardConsider the following information (2019) on three large corporations in the consumer home- retailing industry: Williams-Sonoma, IKEA Group, and Otto Group. Values are in millions USD. Calculate all financial metrics relevant to supply chain management. Interpret the values in the financial statements and the metrics you calculate to characterize the supply chain strategies of the firms in comparison to each other You can use the Internet to gather additional information on the firms, to improve your insights.arrow_forward

- The following quote appeared in an article entitled ‘Business and society in the coming decades’, which was available on the website of McKinsey & Company (accessed in October 2015).“There are compelling reasons companies should seize the initiative to drive social and business benefits. First, in an interconnected world facing unprecedented environmental and social challenges,society will demand it. Increasingly, a basic expectation among customers, governments, and communities will be that the companies they do business with provide a significant net positive return for society at large, not just for investors. This will be part of the implicit contract or license to operate”.Required:a) Explain the above statement in the context of corporate social responsibility. [Word limit 150-200words] b) Further, do you think such a statement would impact the perceived ‘legitimacy’ of companies?Explain. [Word limit 200 – 250]arrow_forwardThe following quote appeared in an article entitled ‘Business and society in the coming decades’, which was available on the website of McKinsey & Company (accessed in October 2015). “There are compelling reasons companies should seize the initiative to drive social and business benefits. First, in an interconnected world facing unprecedented environmental and social challenges, society will demand it. Increasingly, a basic expectation among customers, governments, and communities will be that the companies they do business with provide a significant net positive return for society at large, not just for investors. This will be part of the implicit contract or license to operate”. Required: a) Explain the above statement in the context of corporate social responsibility.b) Further, do you think such a statement would impact the perceived ‘legitimacy’ of companies? Explain.arrow_forwardThe following quote appeared in an article entitled ‘Business and society in the coming decades’, which was available on the website of McKinsey & Company (accessed in October 2015). “There are compelling reasons companies should seize the initiative to drive social and business benefits. First, in an interconnected world facing unprecedented environmental and social challenges, society will demand it. Increasingly, a basic expectation among customers, governments, and communities will be that the companies they do business with provide a significant net positive return for society at large, not just for investors. This will be part of the implicit contract or license to operate”. Now a) Explain the above statement in the context of corporate social responsibility. b) Further, do you think such a statement would impact the perceived ‘legitimacy’ of companies? Explain.arrow_forward

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning