Carla Vista Company bottles and distributes B-Lite, a diet soft drink. The beverage is sold for 50 cents per 16-ounce bottle to retailers, who charge customers 75 cents per bottle. For the year 2020, management estimates the following revenues and costs $ 2,000,000 Selling expenses-variable $ 109,000 Sales Direct materials 550,000 Selling expenses-fixed 58,000 Direct labor 400,000 Administrative expenses-variable 21,000 Manufacturing overhead-variable 420,000 Administrative expenses-fıxed 52,000 Manufacturing overhead-fixed 190,000 Prepare a CVP income statement for 2020 based on management's estimates. CARLA VISTA COMPANY CVP Income Statement (Estimated) For the Year Ending December 31, 2020 Sales 2000000 Variable Expenses > > >

Carla Vista Company bottles and distributes B-Lite, a diet soft drink. The beverage is sold for 50 cents per 16-ounce bottle to retailers, who charge customers 75 cents per bottle. For the year 2020, management estimates the following revenues and costs $ 2,000,000 Selling expenses-variable $ 109,000 Sales Direct materials 550,000 Selling expenses-fixed 58,000 Direct labor 400,000 Administrative expenses-variable 21,000 Manufacturing overhead-variable 420,000 Administrative expenses-fıxed 52,000 Manufacturing overhead-fixed 190,000 Prepare a CVP income statement for 2020 based on management's estimates. CARLA VISTA COMPANY CVP Income Statement (Estimated) For the Year Ending December 31, 2020 Sales 2000000 Variable Expenses > > >

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 2CE

Related questions

Question

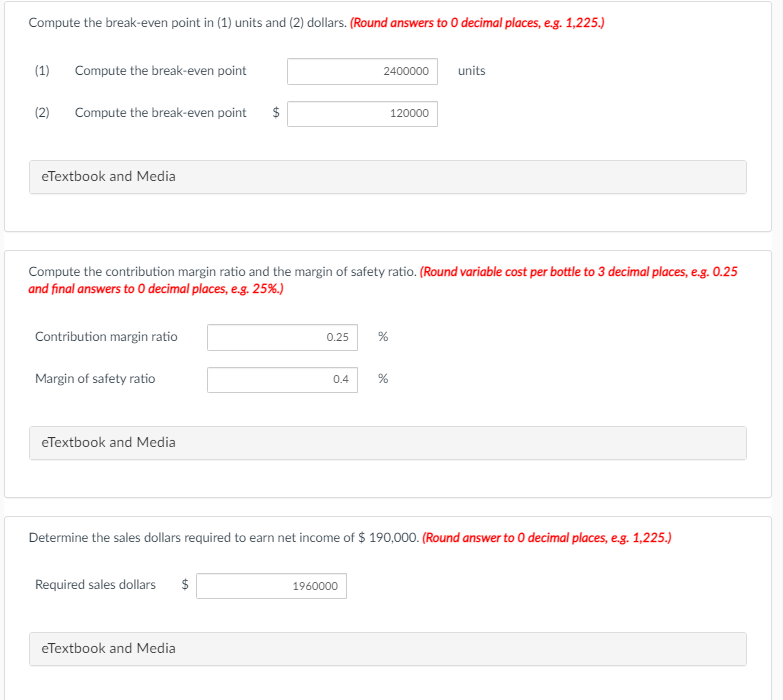

Transcribed Image Text:Compute the break-even point in (1) units and (2) dollars. (Round answers to 0 decimal places, e.g. 1,225.)

(1)

Compute the break-even point

2400000

units

(2)

Compute the break-even point

$

120000

eTextbook and Media

Compute the contribution margin ratio and the margin of safety ratio. (Round variable cost per bottle to 3 decimal places, e.g. 0.25

and final answers to 0 decimal places, e.g. 25%.)

Contribution margin ratio

0.25

Margin of safety ratio

0.4

eTextbook and Media

Determine the sales dollars required to earn net income of $ 190,000. (Round answer to 0 decimal places, e.g. 1,225.)

Required sales dollars

$

1960000

eTextbook and Media

%24

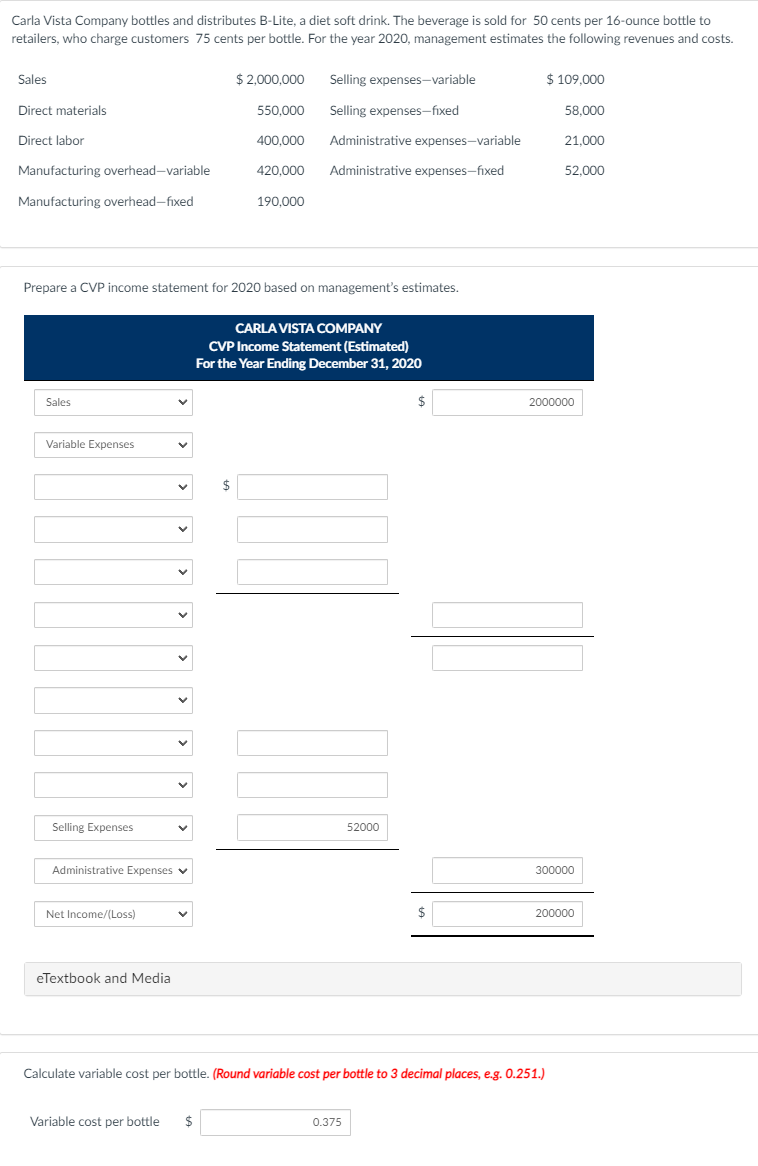

Transcribed Image Text:Carla Vista Company bottles and distributes B-Lite, a diet soft drink. The beverage is sold for 50 cents per 16-ounce bottle to

retailers, who charge customers 75 cents per bottle. For the year 2020, management estimates the following revenues and costs.

Sales

$ 2,000,000

Selling expenses-variable

$ 109.000

Direct materials

550,000

Selling expenses-fixed

58.000

Direct labor

400,000

Administrative expenses-variable

21.000

Manufacturing overhead-variable

420.000

Administrative expenses-fixed

52,000

Manufacturing overhead-fixed

190,000

Prepare a CVP income statement for 2020 based on management's estimates.

CARLA VISTA cOMPANY

CVP Income Statement (Estimated)

For the Year Ending December 31, 2020

Sales

2000000

Variable Expenses

Selling Expenses

52000

Administrative Expenses v

300000

Net Income/(Loss)

$

200000

eTextbook and Media

Calculate variable cost per bottle. (Round variable cost per bottle to 3 decimal places, e.g. 0.251.)

Variable cost per bottle

0.375

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub