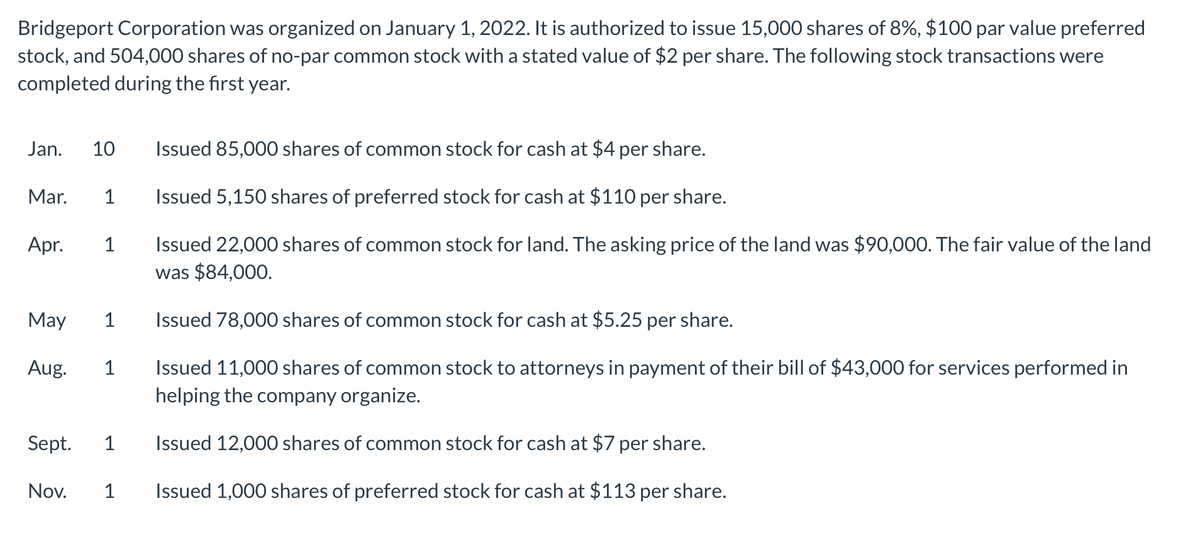

Bridgeport Corporation was organized on January 1, 2022. It is authorized to issue 15,000 shares of 8%, $100 par value preferred stock, and 504,000 shares of no-par common stock with a stated value of $2 per share. The following stock transactions were completed during the first year. Jan. 10 Issued 85,000 shares of common stock for cash at $4 per share. Issued 5,150 shares of preferred stock for cash at $110 per share. Issued 22,000 shares of common stock for land. The asking price of the land was $90,000. The fair value of the land was $84,000. Issued 78,000 shares of common stock for cash at $5.25 per share. Issued 11,000 shares of common stock to attorneys in payment of their bill of $43,000 for services performed in helping the company organize. Issued 12,000 shares of common stock for cash at $7 per share. Issued 1,000 shares of preferred stock for cash at $113 per share. Mar. 1 Apr. May Aug. 1 Nov. 1 1 Sept. 1 1

Bridgeport Corporation was organized on January 1, 2022. It is authorized to issue 15,000 shares of 8%, $100 par value preferred stock, and 504,000 shares of no-par common stock with a stated value of $2 per share. The following stock transactions were completed during the first year. Jan. 10 Issued 85,000 shares of common stock for cash at $4 per share. Issued 5,150 shares of preferred stock for cash at $110 per share. Issued 22,000 shares of common stock for land. The asking price of the land was $90,000. The fair value of the land was $84,000. Issued 78,000 shares of common stock for cash at $5.25 per share. Issued 11,000 shares of common stock to attorneys in payment of their bill of $43,000 for services performed in helping the company organize. Issued 12,000 shares of common stock for cash at $7 per share. Issued 1,000 shares of preferred stock for cash at $113 per share. Mar. 1 Apr. May Aug. 1 Nov. 1 1 Sept. 1 1

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 5MC: Kent Corporation was organized on January 1, 2014. On that date, it issued 200,000 shares of 10 par...

Related questions

Question

Transcribed Image Text:Bridgeport Corporation was organized on January 1, 2022. It is authorized to issue 15,000 shares of 8%, $100 par value preferred

stock, and 504,000 shares of no-par common stock with a stated value of $2 per share. The following stock transactions were

completed during the first year.

Jan. 10 Issued 85,000 shares of common stock for cash at $4 per share.

Issued 5,150 shares of preferred stock for cash at $110 per share.

Issued 22,000 shares of common stock for land. The asking price of the land was $90,000. The fair value of the land

was $84,000.

Mar. 1

Apr.

May

Aug.

Sept.

Nov.

1

Issued 78,000 shares of common stock for cash at $5.25 per share.

Issued 11,000 shares of common stock to attorneys in payment of their bill of $43,000 for services performed in

helping the company organize.

Issued 12,000 shares of common stock for cash at $7 per share.

1 Issued 1,000 shares of preferred stock for cash at $113 per share.

1

1

1

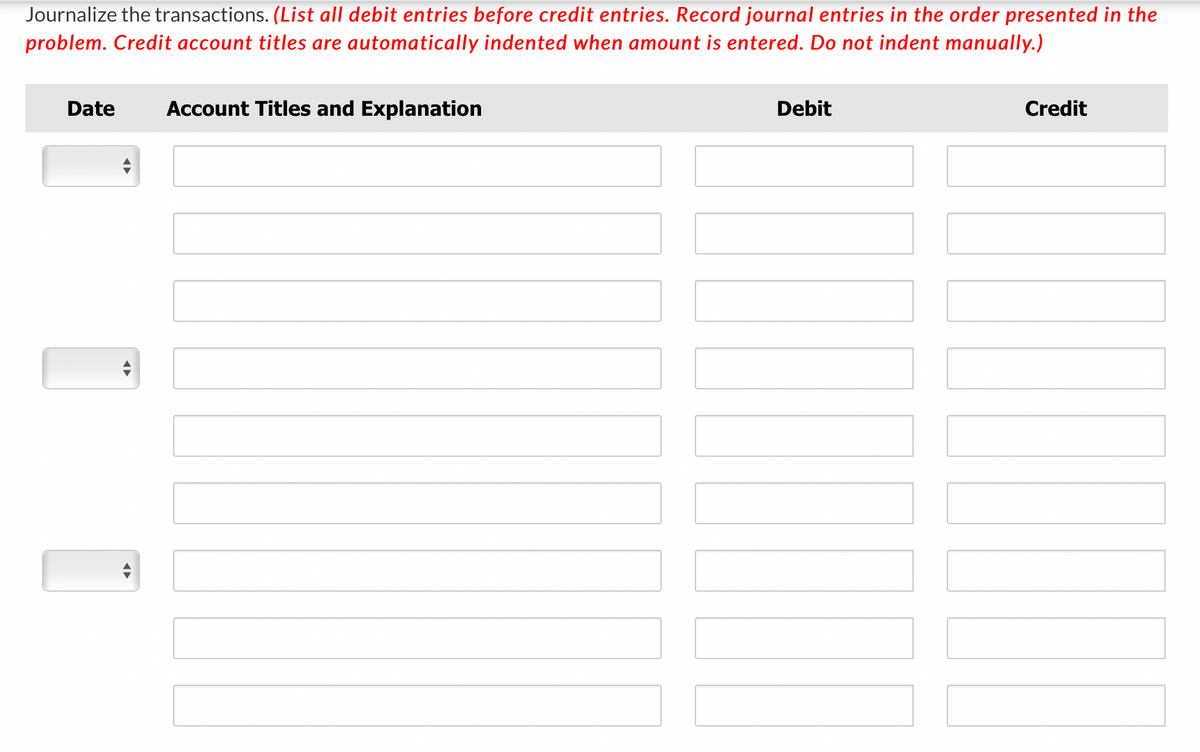

Transcribed Image Text:Journalize the transactions. (List all debit entries before credit entries. Record journal entries in the order presented in the

problem. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Date Account Titles and Explanation

|||||||

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning