Brief Exercise 9-06 a-b Sunland Co. uses the percentage-of-receivables basis to record bad debt expense. It estimates that 2% of accounts receivable will become uncollectible. Accounts receivable are $620,000 at the end of the year, and the allowance for doubtful accounts has a credit balance of $2,02 Prepare the adjusting Journal entry to record bad debt expense for the year. (Credit account titles are automatically indented when amount entered. Do not indent manually.) Account Titles and Explanation Debit Credit SHOW LIST OF ACCOUNTS If the allowance for doubtful accounts had a debit balance of $800 instead of a credit balance of $2,020, determine the amount to be reported for bad debt expense. Bad Debts Expense

Brief Exercise 9-06 a-b Sunland Co. uses the percentage-of-receivables basis to record bad debt expense. It estimates that 2% of accounts receivable will become uncollectible. Accounts receivable are $620,000 at the end of the year, and the allowance for doubtful accounts has a credit balance of $2,02 Prepare the adjusting Journal entry to record bad debt expense for the year. (Credit account titles are automatically indented when amount entered. Do not indent manually.) Account Titles and Explanation Debit Credit SHOW LIST OF ACCOUNTS If the allowance for doubtful accounts had a debit balance of $800 instead of a credit balance of $2,020, determine the amount to be reported for bad debt expense. Bad Debts Expense

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter16: Accounting For Accounts Receivable

Section: Chapter Questions

Problem 2SEA: UNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES Rossins Racers has total credit sales for the year of...

Related questions

Question

Please answer question correctly

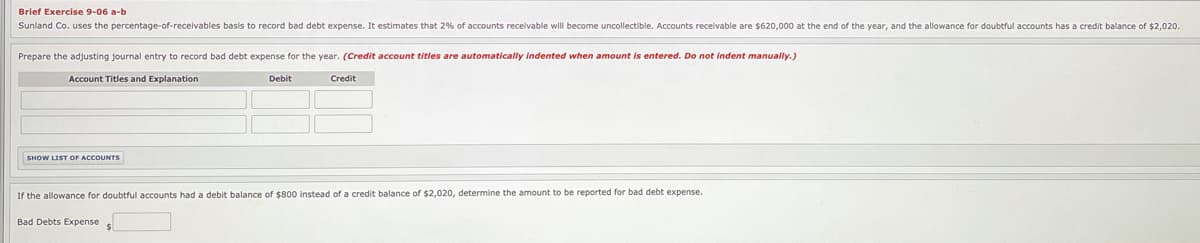

Transcribed Image Text:Brief Exercise 9-06 a-b

Sunland Co. uses the percentage-of-receivables basis to record bad debt expense. It estimates that 2% of accounts receivable will become uncollectible. Accounts receivable are $620,000 at the end of the year, and the allowance for doubtful accounts has a credit balance of $2,020.

Prepare the adjusting journal entry to record bad debt expense for the year. (Credit account titles are automatically indented when amount

entered. Do not indent manually.)

Account Titles and Explanation

Debit

Credit

SHOW LIST OF ACCOUNTS

If the allowance for doubtful accounts had a debit balance of $800 instead of a credit balance of $2,020, determine the amount to be reported for bad debt expense.

Bad Debts Expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,