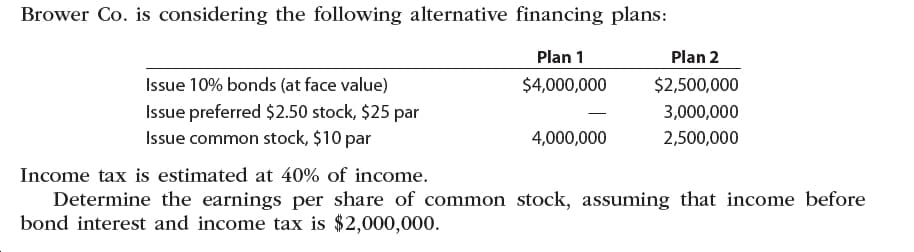

Brower Co. is considering the following alternative financing plans: Plan 1 Plan 2 Issue 10% bonds (at face value) $4,000,000 $2,500,000 Issue preferred $2.50 stock, $25 par Issue common stock, $10 par 3,000,000 4,000,000 2,500,000 Income tax is estimated at 40% of income. Determine the earnings per share of common stock, assuming that income before bond interest and income tax is $2,000,000.

Brower Co. is considering the following alternative financing plans: Plan 1 Plan 2 Issue 10% bonds (at face value) $4,000,000 $2,500,000 Issue preferred $2.50 stock, $25 par Issue common stock, $10 par 3,000,000 4,000,000 2,500,000 Income tax is estimated at 40% of income. Determine the earnings per share of common stock, assuming that income before bond interest and income tax is $2,000,000.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter14: Long-term Liabilities: Bonds And Notes

Section: Chapter Questions

Problem 1PEB: Brower Co. is considering the following alternative financing plans: Income tax is estimated at 40%...

Related questions

Question

Practice Pack

Transcribed Image Text:Brower Co. is considering the following alternative financing plans:

Plan 1

Plan 2

Issue 10% bonds (at face value)

$4,000,000

$2,500,000

Issue preferred $2.50 stock, $25 par

Issue common stock, $10 par

3,000,000

4,000,000

2,500,000

Income tax is estimated at 40% of income.

Determine the earnings per share of common stock, assuming that income before

bond interest and income tax is $2,000,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning