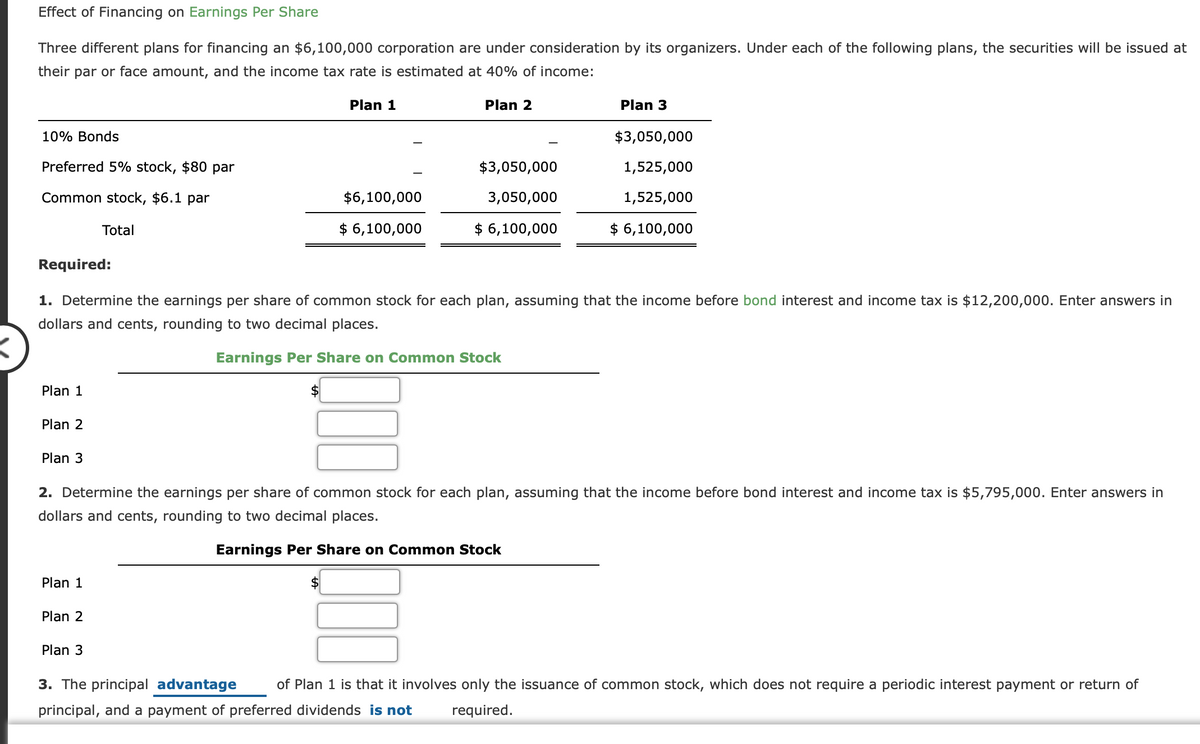

Effect of Financing on Earnings Per Share Three different plans for financing an $6,100,000 corporation are under consideration by its organizers. Under each of the following plans, the securities will be issued at their par or face amount, and the income tax rate is estimated at 40% of income: Plan 1 Plan 2 Plan 3 10% Bonds $3,050,000 Preferred 5% stock, $80 par $3,050,000 1,525,000 Common stock, $6.1 par $6,100,000 3,050,000 1,525,000 Total $ 6,100,000 $ 6,100,000 $ 6,100,000 Required: 1. Determine the earnings per share of common stock for each plan, assuming that the income before bond interest and income tax is $12,200,000. Enter answers in dollars and cents, rounding to two decimal places. Earnings Per Share on Common Stock Plan 1 Plan 2 Plan 3 2. Determine the earnings per share of common stock for each plan, assuming that the income before bond interest and income tax is $5,795,000. Enter answers in dollars and cents, rounding to two decimal places. Earnings Per Share on Common Stock Plan 1 Plan 2 Plan 3 3. The principal advantage of Plan 1 is that it involves only the issuance of common stock, which does not require a periodic interest payment or return of principal, and a payment of preferred dividends is not required.

Effect of Financing on Earnings Per Share Three different plans for financing an $6,100,000 corporation are under consideration by its organizers. Under each of the following plans, the securities will be issued at their par or face amount, and the income tax rate is estimated at 40% of income: Plan 1 Plan 2 Plan 3 10% Bonds $3,050,000 Preferred 5% stock, $80 par $3,050,000 1,525,000 Common stock, $6.1 par $6,100,000 3,050,000 1,525,000 Total $ 6,100,000 $ 6,100,000 $ 6,100,000 Required: 1. Determine the earnings per share of common stock for each plan, assuming that the income before bond interest and income tax is $12,200,000. Enter answers in dollars and cents, rounding to two decimal places. Earnings Per Share on Common Stock Plan 1 Plan 2 Plan 3 2. Determine the earnings per share of common stock for each plan, assuming that the income before bond interest and income tax is $5,795,000. Enter answers in dollars and cents, rounding to two decimal places. Earnings Per Share on Common Stock Plan 1 Plan 2 Plan 3 3. The principal advantage of Plan 1 is that it involves only the issuance of common stock, which does not require a periodic interest payment or return of principal, and a payment of preferred dividends is not required.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter8: Liabilities And Stockholders' Equity

Section: Chapter Questions

Problem 8.1.3P

Related questions

Question

100%

Practice Pack

I couldnt find teh solution for these problems

Transcribed Image Text:Effect of Financing on Earnings Per Share

Three different plans for financing an $6,100,000 corporation are under consideration by its organizers. Under each of the following plans, the securities will be issued at

their par or face amount, and the income tax rate is estimated at 40% of income:

Plan 1

Plan 2

Plan 3

10% Bonds

$3,050,000

Preferred 5% stock, $80 par

$3,050,000

1,525,000

Common stock, $6.1 par

$6,100,000

3,050,000

1,525,000

Total

$ 6,100,000

$ 6,100,000

$ 6,100,000

Required:

1. Determine the earnings per share of common stock for each plan, assuming that the income before bond interest and income tax is $12,200,000. Enter answers in

dollars and cents, rounding to two decimal places.

Earnings Per Share on Common Stock

Plan 1

Plan 2

Plan 3

2. Determine the earnings per share of common stock for each plan, assuming that the income before bond interest and income tax is $5,795,000. Enter answers in

dollars and cents, rounding to two decimal places.

Earnings Per Share on Common Stock

Plan 1

Plan 2

Plan 3

3. The principal advantage

of Plan 1 is that it involves only the issuance of common stock, which does not require a periodic interest payment or return of

principal, and a payment of preferred dividends is not

required.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT