Buildit Corp. was contracted to construct a building for $2,440,000. The contract provided for progress payments. Buildit's accounting year ends 31 December. Work began under the contract on 1 March 20X3, and was completed on 30 November 20X5. Construction activities are summarized below by year: 20x3 20x4 20x5 Construction costs incurred during the year, $610,000; estimated costs to complete, $1,110,000; progress billings during the year, $520,000; and collections, $430,000. Construction costs incurred during the year, $980,000; estimated costs to complete, $350,000; progress billing during the year, $1,690,000; and collections, $1,430,000. Construction costs incurred during the year, $330,000. Because the contract was completed, the remaining balance was billed and later collected in full. per the contract. Required: 1. Prepare Buildit's journal entries to record these events. Assume that percentage of completion is measured by the ratio of costs incurred to date divided by total estimated construction costs. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Do not round intermediate calculations. Round your final answers to the nearest whole dollar. Enter answer in thousands, not in million or in whole Canadian dollars.)

Buildit Corp. was contracted to construct a building for $2,440,000. The contract provided for progress payments. Buildit's accounting year ends 31 December. Work began under the contract on 1 March 20X3, and was completed on 30 November 20X5. Construction activities are summarized below by year: 20x3 20x4 20x5 Construction costs incurred during the year, $610,000; estimated costs to complete, $1,110,000; progress billings during the year, $520,000; and collections, $430,000. Construction costs incurred during the year, $980,000; estimated costs to complete, $350,000; progress billing during the year, $1,690,000; and collections, $1,430,000. Construction costs incurred during the year, $330,000. Because the contract was completed, the remaining balance was billed and later collected in full. per the contract. Required: 1. Prepare Buildit's journal entries to record these events. Assume that percentage of completion is measured by the ratio of costs incurred to date divided by total estimated construction costs. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Do not round intermediate calculations. Round your final answers to the nearest whole dollar. Enter answer in thousands, not in million or in whole Canadian dollars.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 18RE

Related questions

Question

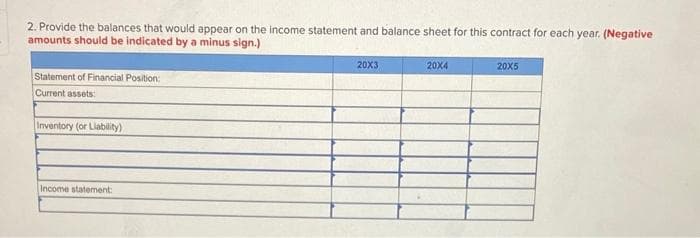

Transcribed Image Text:2. Provide the balances that would appear on the income statement and balance sheet for this contract for each year. (Negative

amounts should be indicated by a minus sign.)

Statement of Financial Position:

Current assets:

Inventory (or Liability)

Income statement:

20X3

20X4

20X5

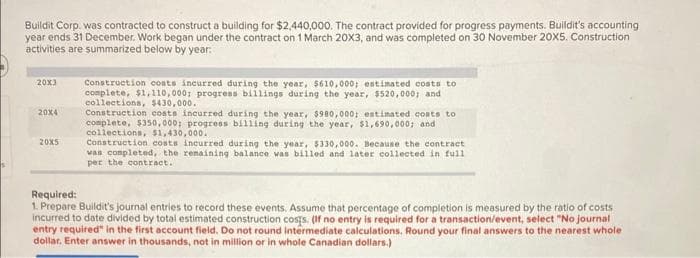

Transcribed Image Text:Buildit Corp. was contracted to construct a building for $2,440,000. The contract provided for progress payments. Buildit's accounting

year ends 31 December. Work began under the contract on 1 March 20X3, and was completed on 30 November 20X5. Construction

activities are summarized below by year:

20x3

20x4

20X5

Construction coats incurred during the year, $610,000; estimated costs to

complete, $1,110,000; progress billings during the year, $520,000; and

collections, $430,000.

Construction costs incurred during the year, $980,000; estimated costs to

complete, $350,000; progress billing during the year, $1,690,000; and

collections, $1,430,000.

Construction costs incurred during the year, $330,000. Because the contract

was completed, the remaining balance was billed and later collected in full

per the contract.

Required:

1. Prepare Buildit's journal entries to record these events. Assume that percentage of completion is measured by the ratio of costs

incurred to date divided by total estimated construction costs. (If no entry is required for a transaction/event, select "No journal

entry required" in the first account field. Do not round intermediate calculations. Round your final answers to the nearest whole

dollar. Enter answer in thousands, not in million or in whole Canadian dollars.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT