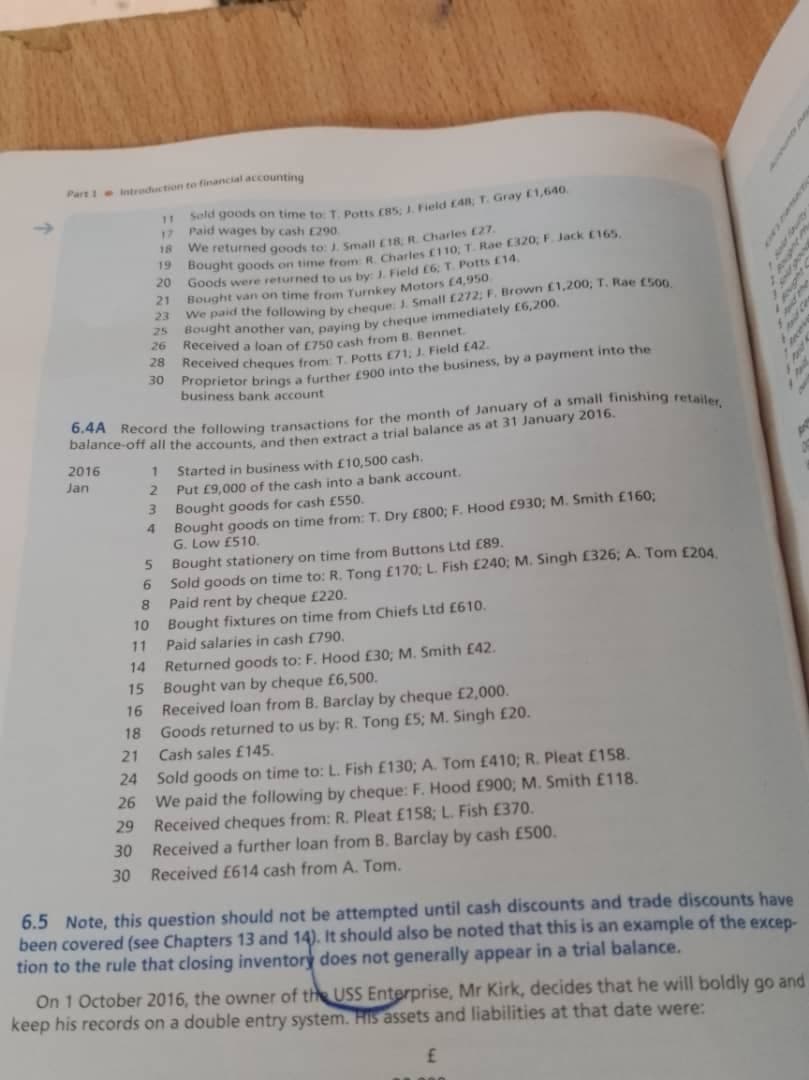

business bank account 2016 1 Started in business with £10,500 cash. Jan 2. Put £9,000 of the cash into a bank account. 3 Bought goods for cash £550. Bought goods on time from: T. Dry £800; F. Hood £930; M. Smith £160; G. Low £510. 5 Bought stationery on time from Buttons Ltd £89. 6 Sold goods on time to: R. Tong £170; L Fish £240; M. Singh £326; A. Tom £204. Paid rent by cheque £220. 8. 10 Bought fixtures on time from Chiefs Ltd £610. 11 Paid salaries in cash £790. 14 Returned goods to: F. Hood £30; M. Smith £42. 15 Bought van by cheque £6,500. 16 Received loan from B. Barclay by cheque £2,000. 18 Goods returned to us by: R. Tong E5; M. Singh £20. 21 Cash sales £145. 24 Sold goods on time to: L. Fish £130; A. Tom £410; R. Pleat £158. 26 We paid the following by cheque: F. Hood £900; M. Smith £118. 29 Received cheques from: R. Pleat £158; L Fish £370. 30 Received a further loan from B. Barclay by cash £500. 30 Received £614 cash from A. Tom.

business bank account 2016 1 Started in business with £10,500 cash. Jan 2. Put £9,000 of the cash into a bank account. 3 Bought goods for cash £550. Bought goods on time from: T. Dry £800; F. Hood £930; M. Smith £160; G. Low £510. 5 Bought stationery on time from Buttons Ltd £89. 6 Sold goods on time to: R. Tong £170; L Fish £240; M. Singh £326; A. Tom £204. Paid rent by cheque £220. 8. 10 Bought fixtures on time from Chiefs Ltd £610. 11 Paid salaries in cash £790. 14 Returned goods to: F. Hood £30; M. Smith £42. 15 Bought van by cheque £6,500. 16 Received loan from B. Barclay by cheque £2,000. 18 Goods returned to us by: R. Tong E5; M. Singh £20. 21 Cash sales £145. 24 Sold goods on time to: L. Fish £130; A. Tom £410; R. Pleat £158. 26 We paid the following by cheque: F. Hood £900; M. Smith £118. 29 Received cheques from: R. Pleat £158; L Fish £370. 30 Received a further loan from B. Barclay by cash £500. 30 Received £614 cash from A. Tom.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter2: The Accounting Information System

Section: Chapter Questions

Problem 67.2C

Related questions

Topic Video

Question

Transcribed Image Text:Part 1 Intraduction to financial accounting

na goods on time to 1. Petts (a5 Fjeld F4B, T. Gray 1,640.

11

Paid wages by

17

cash

290

18

Potts £14.

20 Goods were returned to us by: 1. Field E6:

21 Bought van on time from Turnkey Motors (4,950

23

26 Received a loan of E750 cash from 8. Bennet

28 Received cheques from T. Potts (71, J. Field £42.

Froprietor brings a further £900 into the business, by a payment into the

business bank account

balance-off all the accounts, and then extract a trial balance as at 31 January 2016.

2016

Started in business with £10,500 cash.

Put £9,000 of the cash into a bank account.

Bought goods for cash £550.

Bought goods on time from: T. Dry £800; F. Hood £930; M. Smith £160;

G. Low £510.

Jan

2.

4.

Bought stationery on time from Buttons Ltd £89.

Sold goods on time to: R. Tong £170; L. Fish £240; M. Singh £326; A. Tom £204

Paid rent by cheque £220.

10 Bought fixtures on time from Chiefs Ltd £610.

Paid salaries in cash £790.

11

14 Returned goods to: F. Hood £30; M. Smith £42.

15 Bought van by cheque £6,500.

Received loan from B. Barclay by cheque £2,000.

18 Goods returned to us by: R. Tong £5; M. Singh £20.

16

21 Cash sales £145.

24 Sold goods on time to: L. Fish £130; A. Tom £410; R. Pleat £158.

26 We paid the following by cheque: F. Hood £900; M. Smith £118.

29 Received cheques from: R. Pleat £158; L. Fish £370.

Received a further loan from B. Barclay

30

cash £500.

30

Received £614 cash from A. Tom.

6.5 Note, this question should not be attempted until cash discounts and trade discounts have

been covered (see Chapters 13 and 14). It should also be noted that this is an example of the excep-

tion to the rule that closing inventory does not generally appear in a trial balance.

On 1 October 2016, the owner of the USS Enterprise, Mr Kirk, decides that he will boldly go and

keep his records on a double entry system. HIs assets and liabilities at that date were:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning