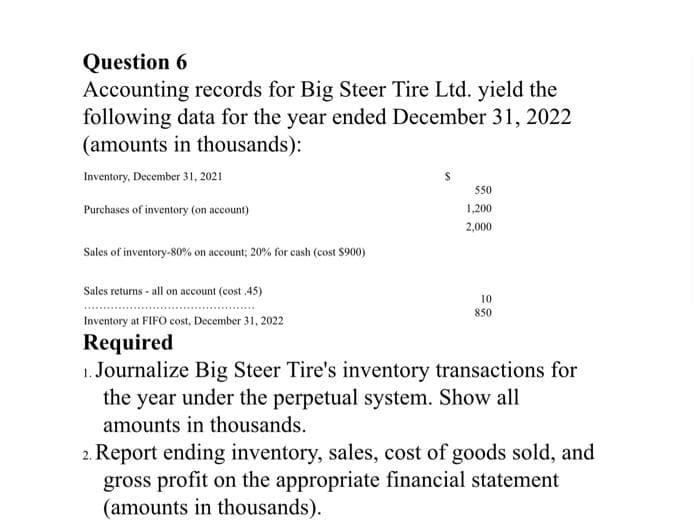

Question 6 Accounting records for Big Steer Tire Ltd. yield the following data for the year ended December 31, 2022 (amounts in thousands): Inventory, December 31, 2021 550 Purchases of inventory (on account) 1,200 2,000 Sales of inventory-80% on account; 20% for cash (cost $900) Sales returns - all on account (cost 45) 10 850 Inventory at FIFO cost, December 31, 2022 Required 1. Journalize Big Steer Tire's inventory transactions for the year under the perpetual system. Show all amounts in thousands. 2. Report ending inventory, sales, cost of goods sold, and gross profit on the appropriate financial statement (amounts in thousands).

Question 6 Accounting records for Big Steer Tire Ltd. yield the following data for the year ended December 31, 2022 (amounts in thousands): Inventory, December 31, 2021 550 Purchases of inventory (on account) 1,200 2,000 Sales of inventory-80% on account; 20% for cash (cost $900) Sales returns - all on account (cost 45) 10 850 Inventory at FIFO cost, December 31, 2022 Required 1. Journalize Big Steer Tire's inventory transactions for the year under the perpetual system. Show all amounts in thousands. 2. Report ending inventory, sales, cost of goods sold, and gross profit on the appropriate financial statement (amounts in thousands).

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter9: Working Capital

Section: Chapter Questions

Problem 28E

Related questions

Question

Transcribed Image Text:Question 6

Accounting records for Big Steer Tire Ltd. yield the

following data for the year ended December 31, 2022

(amounts in thousands):

Inventory, December 31, 2021

550

Purchases of inventory (on account)

1,200

2,000

Sales of inventory-80% on account; 20% for cash (cost $900)

Sales returns - all on account (cost 45)

10

850

Inventory at FIFO cost, December 31, 2022

Required

1. Journalize Big Steer Tire's inventory transactions for

the year under the perpetual system. Show all

amounts in thousands.

2. Report ending inventory, sales, cost of goods sold, and

gross profit on the appropriate financial statement

(amounts in thousands).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning