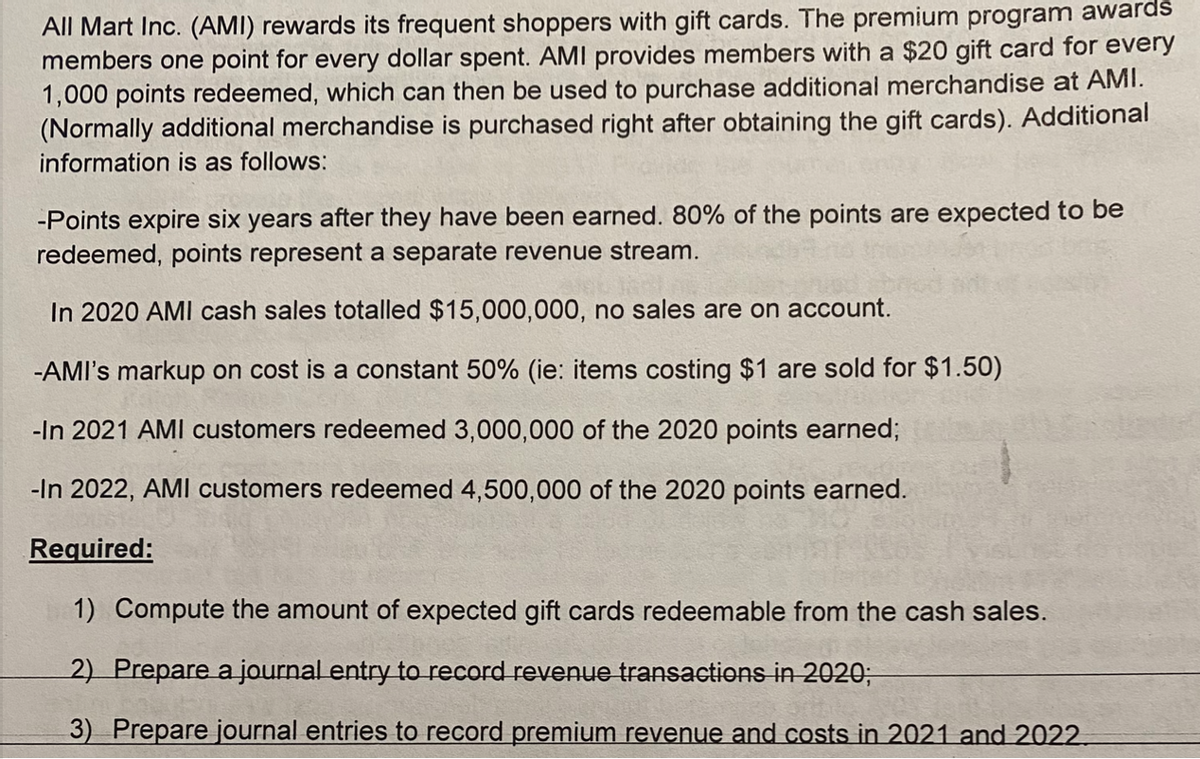

All Mart Inc. (AMI) rewards its frequent shoppers with gift cards. The premium program awards members one point for every dollar spent. AMI provides members with a $20 gift card for every 1,000 points redeemed, which can then be used to purchase additional merchandise at AMI. (Normally additional merchandise is purchased right after obtaining the gift cards). Additional information is as follows: -Points expire six years after they have been earned. 80% of the points are expected to be redeemed, points represent a separate revenue stream. In 2020 AMI cash sales totalled $15,000,000, no sales are on account. -AMI's markup on cost is a constant 50% (ie: items costing $1 are sold for $1.50) -In 2021 AMI customers redeemed 3,000,000 of the 2020 points earned; -In 2022, AMI customers redeemed 4,500,000 of the 2020 points earned. Required: 1) Compute the amount of expected gift cards redeemable from the cash sales. 2) Prepare a journal entry to record revenue transactions in 2020; 3) Prepare journal entries to record premium revenue and costs in 2021 and 2022

All Mart Inc. (AMI) rewards its frequent shoppers with gift cards. The premium program awards members one point for every dollar spent. AMI provides members with a $20 gift card for every 1,000 points redeemed, which can then be used to purchase additional merchandise at AMI. (Normally additional merchandise is purchased right after obtaining the gift cards). Additional information is as follows: -Points expire six years after they have been earned. 80% of the points are expected to be redeemed, points represent a separate revenue stream. In 2020 AMI cash sales totalled $15,000,000, no sales are on account. -AMI's markup on cost is a constant 50% (ie: items costing $1 are sold for $1.50) -In 2021 AMI customers redeemed 3,000,000 of the 2020 points earned; -In 2022, AMI customers redeemed 4,500,000 of the 2020 points earned. Required: 1) Compute the amount of expected gift cards redeemable from the cash sales. 2) Prepare a journal entry to record revenue transactions in 2020; 3) Prepare journal entries to record premium revenue and costs in 2021 and 2022

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter9: Current Liabilities And Contingent Obligations

Section: Chapter Questions

Problem 21E: Cash Rebates On January 1, 2020, Fro-Yo Inc. began offering customers a cash rebate of 5.00 if the...

Related questions

Question

godo

subject-Accounting

Transcribed Image Text:All Mart Inc. (AMI) rewards its frequent shoppers with gift cards. The premium program awards

members one point for every dollar spent. AMI provides members with a $20 gift card for every

1,000 points redeemed, which can then be used to purchase additional merchandise at AMI.

(Normally additional merchandise is purchased right after obtaining the gift cards). Additional

information is as follows:

-Points expire six years after they have been earned. 80% of the points are expected to be

redeemed, points represent a separate revenue stream.

In 2020 AMI cash sales totalled $15,000,000, no sales are on account.

-AMI's markup on cost is a constant 50% (ie: items costing $1 are sold for $1.50)

-In 2021 AMI customers redeemed 3,000,000 of the 2020 points earned;

-In 2022, AMI customers redeemed 4,500,000 of the 2020 points earned.

Required:

1) Compute the amount of expected gift cards redeemable from the cash sales.

2) Prepare a journal entry to record revenue transactions in 2020;

3) Prepare journal entries to record premium revenue and costs in 2021 and 2022

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning