Current Attempt in Progress Crane Ltd. purchased a new machine on April 4, 2017, at a cost of $172,000. The company estimated that the machine would have a residual value of $14,000. The machine is expected to be used for 10,000 working hours during its four-year life. Actual machine usage was 1,600 hours in 2017: 2,000 hours in 2018; 2,200 hours in 2019; 2,300 hours in 2020; and 1,900 hours in 2021. Crane has a December 31 year end.

Current Attempt in Progress Crane Ltd. purchased a new machine on April 4, 2017, at a cost of $172,000. The company estimated that the machine would have a residual value of $14,000. The machine is expected to be used for 10,000 working hours during its four-year life. Actual machine usage was 1,600 hours in 2017: 2,000 hours in 2018; 2,200 hours in 2019; 2,300 hours in 2020; and 1,900 hours in 2021. Crane has a December 31 year end.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter10: Long-lived Tangible And Intangible Assets

Section: Chapter Questions

Problem 19E

Related questions

Question

Subject:

Transcribed Image Text:Current Attempt in Progress

Crane Ltd. purchased a new machine on April 4, 2017, at a cost of $172,000. The company estimated that the machine would have a

residual value of $14,000. The machine is expected to be used for 10,000 working hours during its four-year life. Actual machine usage

was 1,600 hours in 2017: 2,000 hours in 2018; 2,200 hours in 2019; 2,300 hours in 2020; and 1,900 hours in 2021. Crane has a

December 31 year end.

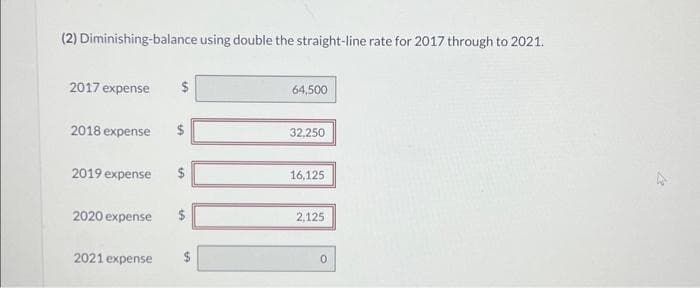

Transcribed Image Text:(2) Diminishing-balance using double the straight-line rate for 2017 through to 2021.

2017 expense

2018 expense

2019 expense

$

2020 expense $

2021 expense

64,500

32,250

16,125

2,125

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning