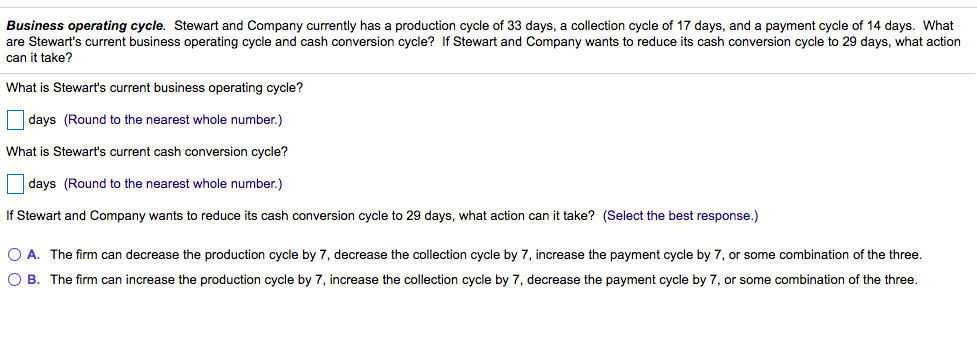

Business operating cycle. Stewart and Company currently has a production cycle of 33 days, a collection cycle of 17 days, and a payment cycle of 14 days. What are Stewart's current business operating cycle and cash conversion cycle? If Stewart and Company wants to reduce its cash conversion cycle to 29 days, what action can it take? What is Stewart's current business operating cycle? days (Round to the nearest whole number.) What is Stewart's current cash conversion cycle? days (Round to the nearest whole number.) If Stewart and Company wants to reduce its cash conversion cycle to 29 days, what action can it take? (Select the best response.) O A. The firm can decrease the production cycle by 7, decrease the collection cycle by 7, increase the payment cycle by 7, or some combination of the three. O B. The firm can increase the production cycle by 7, increase the collection cycle by 7, decrease the payment cycle by 7, or some combination of the three.

Business operating cycle. Stewart and Company currently has a production cycle of 33 days, a collection cycle of 17 days, and a payment cycle of 14 days. What are Stewart's current business operating cycle and cash conversion cycle? If Stewart and Company wants to reduce its cash conversion cycle to 29 days, what action can it take? What is Stewart's current business operating cycle? days (Round to the nearest whole number.) What is Stewart's current cash conversion cycle? days (Round to the nearest whole number.) If Stewart and Company wants to reduce its cash conversion cycle to 29 days, what action can it take? (Select the best response.) O A. The firm can decrease the production cycle by 7, decrease the collection cycle by 7, increase the payment cycle by 7, or some combination of the three. O B. The firm can increase the production cycle by 7, increase the collection cycle by 7, decrease the payment cycle by 7, or some combination of the three.

Chapter17: The Management Of Cash And Marketable Securities

Section: Chapter Questions

Problem 2P

Related questions

Question

2

Transcribed Image Text:Business operating cycle. Stewart and Company currently has a production cycle of 33 days, a collection cycle of 17 days, and a payment cycle of 14 days. What

are Stewart's current business operating cycle and cash conversion cycle? If Stewart and Company wants to reduce its cash conversion cycle to 29 days, what action

can it take?

What is Stewart's current business operating cycle?

days (Round to the nearest whole number.)

What is Stewart's current cash conversion cycle?

days (Round to the nearest whole number.)

If Stewart and Company wants to reduce its cash conversion cycle to 29 days, what action can it take? (Select the best response.)

O A. The firm can decrease the production cycle by 7, decrease the collection cycle by 7, increase the payment cycle by 7, or some combination of the three.

O B. The firm can increase the production cycle by 7, increase the collection cycle by 7, decrease the payment cycle by 7, or some combination of the three.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning